Living 'costs at least £14,400' for a single person

- Published

The cost of living for families is growing, the report says

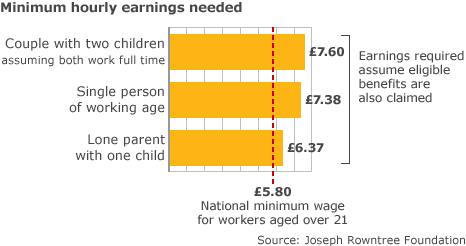

A single person in the UK needs a gross income of at least £14,400 in 2010 to live to an acceptable standard, a charity says.

And a couple with two children need £29,200 for a minimum acceptable standard of living, the Joseph Rowntree Foundation (JRF) said.

The figure indicates a growing gap between the national minimum wage and the minimum income standard.

The charity claimed this was due to rising inflation for necessities.

"This research shows what ordinary members of the public think is needed - not just to survive but to take part in society," said Julia Unwin, chief executive of the JRF.

"It provides powerful evidence for the new government to use as it develops policies to deal with poverty."

Typical basket

The JRF report, external is an attempt to raise the debate about the level of relative poverty in the UK beyond the official poverty line of 60% of average earnings.

Inflation is calculated using a typical basket of goods. Similarly, since 2008, the JRF has gathered information from focus groups to set a benchmark for an "acceptable standard of living".

For example, it now considers a computer and home internet connection as essential for all working age households. In previous years this has only been necessary for people with school-age children, it concluded.

Pensioners, however, thought the internet was growing in relevance - but not yet a necessity.

Key findings from the report included:

The minimum household budget needed to rise by 3% to 4% in the year to April - broadly in line with inflation.

In the last 10 years, inflation had risen by 23%, but key essentials cost 38% more.

This included food prices (up 37%), bus fares (up 59%), and council tax (up 67%).

The essentials required for a minimum standard of living have not been reduced in people's thinking, despite the level of economic uncertainty, the Foundation said.

For example, a week's holiday a year in the UK was still considered necessary to participate at an acceptable level in society.

Trends

The JRF, which has produced a minimum income calculator, external, said that the Budget's announcement of a £1,000 hike in tax allowances from next year would make a family £320 a year better off, after inflation, if both partners were working.

But all of these gains could be lost by other Budget changes, such as cuts in tax credits, the freezing of child benefit, the rise in VAT, and the cap on housing benefit.

"This new research underlines how people living close to the minimum income standard can end up not having enough, if economic trends start going against them," said one of the report's authors, Donald Hirsch, of Loughborough University.

"For example, a single person who a decade ago had just enough to get by, and whose income has risen in line with official inflation, cannot afford a minimum budget today.

"Big rises in the prices of things like food and council tax means that they are nearly £20 a week short of what they need, and must think of what essentials they will go without."

A spokesman for the Department for Work and Pensions said: "Work is the best route out of poverty and we are determined through our programme of welfare reform to make work pay in order to encourage people off benefits and into jobs. The current system is broken.

"We are firmly committed to tackling poverty and improving the lives of low-income families. We remain focused on our goal of ending child poverty by 2020 and are conducting a review into poverty and life chances."