Libyan Semtex: MPs call for compensation for IRA victims

- Published

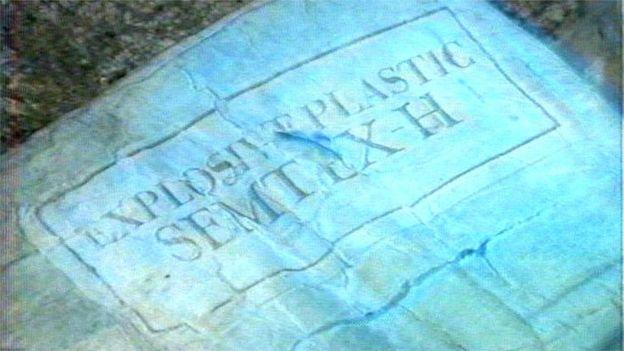

Libyan-supplied Semtex was used in many IRA attacks, such as the Harrods bombing of 1983

It would be "inconceivable" if the government was collecting tax on frozen Libyan assets but not using it to compensate IRA victims, MPs have said.

In 2017, the NI Affairs Committee said the government had missed opportunities to secure compensation for victims of Libyan-supplied Semtex.

It asked the Treasury if frozen Libyan assets were subject to UK tax liability.

The government did not confirm whether it had collected tax on the assets.

Former Libyan leader Muammar Gaddafi supplied weapons, including Semtex explosives, to the IRA during the Troubles.

Libya compensated US victims of terrorism, external, but UK victims were left out of the deal.

In 2011, Libyan assets which are now worth approximately £12bn were frozen under UN sanctions.

In May 2017, the Northern Ireland Affairs Committee said the government's response to its report, which highlighted missed opportunities to secure compensation, was "unacceptable".

Muammar Gaddafi supplied weapons to the IRA during the Troubles

In a recent evidence session with Foreign Office Minister Alastair Burt, it questioned whether the assets were subject to tax liability and whether the Treasury had ever released funds or the interest or dividends from the assets.

Mr Burt has now written to the committee, stating: "HM Treasury may grant permission for frozen funds to be released."

But the committee said he had failed to answer the "crucial" question of whether the Treasury had issued licenses for funds, or interest accrued from the assets, to be released.

Chancellor questioned

Committee chairman Andrew Murrison said: "The government said it would take a 'visibly proactive' approach to securing compensation for victims of IRA Semtex attacks.

"We welcome that, but this letter prompts more questions than it gives answers.

"It is inconceivable that the government could profit from frozen Libyan assets but not use receipts to compensate victims. Compensation is needed now."

The committee has written to Chancellor Philip Hammond "to clarify the status of the frozen assets", he added.

- Published21 October 2015

- Published20 November 2018

- Published15 September 2017