General election 2019: Does £80,000 put you in the top 5% of earners?

- Published

A Question Time audience member, who earns over £80,000, criticised Labour's taxation promises

A member of the audience on last night's Question Time on BBC One criticised Labour's policy of raising income taxes for people earning over £80,000 on the grounds that it wouldn't be enough to put them in the top 5% of earners.

"I am nowhere near in the top 5%, let me tell you, I'm not even in the top 50%," he said.

Presenter Fiona Bruce said Labour, "would raise income tax on those earning over £80,000. You're saying that would affect you because you earn over that sum?" The man confirmed he did.

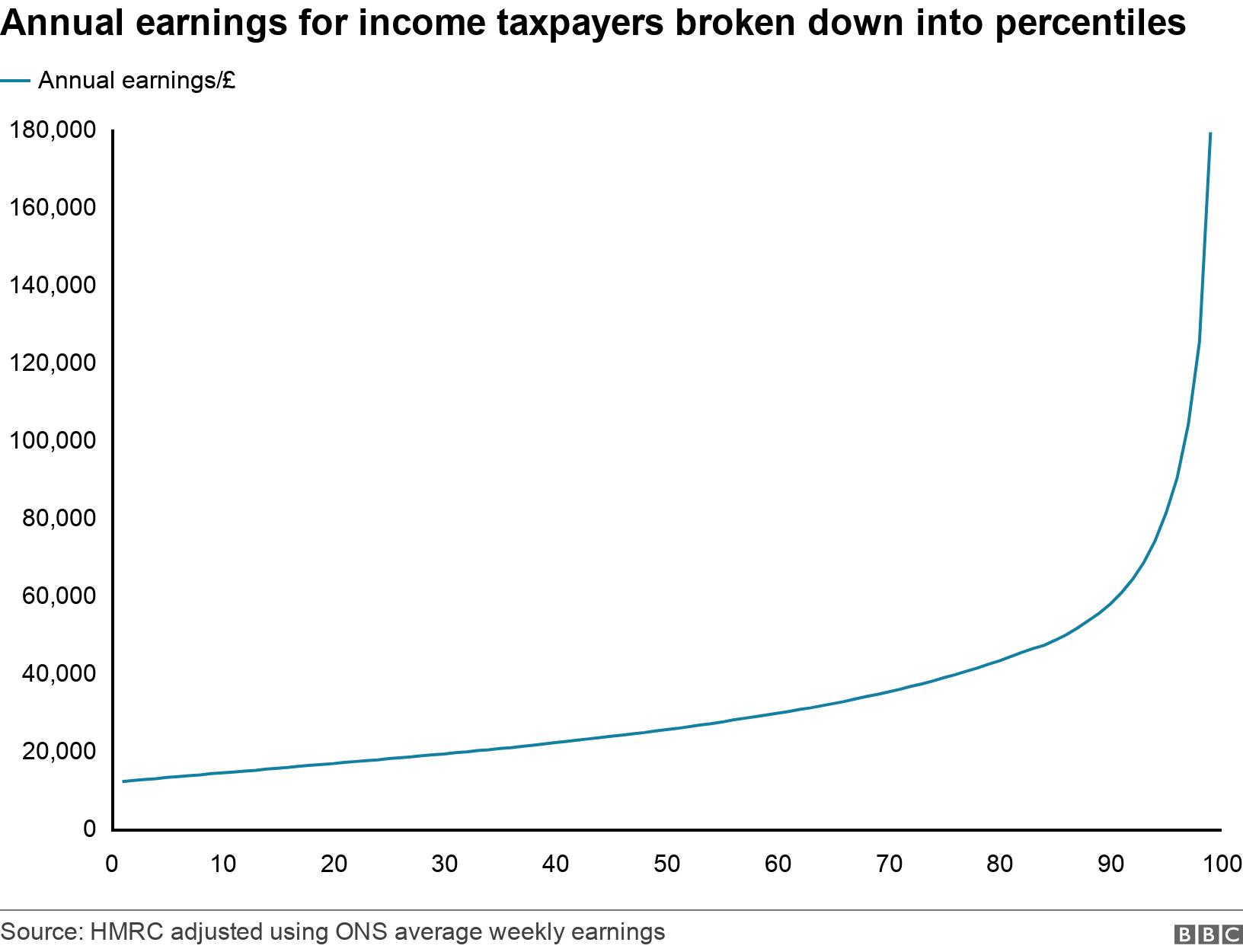

HMRC publishes tables, external each year breaking down income taxpayers into 100 equally-sized groups based on how much they earn.

The most recent figures, for 2016-17, show that you needed to be earning £75,300 to be in the top 5%.

If you adjust that using average earnings figures from the ONS, external, it's likely that you need to be earning about £81,000 to be in the top 5% of income taxpayers today.

But the figures from HMRC exclude people earning too little to pay income tax, which means that the audience member would have been well into the top 5% of all earners.

He's certainly not outside the top 50% - anything over about £25,000 would put him in the top half.

