UK economic growth 'robust' in 2024, think tank says

- Published

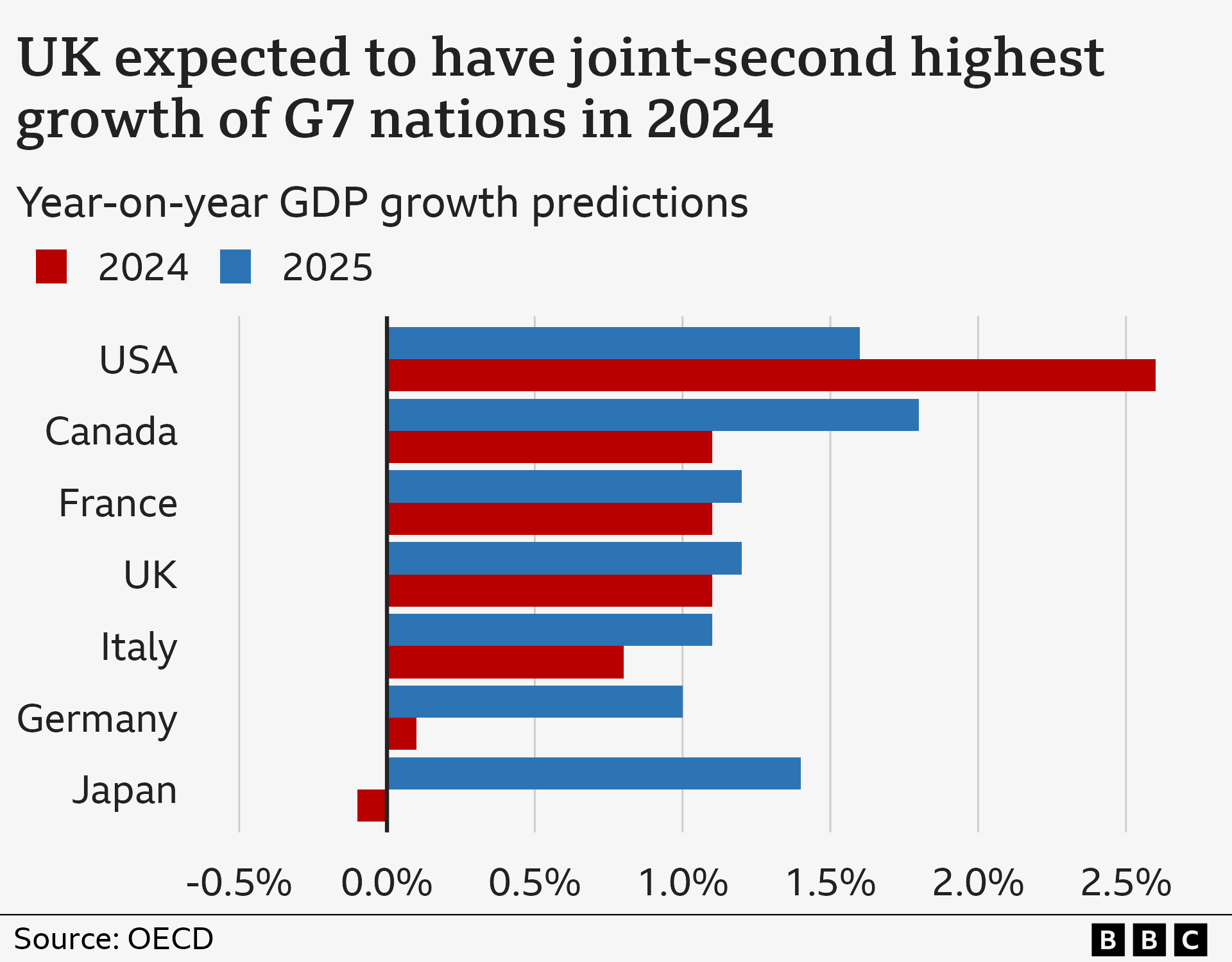

The UK has risen in the rankings of a group of wealthy nations to have the joint-second highest economic growth for this year, a think tank has predicted.

The economy is now expected to grow by 1.1%, the same rate as Canada and France, but behind the US.

The Organisation for Economic Co-operation and Development's (OECD) previous growth estimate in May had put UK growth at 0.4% for this year.

Chancellor Rachel Reeves welcomed the faster growth figures, which will help reinforce the more upbeat tone she sought to strike in her speech to the Labour Conference.

She is facing the twin challenge of managing expectations ahead of the Budget next month by explaining how tough times lie ahead, while attempting to paint a positive picture to encourage investment.

"Next month’s Budget will be about fixing the foundations, so we can deliver on the promise of change and rebuild Britain," Reeves said.

Dan Coatsworth, an investment analyst at AJ Bell, said that public sector wage increases, the end of train strikes, and a more stable political backdrop following July's general election could all be factors behind the stronger outlook for the UK.

"August’s rate cut from the Bank of England should also help the economy as it finally shows the country has started the journey to lower the cost of borrowing," he added.

The OECD, which is a globally recognised think tank, said that economic growth had been "relatively robust" in many countries, including the UK.

But it added: "Significant risks remain. Persisting geopolitical and trade tensions could increasingly damage investment and raise import prices."

While the OECD's prediction for the UK has improved for this year, it is only set to enjoy joint-fourth fastest growth in 2025, at 1.2%, ahead of only Germany and Italy.

The UK is also still projected to see consumer prices rise at a faster rate than other G7 nations.

It is set to rise by 2.7% this year and 2.4% next year, the OECD forecast.

The OECD's economic estimates, which are released twice yearly, aim to give a guide to what is most likely to happen in the future, but they can be incorrect and do change.

They are used by businesses to help plan investments, and by governments to guide policy decisions.

Alvaro Pereira, the OECD's chief economist, said the the government needed to create "fiscal space" for more investment in infrastructure, including for the green transition.

Reeves has suggested she might tweak the debt targets she has pledged to stick by under her fiscal rules.

Fiscal rules are self-imposed and designed to maintain credibility with financial markets. The UK government has a rule to manage its borrowing within a five-year time-frame.

But it could change this to give itself more flexibility over tax and spending plans in the upcoming budget. The chancellor has so far refused to rule out altering them.

The OECD has prescribed a "carefully judged" reduction in interest rates and "decisive" action to bring down debt to allow more room for governments to react to any future economic shocks.

Stronger efforts to contain government spending and raise more revenue were key to stabilising debt burdens, it argued.

Many wealthy countries are facing ageing populations, the challenges of climate change, and geopolitical pressure to raise defence spending.

That is all in the wake of the financial crisis 16 years ago and more recently the Covid pandemic, which increased government borrowing and built up higher levels of debt.

However, not all economists agree that bringing debt down should be the policy priority. Some would like to see borrowing rise for a time, which they argue would boost growth and reduce debt over the longer term.

Related topics

- Published2 May 2024

- Published23 September 2024