World Cup: To tax or not to tax?

- Published

The moment every bidding nation wants to see in its soil

The BBC can reveal, for the first time, the full scale of the remarkable tax concessions that the world football authority Fifa demands of countries that wish to host a World Cup competition.

This Friday, 14 May, in Zurich in Switzerland, representatives of footballing countries around the world will submit their bids to host either the 2018 or 2022 tournaments.

The bidding nations have been asked to comply with a wide variety of conditions that Fifa has laid down - and which it would like to keep confidential.

Among them is that the entire event should be free of tax for Fifa.

"Any host country requires a comprehensive tax exemption to be given to Fifa and further parties involved in the hosting and staging of an event," said a Fifa spokesman.

This means that to be successful in its bid, the UK government must agree to forgo tens of millions of pounds in tax for the benefit of Fifa, which - as a charitable organisation - pays hardly any tax to its home country of Switzerland.

It also appears to mean that the tournament income of the players, some of whom are among the highest paid earners in the world, should also be exempt from tax.

Confidentiality

The decision on where the 2018 and 2022 competitions are to be staged will be taken by Fifa in December, after considering the huge Bid Books that the contending nations are about to submit.

These will contain the details of how, exactly, the would-be hosts propose to go about organising such a massive event.

They will have to comply with eight government guarantees, which the UK government signed last December in support of England's bid.

Do they involve relieving the players, possibly even those already resident in the UK, from paying tax on their incomes?

"I'm not able to tell you," said a spokesman for the England 2018 bid team. "Fifa requires it [the technical bid document] to remain confidential."

But he stressed that this applied to all conditions, including those applying to visas, work permits, travel, security, banking and foreign currency, commercial rights and broadcasting.

"It is not a selective confidentiality," he said.

A spokesman for the Department of Culture, Media and Sport (DCMS) said: "I can't go into detail of any of that because Fifa have very strict confidentiality clauses - but there is always room for manoeuvre."

What does the former sports minister Gerry Sutcliffe say? "Fifa require that details of the guarantees not be made public," he told me.

"If I did that it would damage the bid and I am not prepared to do that."

The tax exemption

Not all bidders feel so bound by this confidentiality. Holland and Belgium have a joint bid to host the 2018 or 2022 World Cup.

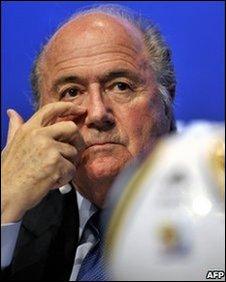

Fifa President Sepp Blatter is overseeing the bids for 2018 and 2022

The Dutch government recently published all eight government guarantees on its official website, in the form of a draft letter to Fifa President Sepp Blatter.

Guarantee no.3 requires "Full tax exemption of Fifa and Fifa subsidiaries" and "is not limited to the events and is not limited time-wise."

"The exemption stated in this section shall encompass all revenues, profits, income, expenses, costs, investments and any and all kind of payments, in cash or otherwise, including through (i) the delivery of goods or services, (ii) accounting credits, (iii) other deliveries, (iv) applications, or (v) remittances, made by or to Fifa and/or Fifa subsidiaries," the letter says.

This exemption also applies to associated bodies such as the local organising committee; Fifa confederations; Fifa member associations including the hosting association; the host broadcaster; and Fifa service providers.

That applies so long as the potential tax relates directly or indirectly to the World Cup and any of its associated events.

Intriguingly, the document does not directly mention the most high-profile participants in the World Cup - the players.

But the Dutch exemption for individuals seems all-encompassing:

"Individuals employed or otherwise hired by

Fifa

a Fifa subsidiary

the local organising committee (LOC)

Fifa confederations

Fifa member associations

Fifa host broadcasters

Fifa service providers

regardless whether these individuals are deemed as tax residents in the Netherlands or not, shall not be subject to payment of individuals taxes on

payments

fringe benefits

reimbursements

and any other sort of compensation received from one of the entities above which is not resident in the Netherlands

but only as regards to payments, fringe benefits, reimbursements and any other sort of compensation received until December 31 of the second year following the year of the competitions."

Experience so far

It is not a foregone conclusion that all taxes will be avoided during the 2018 or 2022 World Cups, should they be staged in England.

