House prices fall as lenders raise mortgage rates

- Published

House prices fell in April as potential buyers continued to face pressure on affordability, according to the Nationwide.

The UK's biggest building society said that UK house prices were down by 0.4% compared with the previous month.

It said the average home cost £261,962, some 4% below the peak in the summer of 2022.

The rising cost of borrowing was key to the latest fall in prices, it said.

'Rock-bottom rates long gone'

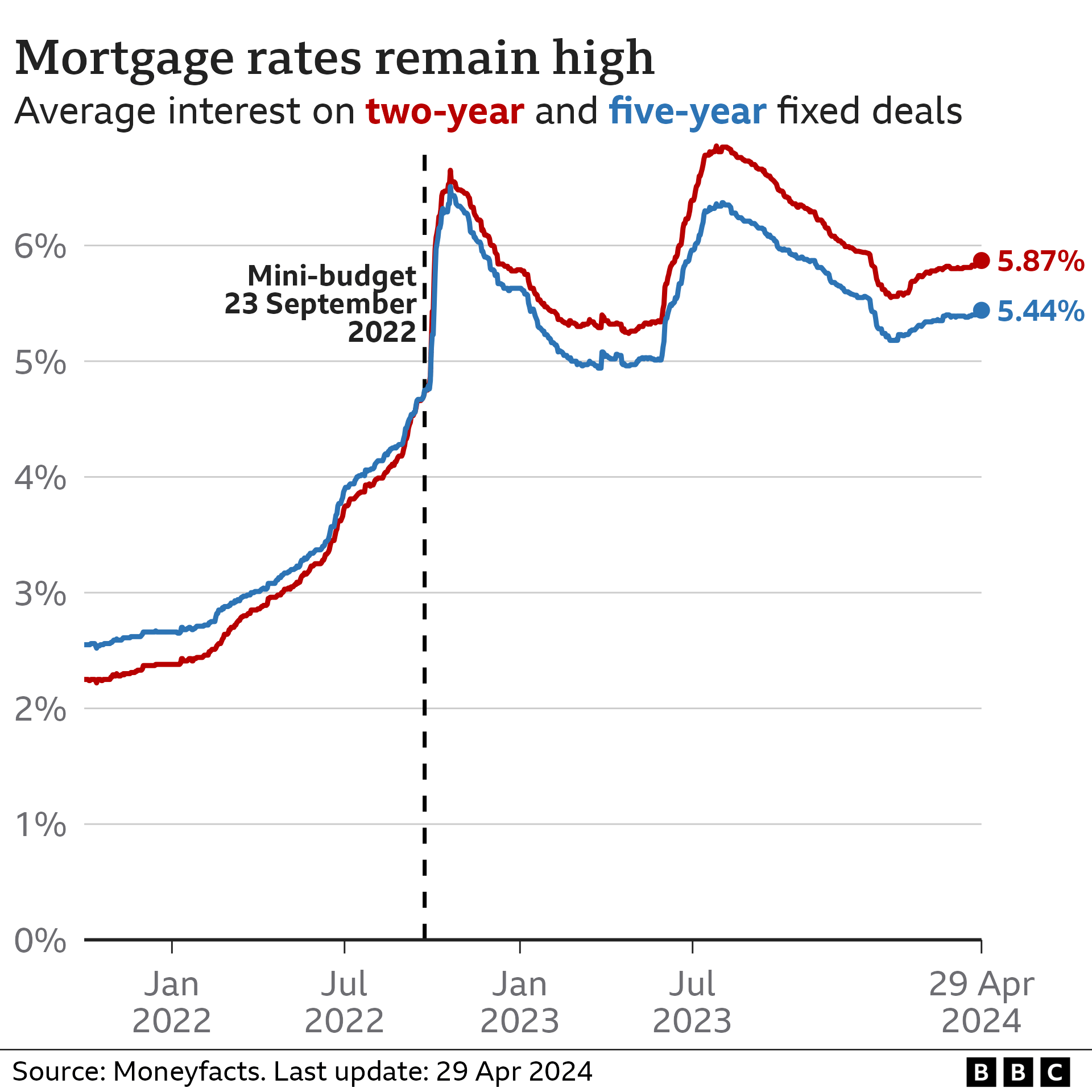

The figures come after a string of lenders raised rates on new fixed-rate mortgage deals in recent days.

The increases were prompted by expectations of fewer and slower interest rate cuts by the Bank of England.

The Halifax is the latest lender to announce higher rates, with a plan to put up the cost of much of its mortgage range by 0.2 percentage points on Thursday.

The interest rate on a fixed mortgage does not change until the deal expires, usually after two or five years, and a new one is chosen to replace it. Doing nothing would leave people on a variable rate, which is very expensive.

About 1.6 million existing borrowers have relatively cheap fixed-rate deals expiring this year.

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: ”There are likely to be ups and downs in mortgage pricing in the weeks and months ahead but ultimately borrowers will have to get used to paying more for their mortgages as the days of rock-bottom rates have long gone.”

This is the second consecutive monthly fall in UK house prices, according to Nationwide’s data. Every area has its own factors affecting house prices, so property values would have changed at varying rates in different parts of the country.

The figures are based on the building society's own mortgage lending, which does not include buyers who purchase homes with cash, or buy-to-let deals. Cash buyers account for about a third of housing sales.

On an annual basis, the pace of house price growth slowed from 1.6% in March to 0.6% in April.

First-time-buyers

The Nationwide said that potential first-time buyers were being put off their plans to purchase a property owing to high house prices and the high cost of borrowing.

Its survey suggested that about half of those considering buying a first home in the five years, had delayed their plans over the last year.

Single first-time buyers recently told the BBC how they faced even tougher conditions, with only one income.

Jess told the BBC she had drawn up a plan but was having to save for years

Jess Waring-Hughes, a 32 year-old business manager, said she was saving hard to buy on her own but there was little support for people in such circumstances.

As a result she has moved back in with her parents while she saves.

“It is weird going back to the childhood room and home again,” she said.

Earlier in the week, the Halifax, which is part of Lloyds Banking Group, said demand for smaller homes such as flats had been increasing at a faster rate than bigger properties, owing to the squeeze on affordability.

It said there had been a switch in demand, reversing the "race for space" that was seen during the Covid pandemic when buyers searched for bigger homes.

Ways to make your mortgage more affordable

Make overpayments. If you still have some time on a low fixed-rate deal, you might be able to pay more now to save later.

Move to an interest-only mortgage. It can keep your monthly payments affordable although you won't be paying off the debt accrued when purchasing your house.

Extend the life of your mortgage. The typical mortgage term is 25 years, but 30 and even 40-year terms are now available.

Get in touch

Are you affected by issues covered in this story?