Nordea boss says climate protests are 'just the beginning'

- Published

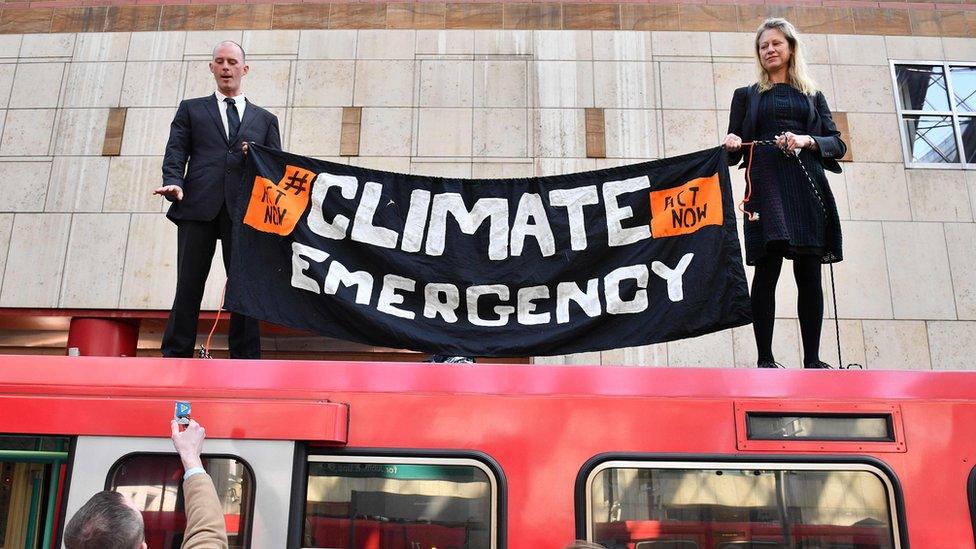

Nordea Bank's Sasja Beslik said the climate change protests were "just the beginning"

Climate change protests will become much more commonplace, according to the head of one of Europe's biggest ethical investment funds.

The warning coincides with the arrest of nearly 300 people in London this week amid huge protests against climate change.

Nordea Bank's Sasja Beslik told the BBC the protests were "just the beginning".

People who were worried about climate change did not feel that had many other "tools" at their disposal, he said.

Mr Beslik is in charge of sustainable finance at Nordea, one of the biggest banks in Europe, and the third largest corporation in the Nordic region of Denmark, Finland, Norway and Sweden.

The fund Mr Beslik manages stopped investing in VW after the emissions scandal and no longer authorises the buying of Facebook stock because of concerns over how the company has been addressing its data privacy issues.

Speaking to 5 Live's Wake up to Money, he said: "I think this [this week's wave of protests] is just the beginning. If we talk about the number of millennials in Europe and in countries all over the world, they are very concerned about the situation and I don't think they feel that they have too many other tools in their hands to approach this."

He said the key to forcing companies to change lay not just with grassroots protest, but in the boardroom, because the world's financial sector was "the biggest global tool at the table".

"I think it is fairly obvious that the actions taken by politicians and businesses around the world are not enough," he said, adding: "87% of all the capital in the world is not managed in a way that takes into account climate issues… If we want to employ the big muscles in the world when it comes to changing the industries… you need to deploy financial capital."

'Public statement'

Earlier this week, Legal & General Investment, which manages £1tn worth of UK pension fund investments, said it was putting climate change at the top of its list of concerns when looking into how companies are run.

Sonja Laud, deputy chief investment officer at Legal & General Investment Management, said it was important that investors pushed for change.

"We've seen a lot more engagement especially when we started with this very public statement that we would actually name those where we feel there is not sufficient progress on a corporate level," she added.

"There is no individual sector where we would say straight away that we would divest because to us it is all about the engagement and making sure we get the company in line with what we would like to achieve."

- Published17 April 2019

- Published17 April 2019

- Published16 April 2019