After the 2006 World Cup, the German football association (DFB) paid 101 million Euros (£87.8m at current exchange rates) in various taxes on its activities during the tournament.

Germany also taxed the non-resident players and trainers as normal, charging them 21.1% on their football fees and bonuses, and other commercial earnings; for instance from appearing in adverts.

That raised just over seven million Euros (£6.1m).

Everyone else from abroad who was officially accredited to the competition was exempted from German income or corporation tax, although VAT was applied to sales and services as normal.

The German government's official report into the way it organised the 2006 event reveals that as many as 170,000 foreigners were given permits to work in the country as part of the competition.

A spokesman said this did not equate exactly to the number exempted from tax; no exact figure is available.

But it clearly suggests that tens of thousands of people benefited from Fifa's tax requirements.

Meanwhile the Brazilian government, already awarded the 2014 World Cup, has just agreed that Fifa and its partners can be exempt from taxes on any goods and services related to the tournament for five years; from January 2011 until the end of 2015.

"Brazil stands to win a lot more by the stimulating effect on the economy," said the Brazilian sports minister Orlando Silva last month.

When a law is passed by the country's Congress, an exemption from personal income tax will also apply to non-residents who are employed, or in some way contracted, in organising or taking part in the World Cup.

"This exemption will also apply to referees, players and other members of national delegations, but only with regard to the receipt of payments directly related to the events," said a spokesman for the Receita Federal (Federal Revenue), the Brazilian tax authority.

South Africa

In this year's competition in South Africa, a "tax-free bubble" has been established around the tournament at Fifa's request, relieving Fifa, its subsidiaries, and foreign football associations which are taking part, of income tax, customs duties, and VAT.

World Cup preparations have cost South Africa an estimated R33bn - nearly £3bn

This also applies to the various organisations designated as Fifa's commercial affiliates, licensees, host broadcasters, broadcast rights agencies, merchandise partners, service providers, concession operators and providers of hospitality.

For these organisations the tax concessions only apply when the goods or services are provided at an official Fifa site.

A standard 15% tax on the earnings of foreign sportsmen and entertainers will be applied as normal and ticket sales will have 14% VAT applied.

So how much money may go untaxed if a World Cup is staged in the UK?

No one can tell yet, but Fifa's accounts for 2007, which cover the previous year's World Cup, give a flavour of the huge amounts of money that sloshed around.

Nearly 900 million Swiss Francs (£552m at current exchange rates) were spent by Fifa on organising the tournament, including prize money and preparation payments for participating teams, on their hotel and travelling costs, and in a subsidy to the organising committee.

Much of that might have been taxed in Germany had it not been for the tournament's favourable tax arrangements.

Meanwhile Fifa accrued more than 2.8 billion Swiss Francs (£1.72bn) in the four years up to and including the competition, mainly from selling broadcasting rights, sponsorship, hospitality packages and licensing rights in advance, plus a share of the local organising committee's eventual profits from the tournament.

Much of that will have gone directly to Fifa in Switzerland, outside the scope of the German tax net.

How much income tax did Fifa pay in 2006 locally? Just one million Swiss Francs (£613,500).

What about England?

The authorities in the UK may be shy about talking about Fifa's demands now, but if they wish to comply they will eventually have to change UK tax law, and do so in public.

The government has agreed this sort of thing before.

The 2006 Budget exempted overseas sportsmen and women from being taxed here during the 2012 London Olympics.

The London Organising Committee is exempt from corporation tax, the International Olympic Committee is exempt from income and capital gains tax as well, and foreign competitors and staff are covered by this too.

A little-noticed, one line, clause in this year's Budget exempted foreign players, and officials, of teams competing in the 2011 Champions League final at Wembley from paying income tax.

This fulfilled a government promise made in 2008 in response to the demands of the European football authority Uefa.

Should we care?

Moray Wilson, from the professional advisory firm Deloitte in Cape Town, says the financing of this year's competition has still stirred up a fair bit of public debate in South Africa.

He points to taxpayers' money being used to build new stadiums while untaxed profits largely go to Fifa in Switzerland.

"The host government has given away almost the entire tax-take to Fifa," he says.

"It is certainly taking the lion's share of the revenue.

"There is a degree of suspicion in the minds of many people of global organisations who extract extensive concessions from the host government," he adds.