Productivity: the UK's key economic challenge

- Published

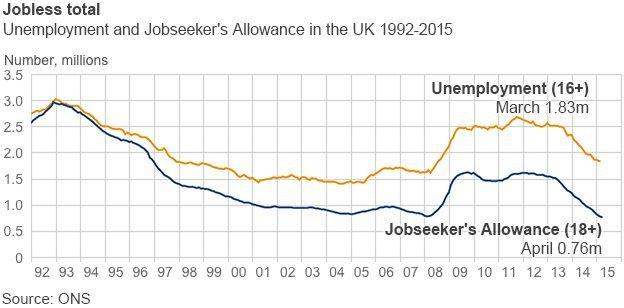

Another day, another strong set of employment growth figures from the Office for National Statistics and another downgrade in productivity forecast from the Bank of England.

Much of this will feel familiar to anyone watching the UK economy over the past few years but, in the months ahead, that pattern may soon start to change.

As I noted on Monday productivity growth (the amount of output produced per-hour-worked) will be one of the key challenges for the UK economy over the next five years, in some ways it is the key challenge.

Since 2007 productivity has been broadly flat and employment has surged in recent years as firms have required more workers to produce more output rather than getting more from their existing staff.

In effect, economic growth has been generated by increasing the inputs (hours worked) rather than increasing the efficiency with which those inputs are used. The problem with this is that eventually the economy will run into a constraint, it will simply run out of additional workers to employ and, without an increase in productivity, output growth will hit a wall.

The wage factor

Unemployment was fallen from 8.5% in late 2011 to 5.5% today - its lowest level since the recession. The number of economically inactive people (neither employed nor actively looking for a job) has also declined sharply. It may be that the UK is approaching the point when it begins to run out of workers.

Estimating exactly when that point will be reached is tricky - it maybe that there is "hidden slack" in the labour market , people currently working part-time who want a full-time job, or some of the newly self-employed who would rather have a traditional employee position. Immigration, through providing new workers, can also ease the constrains on businesses.

While economists debate about the degree of "slack", the indicator to watch may be well wages. All things being equal, the tighter the labour market is the higher wage growth should be. In a tight market, with firms competing to employ workers, then wages should be nudged up.

Throughout 2011, 2012, 2013 and much of 2014 despite falling unemployment and falling inactivity rates wage growth remained extremely muted. But in recent months it has become to pick up.

Most of the growth in real wages (wages accounting for changes in inflation) since late 2014 has been a result of falling inflation rather than rising nominal wages. But that isn't the whole story. Nominal (cash terms) regular pay growth has picked up from 0.9% a year in August last year to 2.2% in today's figures. In the private sector regular pay growth is now running at 2.7%, up from 1.6% a year ago.

That sport of wage growth - given the absence of an improvement in productivity - suggests a tighter labour market.

So, what happens if the labour market continues to tighten and productivity growth continues to disappoint?

That outcome would be far from good. In the short run those in work would enjoy larger real wage boosts as earnings were pushed up by a tighter labour market. But, without productivity growth, firms would face a larger wage bill for any given level of output and so be forced into increasing prices. The real wage gains wouldn't last for long.

More capital investment?

For all the worries about deflation and falling prices in the UK over the past year, it isn't (especially given the rebound in the oil price) hard to envisage a scenario where the lack of productivity growth makes rising inflation a bigger threat. If that was the case then interest rates would rise far quicker than currently expected.

It may seem perverse to be fretting about higher inflation when consumer price inflation is at zero, nominal earnings growth at half of their historical levels and real wages still heavily down on where they were in 2008. But that could be the consequence of a continuing productivity shortfall.

Productivity growth - it can't be emphasised enough - is crucial to what happens next in the UK economy. The other thing that can't be emphasised enough is that there is still no single agreed reason as to why productivity has been so weak.

One theory of weak productivity may be about to be tested and, if it is correct, there is far fewer reasons to be concerned.

The traditional way to think about productivity and real wages, is that weak productivity has led to weak real wages. Without the ability to get more out of their employees, firms haven't had the room for the sort of wage rises that were seen as normal pre-2008.

The Bank of England's Mark Carney says it is 'even more conservative' in its forecast for renewed productivity growth

There are, though, those who argue that the relationship is the other way around. When demand fell during the recession of 2008/09 the UK's flexible labour market meant that, rather than unemployment soaring, wages fell. The rise in unemployment was much smaller than in previous recessions and the hit to wages much larger.

This may (and it's still just a "may") have incentivised the growth of businesses that relied on lower-waged work lowering overall productivity growth. This sort of "compositional effect", according to the Bank of England today, has been a drag on productivity.

In addition, faced with cheaper workers, firms may have decided to hold back on investing in new equipment, plant and machinery - why bother investing in getting more out of your existing workforce if it's cheaper to just hire some additional workers?

If the labour market really has tightened, then - if this theory is correct - one might expect that productivity gains will follow wage gains rather than leading them. In other words, faced with more expensive workers, firms may have to focus on increasing productivity and raising investment in capital equipment. That would be a much more benign outcome - high employment, faster wage growth and rising productivity.

Over the coming months, the next stage in the UK's productivity puzzle will be played out.

- Published13 May 2015

- Published13 May 2015

- Published11 May 2015