Scottish income tax changes come into force

- Published

Changes to income tax being introduced on Saturday mean Scotland has moved further away from the set-up in the rest of the UK.

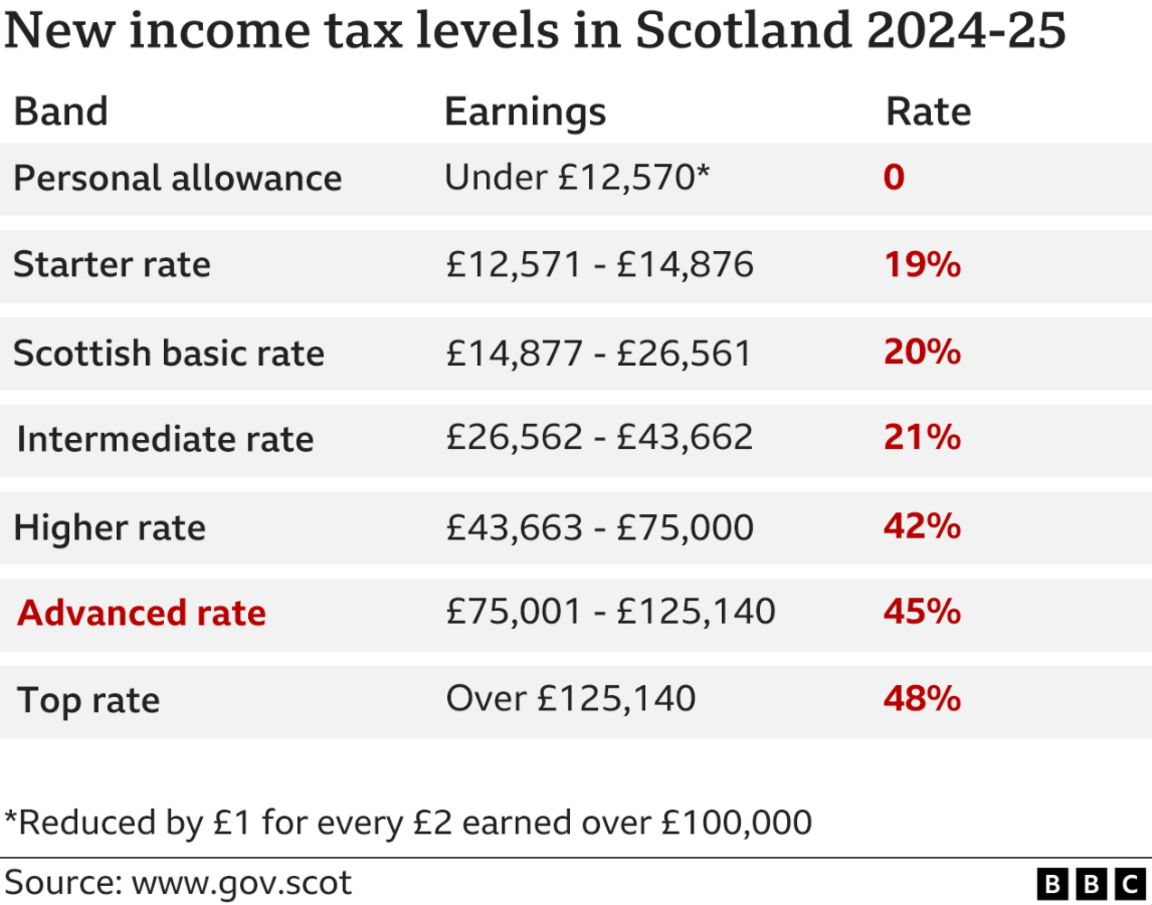

A new "Advanced" band of income tax for those earning more than £75,000 has been introduced along with other changes to tax rates.

It means Scotland now has six tax bands, in contrast to England, Wales and Northern Ireland, where there are just three.