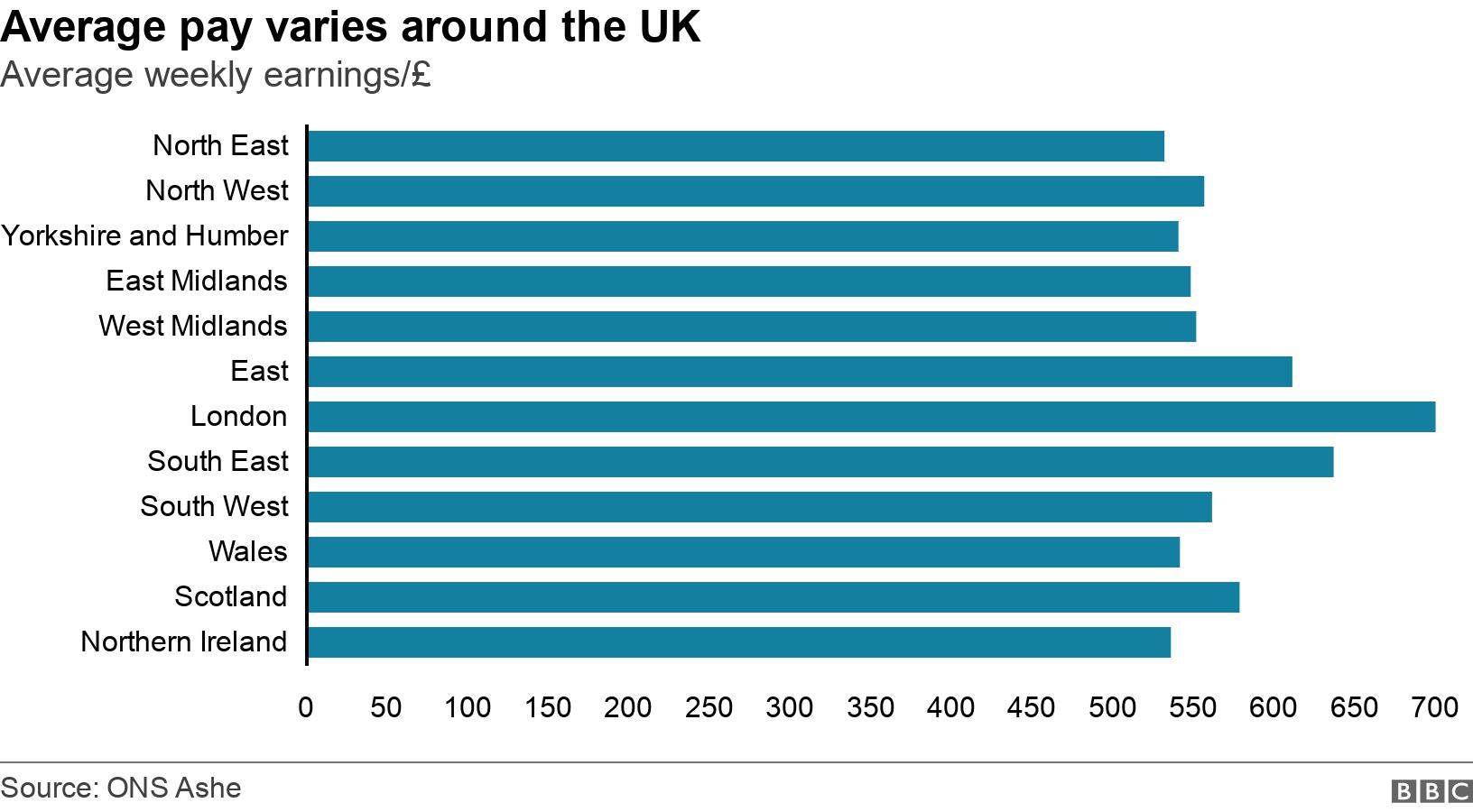

All the figures so far have been for the whole of the UK but there are clearly regional variations in these figures.

While we do not have figures for how much you would need to earn to be in the top 5% of earners in a particular region, we do have figures for median earnings by region, external, that's the amount you'd have to earn to be in the top 50%.

The region with the lowest average weekly earnings is the North East of England at £531.10, which is 24% or £168 a week lower than the highest earning region, London at £699.20.

The audience-member also said: "Every doctor in the country earns more than that [£80,000]. Every doctor, every accountant, every solicitor earns more than that."

The ONS publishes figures for average earnings in various professions (it's table 14.7a here, external).

The median solicitor (that's the one half of solicitors earn more than and half earn less than) earns £41,127 while the median chartered or certified accountant earns £35,730.

For doctors you have to go for the category medical practitioners, which includes anaesthetists, consultants, doctors, general practitioners, paediatricians, psychiatrists, radiologists and surgeons. Their average earnings are £60,838.

Correction: This piece was amended to reflect the fact that the HMRC figures exclude earners who do not make enough to pay income tax.