The outcry over Australia's planned mining tax

- Published

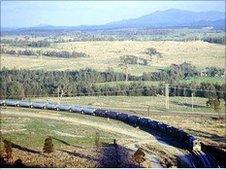

Some 700,000 Australians are employed in the mining industry

The sudden and brutal dumping of Kevin Rudd as Australian prime minister has led to a thaw in hostilities between the government and the mining industry over a contentious new tax.

The ousted leader crashlanded in opinion polls after launching the 40% Resource Super Profits Tax, which would replace the existing royalty system from July 2012.

Mining is vital to the Australian economy

The proposal sparked an unprecedented clash between heavyweight mining barons from BHP Billiton, Rio Tinto and Xstrata, who predicted doom for their industry, and leftward-leaning politicians, who believed the Australian people deserved more of a share from the exploitation of the nation's bounty.

While Mr Rudd saw the mining levy as part of "historic" taxation reforms, it was one of the final acts of a fallen leader who has been ambushed by his own side, fearful of defeat in a general election over voter discontent on climate change as well as fiscal policy.

'Flawed tax'

His replacement, Julia Gillard, the first woman to lead Australia, has called for a more conciliatory approach to negotiations.

"Today I am throwing open the government's door to the mining industry, and I ask that in return the mining industry throws open its mind," she said.

Although the early signs are promising, with both sides suspending advertisements that have plastered their respective views on the super profits tax onto television screens across the country, there is clearly much work still to do.

"The tax is totally flawed. We are not opposed to tax reform but this will jeopardise everything that the Australian mining industry represents for the Australian economy and its future," explained Dr Nikki Williams, chief executive of the New South Wales Minerals Council.

Prof Menezes says there are a lot of arguments in favour of the new tax

"The idea that you would put that industry in jeopardy and hand our competitive advantage to countries like Canada, the United States, Colombia, Chile and South Africa which also have abundant mineral resources is completely incomprehensible... and quite shocking," Ms Williams told the BBC.

'More efficient'

Minerals companies provide jobs for some 700,000 Australians. Super-charged demand from China, especially for iron ore, has helped to protect Australia from the global recession.

The International Monetary Fund has said there were no indications that the proposed mining tax would derail Australia's future growth, while Flavio Menezes, a professor of economics at the University of Queensland, said that a tax on profits would make more sense that the current output-based system.

"A royalty is a tax on production no matter how profitable that production is. That has an impact on marginally profitable projects. The idea is by taxing profits instead you have a more efficient tax," Prof Menezes told the BBC News website.

"There might be something in the [Australian] Treasury's argument that in the long run this type of tax might be beneficial to the industry because it is more stable."

Complexities

The mining sector has argued that it is the specific detail of the proposal, and not the principle of taxation reform, that it is so vehemently opposed to. One large - and basic - point of contention is how super profits would be defined in the first place.

Unions say Mr Rudd made a mess of selling the idea of the tax on profits

The tax is complex and while negotiations will invariably take time, trade unions have said Australia's wealthy miners should be more generous.

"Over the last decade with the resources boom, the companies have done very well financially," said Warren Cook, president of the CFMEU United Mineworkers union at one of the largest open cut mines in the New South Wales Hunter Valley.

"It is about time that these huge multinational companies should be giving a little bit extra back to the local communities.

"Fortunately the union movement has probably done a much better job of selling the idea of the super profits tax than the government has. To be perfectly honest, the Rudd Labor government made an absolute mess of it," Mr Cook said.

Labor will hope its new leader will bring some clear thinking to a red-hot issue that helped bring about the extraordinary fall of Kevin Rudd.

- Published24 June 2010

- Published24 June 2010

- Published3 June 2010

- Published19 May 2010

- Published3 May 2010