Price controls on short term loans not needed, says OFT

- Published

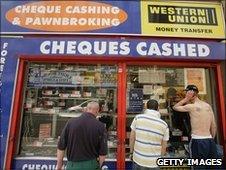

Expensive short term credit fills a gap in the market, the OFT said

The Office of Fair Trading (OFT) has backed away from recommending price controls on expensive forms of short-term borrowing.

The watchdog has been scrutinising the pawnbroking, payday loan and home credit businesses since July last year.

It said although such borrowing was expensive, it met a need for people who could not otherwise borrow cash.

The OFT said the government itself should take action if it thinks there is a problem.

"In a number of respects, these markets work reasonably well in that they serve borrowers not catered for by mainstream suppliers, complaint levels are low, and there is evidence that for some products, lenders do not levy charges on customers who miss payments or make payments late," the OFT said.

'Forbearance'

The OFT started its investigation into the market for expensive short-term loans because of concerns that people who could not borrow elsewhere had to pay interest charges that were far too high.

It estimated that £7.5bn was lent by these businesses in 2008.

However it found they served a legitimate purpose because some customers may have no history of borrowing that would make them attractive to mainstream lenders, or may have defaulted on loans in the past.

Thus they fill a gap in the market for people who cannot borrow elsewhere.

The OFT pointed out that there were often good reasons why this sort of lending was expensive, including:

relatively high administration costs because the sums typically borrowed are low

the need for some lending businesses to pay agents who visit customers' homes to make loans and collect repayments

and the high incidence of missed or late repayments.

The OFT also found that in some cases "lenders show forbearance with repayment difficulties and do not penalise borrowers when payments are late or missed".

Restrict lending?

The OFT warned that imposing formal price controls would not only be very complex and difficult, but might be against the interests of potential borrowers.

It said some lenders might restrict their lending, or stop it altogether, or might find other ways to make money from their loans by imposing late payment fees.

The regulator recommended that the government should take steps to help short-term borrowers to make better borrowing decisions.

One recommendation is for the establishment of a price comparison website for these types of loans.

And the OFT said the government should consider introducing "wealth warnings" on loan adverts.

But it concluded that if the government thought that the very existence of expensive short-term lenders was a problem, it was up to the government to do something about it, perhaps by persuading banks and building societies to expand their lending, or by expanding the government's own social fund.

'Market realities'

Fiona Hoyle, of the Finance & Leasing Association, welcomed the OFT's conclusions.

"This report shows that prices reflect market realities, and that complaint levels are low," she said.

"We hope that the government will take careful note of these arguments against price capping when it considers the credit and store card markets," she added.