China yuan stability pledged

- Published

China's currency policy has been criticised by the West

China's central bank says it plans to keep the Chinese yuan "stable" and there will be no immediate revaluation of the currency.

The comments come just a day after the bank announced plans to make the exchange rate more flexible.

But Chinese authorities have ruled out a large, one-off adjustment in the exchange rate.

China has come under increasing international pressure to change its currency policy.

The US in particular has complained that China is artificially keeping the value of the yuan low to help its exporters at the expense of foreign competitors.

On Saturday, US President Barack Obama welcomed China's promise of increased flexibility in exchange rates, but the Chinese central bank's latest comments cast doubt over the scale of its plans.

"There is at present no basis for major fluctuation or change in the [yuan] exchange rate," the bank's website said.

G20 agenda

The "basic stability" of the currency would be maintained, it added, and keeping the yuan at a "reasonable, balanced level" would help ensure economic stability.

"The management and adjustment of the [yuan] exchange rate needs to be done in a gradual way."

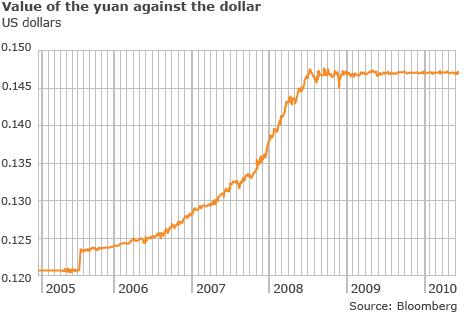

China has effectively pegged the yuan to the US dollar for the last two years.

In 2005, it briefly allowed a controlled appreciation of the currency, but ended that policy when the global economic crisis threatened demand for its goods abroad.

The yuan has stayed at around $0.147 since then, and would be expected to rise higher given a totally free exchange rate.

Analysts expect the yuan to appreciate slowly - by around 0.2% a month - in line with a recovery in demand from Europe.

"A stronger yuan would not only help prevent trade tensions from developing later in the year, but, more importantly, would help to keep China's recovery on a sustainable path and to rebalance its economy," commented Brian Jackson, a strategist at Royal Bank of Canada in Hong Kong.

China's currency policy was expected to be high on the agenda at the G20 summit to be held in Toronto later this month.

According to the BBC's economics editor Stephanie Flanders, the timing of China's concession is no coincidence.

"As usual, the wording is vague," she said.

"But the assumption must be that China plans to move back to the policy of allowing its exchange rate to appreciate in real terms against the dollar."