Versace's owner to be taken over in $8.5bn deal

- Published

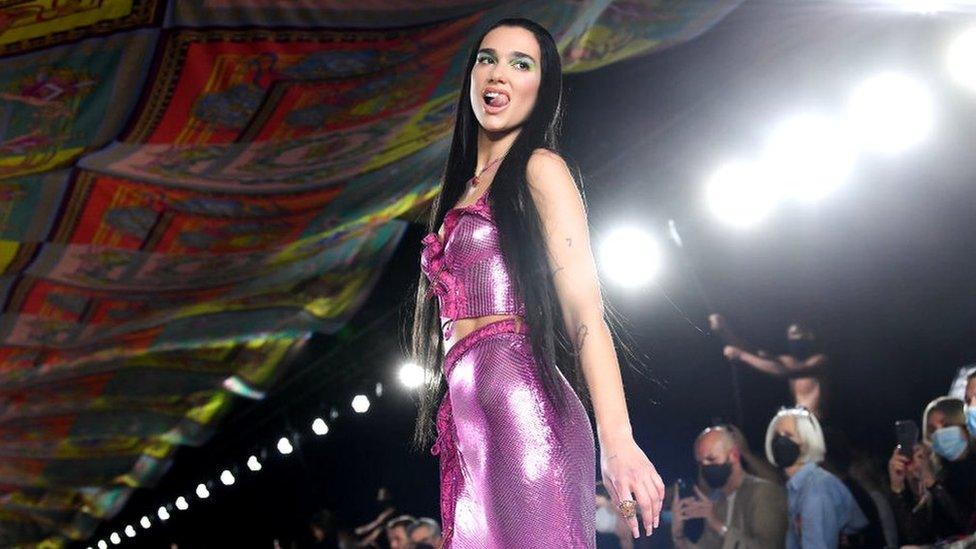

Dua Lipa walks the runway at the Versace fashion show during the Milan Fashion Week in 2022

The company that owns Versace is being bought by the luxury goods group Tapestry in a deal worth $8.5bn (£6.7bn).

Capri Holdings, which also owns Michael Kors and Jimmy Choo, is being taken over by Tapestry whose own brands include high-end names such as Coach.

Tapestry's boss Joanne Crevoiserat said the deal "creates a new powerful global luxury house".

Analysts said it would build a rival to compete with European fashion giants.

"It's creating a major American fashion conglomerate especially in the premium fashion space," said Louise Deglise-Favre, apparel analyst at the analytics company GlobalData, told the BBC.

"It's not as big as the likes of European giants such as LVMH and Kering, but even so it's definitely giving its brands more of a leg to stand on," she added.

LVMH and Kering are both France-based luxury brand giants who each control some of the biggest names in luxury fashion, leather goods and jewellery. Kering owns the likes of Gucci, Yves Saint Laurent and Balenciaga.

LVMH controls Louis Vuitton, Givenchy, Christian Dior and Marc Jacobs.

While Versace has become a symbol of Italian luxury around the world, brands such as Kate Spade and Michael Kors are seen as more affordable for some consumers, with smaller accessories typically costing from about £100.

Coach has previously paired up with celebrities like pop star Selena Gomez (R) to produce handbags and accessories

Ms Deglise-Favre said the merger will strengthen Tapestry's position within this market, by combining brands with offerings at a similar price point, like Coach, which has previously released collaborations aimed at younger shoppers with pop stars like Selena Gomez.

But she warned that Tapestry is also inheriting Michael Kors, which has suffered from years of lacklustre performance.

"It will have a definite challenge with that," she said.

However, Tapestry does have past experience of turning around struggling brands, including Kate Spade, which it took over in 2017.

The deal comes at a time when inflation - the rate at which prices are rising - has been elevated in many countries which has squeezed consumer spending.

It presents yet another challenge for firms like Tapestry, with aspirational shoppers being particularly hit in recent months, Ms Deglise-Favre said, while firms have to cope with higher interest rates, wages and supply chain issues.

It is expected that the deal will close in 2024.

Ms Crevoiserat said that the move would help the group reach more countries around the world.

It is just the latest deal in the luxury fashion space, with Kering announcing it was buying a 30% stake in Italian fashion label Valentino in July.

It is the second time in five years that Versace has been sold. In 2018, Michael Kors acquired the Italian label for more than $2bn following decades of ownership by the Versace family.

At that point, Michael Kors shifted Versace and shoemaker Jimmy Choo, which it bought in 2017, under a new company called Capri Holdings.

Related topics

- Published10 August 2023