Call to speed up banking hub roll-out

So far only two banking hubs have launched in the county, while another four are in the pipeline

- Published

A new type of bank designed to plug the gap left by the decline of the traditional high street branch is not being rolled out quickly enough in Lancashire, county councillors have said.

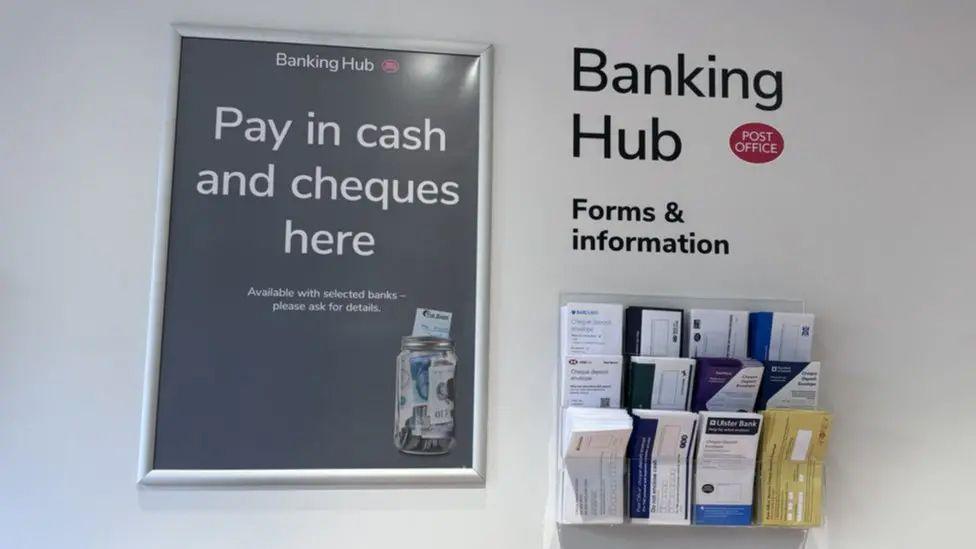

Banking hubs provide a range of banking services and customers can also discuss more complicated financial issues with a representative from their bank.

So far only two banking hubs have opened, while another four are in the pipeline.

Councillor Matthew Maxwell-Scott said "some pressure" needed to be put on Cash Access UK, the organisation behind the hubs, to speed up the delivery.

The hubs provide a range of banking services and customers can also discuss more complicated financial issues

Lancashire County Council members unanimously agreed to establish a working group to explore how the creation of banking hubs could be accelerated in the areas most affected by the dismantling of the branch network, the Local Democracy Reporting Service reports.

Maxwell-Scott, who brought forward the proposal, said: “With the exception, perhaps, of our largest towns, the bank is finished…but banking isn’t – and this is a way of keeping it going.”

The hubs have been set up for people and businesses who either need or prefer to deal in cash, as well as to maintain bank access for elderly and disabled residents who might not want to switch to digital banking.

The only two hubs so far to have opened in Lancashire are in Barnoldswick and Great Harwood. Others are planned for Bacup, Darwen, Kirkham and Morecambe.

The Morecambe branch, which is due to open in September next year, is the only one with a planned opening date so far.

More than 6,000 bank branches have closed across the UK since 2015, according to figures published by the consumer group Which earlier this year.

Listen to the best of BBC Radio Lancashire on Sounds and follow BBC Lancashire on Facebook, external, X, external and Instagram, external. You can also send story ideas to northwest.newsonline@bbc.co.uk, external and via Whatsapp to 0808 100 2230.

Related topics

- Published18 September 2024

- Published14 March 2024