Chinese yuan flexibility comments buoy markets

- Published

Markets expect China to weaken the yuan's peg to the dollar

Stock markets and Asian currencies have risen after weekend comments by China's central bank about its yuan policy.

US stocks climbed sharply in the morning but lost ground in late trading, while major European markets closed up about 1%.

Earlier, Hong Kong's Hang Seng index closed up 3.1%, while the Japanese Nikkei rose 2.4%.

Currencies were also up, with the Korean won and Malaysian ringgit both rising over 2% against the US dollar.

Chinese authorities announced plans on Saturday to make the exchange rate more flexible, while ruling out a large, one-off move in the yuan's value.

China's central bank says it plans to keep the Chinese yuan "stable" and there will be no immediate revaluation of the currency.

The move, ahead of the G20 summit later this month, has tempered market fears of a possible trade war between China and the US.

The Dow Jones index of leading US shares climbed more than 100 points, or 1%, in early trading, but closed down 8 points after investors began to doubt the short-term impact of China's move.

European stock markets reacted positively to the news, with the UK's FTSE 100 index closing up 0.9%, France's Cac 40 rising 1.3% and Germany's Dax climbing 1.2%.

New yuan high

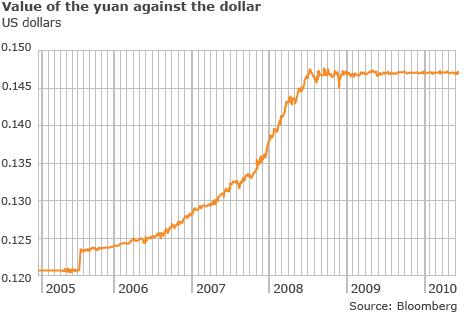

Markets now expect China to weaken or break the two-year peg of its currency to the dollar.

The Chinese central bank currently sets a target exchange rate against the dollar each day.

Monday's target level was unchanged from Friday, signalling that the central bank is in no hurry to allow the yuan to rise.

But with mounting speculation over the change in policy, markets pushed the exchange rate up 0.45% above the target in early trading, to its highest level since 1994.

Officially, the central bank allows the currency to move up or down 0.5% against the central parity, but in practice such movements have rarely been allowed in the past.

"There is surprise over the level of flexibility already shown today," said Stephen Green, head of China research at Standard Chartered Bank.

He now expects the central bank to allow the yuan to appreciate some 2-3% over the next 12 months.

The change in policy will also make it easier for Asian countries that compete with China for exports to allow their own currencies to rise.

Pressure

The Chinese have found themselves in a tough situation over the yuan in recent months.

Many in the US say China is keeping the yuan low to boost exports

The country has come under increasing international pressure - particularly from the US and India - to change its currency policy.

The US has complained that China is artificially keeping the value of the yuan low to help its exporters at the expense of foreign competitors.

On Saturday, US President Barack Obama welcomed China's promise of increased flexibility in exchange rates, but the Chinese central bank's latest comments cast doubt over the scale of its plans.

"There is at present no basis for major fluctuation or change in the [yuan] exchange rate," the bank's website said.

Meanwhile, the euro has fallen more than 17% against the dollar - and therefore also against the yuan - since the European debt crisis began in December.

Europe is China's biggest export market, meaning the euro's decline has made Chinese exports less competitive.

The change in yuan policy may involve switching the peg from the dollar to a basket of currencies, including the euro, that better reflect China's diverse export markets.

G20 agenda

The "basic stability" of the currency would be maintained, the central bank added, and keeping the yuan at a "reasonable, balanced level" would help ensure economic stability.

"The management and adjustment of the [yuan] exchange rate needs to be done in a gradual way."

China's currency policy was expected to be high on the agenda at the G20 summit to be held in Toronto later this month.

According to the BBC's economics editor Stephanie Flanders, the timing of China's concession is no coincidence.

"As usual, the wording is vague," she said.

"But the assumption must be that China plans to move back to the policy of allowing its exchange rate to appreciate in real terms against the dollar."