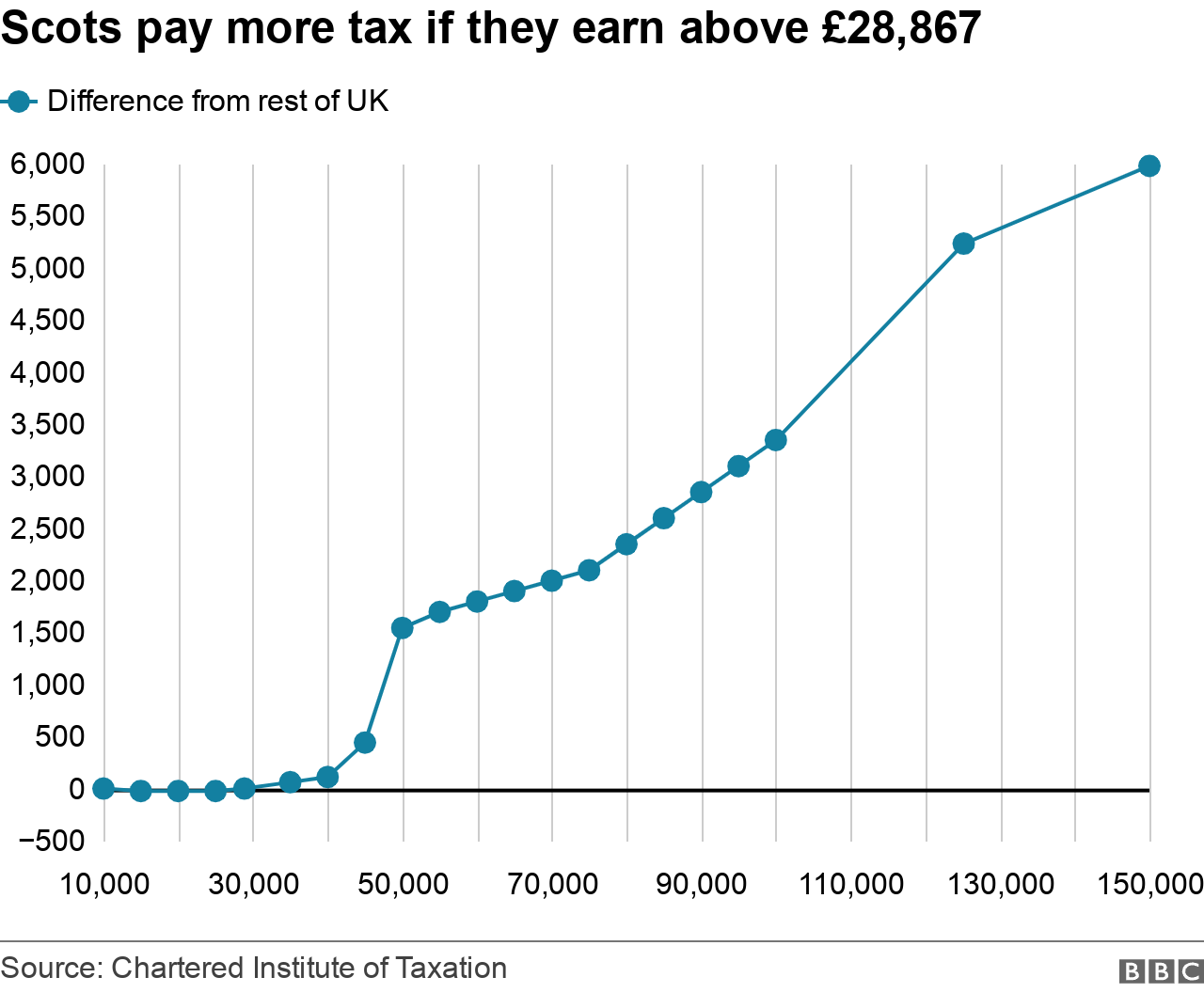

Anyone on more than £28,867 in Scotland will pay more income tax than someone with the same earnings elsewhere in the UK.

However the Scottish government says the majority of Scottish income taxpayers pay less than they would elsewhere in the UK.

At the same time as Scotland changes its income tax rates, the UK government has brought in cuts to National Insurance.

Until January this year, it was 12p in the pound for earnings between £12,571 and £50,270. But a second cut in a year will see it reduced to 8p.

So for someone earning an average £35,000, they will be paying nearly £800 less to the UK government than a year ago.

The Chartered Institute of Taxation said that, despite higher earners paying more tax in Scotland, the rises have been largely offset by the UK-wide National Insurance changes.

It said the new NI rates would mean an increase in the take-home pay for Scots earning up to £112,900 compared with the tax year about to end.

Fiscal drag

There has been a difference between the income tax regimes north and south of the border since 2017 but the latest changes have introduced a new Scottish tax band of 45% between £75,000 and £125,140.

The budget also increased the top rate of tax for those earning more than £125,140, meaning that for each pound earned above that level, 48p will be deducted.

In addition, the higher rate threshold will be frozen for a fourth year at £43,663, instead of rising with inflation.

This means almost 62,000 more people will be dragged into paying at least the 42% tax rate during this tax year, according to figures from the Scottish Fiscal Commission (SFC),, external the Scottish government's independent adviser on taxation.

In total 114,000 people will pay the new Advanced rate of 45%, which starts at salaries over £75,000, with each pound above that level taxed at 45p, up from 42p for the band below.

About 40,000 people are now expected to pay the top rate of 48% on earnings over £125,140. That's about 4,000 more than paid the top rate last year.

The SFC said this "fiscal drag" meant the number of people paying any of the higher rates of tax (currently above £43,662) had risen from about 300,000 eight years ago to 650,000 in the next year.

In 2016 just 12% of Scottish taxpayers paid the higher rate but this has now risen to 22%.

SFC figures suggest about £1.5bn more would be raised in Scotland next year than if it still had UK income tax rates.

For Scottish income taxpayers earning below £28,867 there is a very small advantage to paying tax in Scotland, worth no more than £23 a year.

Above that level Scots are paying more tax than they would in the rest of the UK - a small amount at first but it builds as income rises.

By the time they get to £50,000 a year - the top banding for an unpromoted teacher or a police constable - they are paying £1,542 more than they would on that same pay south of the border.

For a very high earner on £200,000, they will pay £7,478 more in tax than they would elsewhere in the UK.

The Scottish government has previously said the decisions taken in the Scottish budget, including the new tax band, were made to protect frontline services at a time when public sector finances are under pressure.

But critics argue that further widening the tax gap between Scotland and the rest of the UK will hit many Scots in the pocket, harm economic growth and make the country a less attractive place to live and work.

- Published5 April 2024

- Published19 December 2023

- Published19 December 2023