‘Leasehold charges keep us awake at night’

Mike and Grace Wood, pictured with daughter Sienna, say they saw service charges on their flat rise from £2,000 per year to £5,300

- Published

A couple from Leeds say hikes in service charges on their city centre leasehold flat have left them unable to sell.

Mike and Grace Wood recently moved into a new home in Horsforth with their 15-month-old daughter, but say what should have been a time of excitement has been ruined by the financial burden of their first property.

“We’ve had the flat for six years and the service charges have gone from £2,000 per year to £5,300”, Mr Wood says, with the pair forced to rent out the flat at a loss.

The building's owners and a firm which maintains the block say they "empathise with leaseholders who are facing higher insurance costs".

On Thursday, the government announced the leasehold system in England and Wales would be overhauled by the end of the current Parliament.

The couple say two sales have fallen through due to high service charges - a maintenance fee which is paid on top of a mortgage.

These charges are intended to cover costs such as building insurance, repairs and maintenance.

But the couple were staggered by a rise of 165% in six years and say they dread the bills from the property management company.

“I just feel like you’re writing a blank cheque," Mrs Wood says.

"There is no regulation of what they can charge, there’s no holding to account and that’s why, as a leaseholder, we just feel absolutely helpless."

The couple are now renting out their flat in Leeds at a loss

Despite the increase in service charges, Mr Wood says they have seen little return for their money.

“When we first bought the property, the management company said they were going to do a full renovation - six years later nothing’s ever happened," he said.

"I actually took a paintbrush out and decorated the whole of the corridor and common areas around our flat so they looked a bit more respectable.”

“It’s an absolutely huge financial burden and stress," Mrs Wood says.

"It does keep us awake at night.”

In a joint statement, building owner Grey GR and Inspired Property Management, which collects service charges and maintains the block of flats, said: “We appreciate the challenges in respect of insurance for high and mid-rise properties and we empathise with leaseholders who are facing higher insurance costs.

"We seek to secure the best possible arrangements, which involves a competitive quote process with brokers and insurers - however, the number of insurers offering this type of insurance, as well as the increased risks as a result of the building safety crisis, has proved challenging and has resulted in increased premiums."

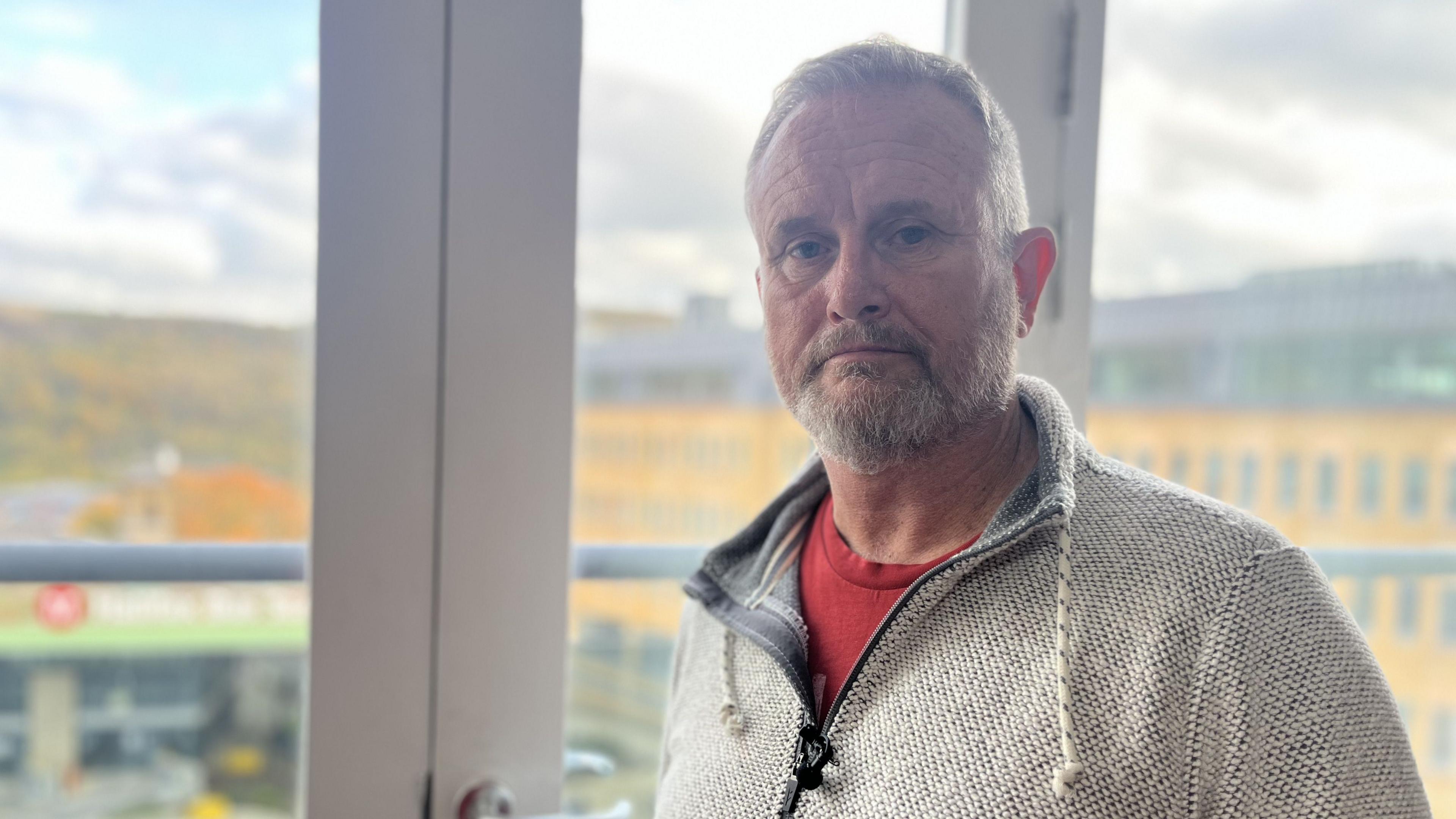

John Barney has seen a five-fold increase to his service charge in Halifax

Less than 20 miles away in Halifax, John Barney faces a similar situation.

He bought a town centre flat 20 years ago as an investment, with service charges increasing five-fold since then.

“It’s basically been a slow, niggling pain in the side, just chipping away at me," the 59-year-old says.

"It’s a millstone round everybody’s neck that we can’t get rid of, we’re caught in a trap.

“Why are we spending £8,000 a year on repairing the lift, every year? We could have bought a new lift by now."

Premier Estates, the company which manages the building, says: “New building safety requirements, the cost-of-living and energy crisis, and the impact of the pandemic have contributed to soaring costs nationwide for leaseholders paying service charges.

"Certain costs have been further impacted by the identification of fire safety defects relating to the external wall(s)."

It concludes: "Resident safety is our absolute priority and we continue to invest significant resource in identifying remediation routes and options for leaseholders."

Listen to highlights from West Yorkshire on BBC Sounds, catch up with the latest episode of Look North or tell us a story you think we should be covering here, external.

Related stories

- Published22 November 2024

- Published21 November 2024