Milkshakes and lattes to face sugar tax in UK

- Published

Pre-packaged milkshakes and coffees that are high in sugar will be hit with an extra tax from 2028, after the health secretary announced he was extending the tax on fizzy drinks to include milk-based products.

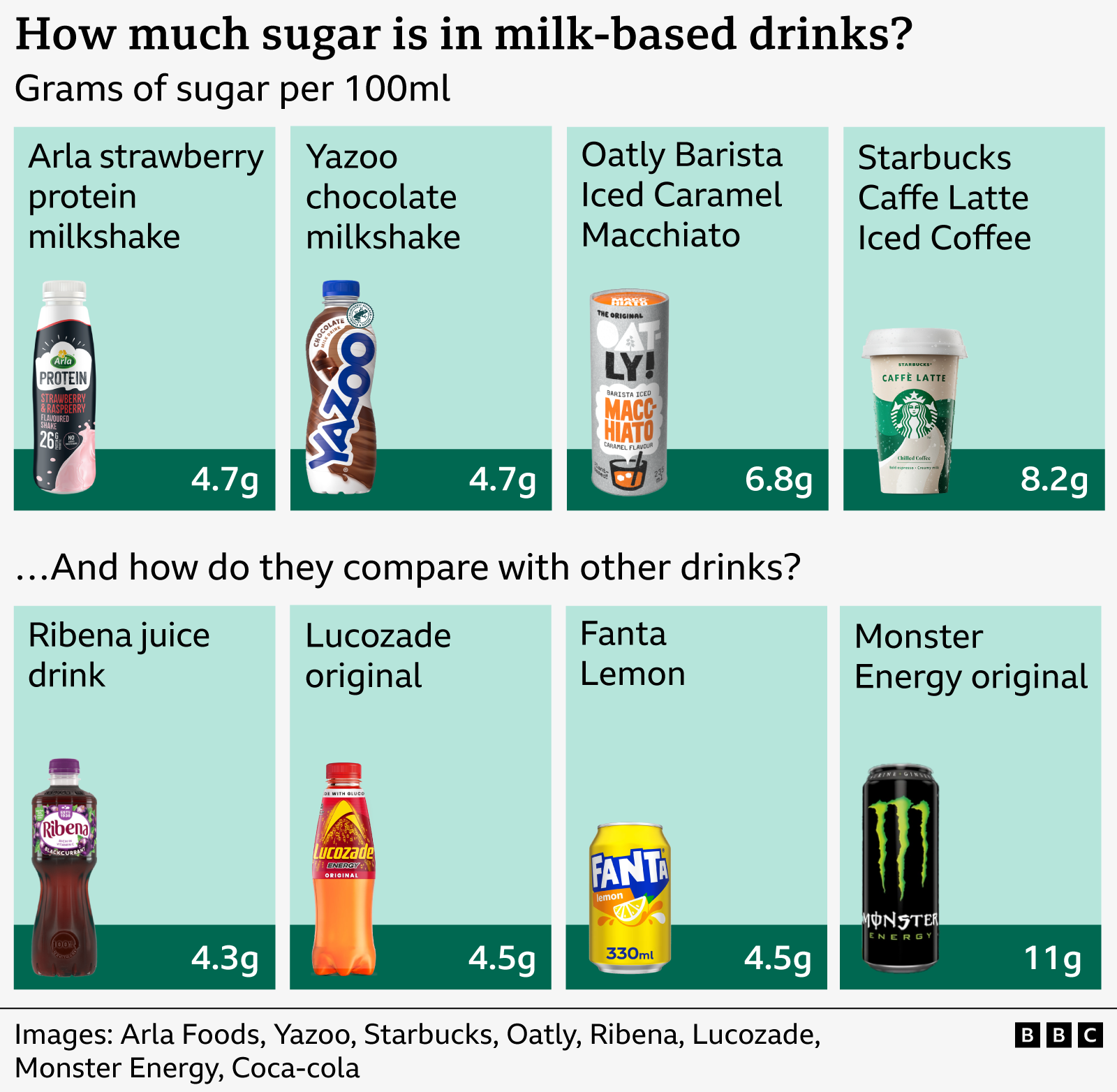

Wes Streeting told Parliament he was also lowering the threshold at which the tax applies from 5g to 4.5g of sugar per 100ml, in an effort to tackle childhood obesity.

That could mean an extra tax on popular products like Yazoo, Muller's Frijj and Starbucks Caffe Latte as well as drinks branded "high protein" like Ufit and Shaken Udder.

The levy, brought in by the Conservative government in 2018, aims to reduce sugar consumption by giving manufacturers an incentive to use less sugar.

The tax applies to products in cans, cartons and other packaging, but not to drinks sold over-the-counter in cafes or coffee shops.

However, there will also be a "lactose allowance" to account for the naturally occurring sugars in milk.

That means some of the sweetness in milk-based drinks will not count towards the total sugar when determining their liability for the tax.

Fruit juices, alcohol-free beer and wine, and meal replacement drinks do not pay the tax.

Milk-based drinks were originally exempt due to their calcium-content.

Drinks made with plant-based milk, such as soya, oat and almond will also be brought into the scope of the tax and treated in a similar way to milk-drinks from 2028.

The tax on sugary drinks has been criticised by politicians who see it as excessive interference from the government in personal consumption choices.

However, the health secretary said it would support the health of the population and help reduce the burden on public health services.

"This government will not look away as children get unhealthier," Streeting said.

"Obesity robs children of the best possible start in life, hits the poorest hardest, sets them up for a lifetime of health problems and costs the NHS billions."

What can nervous businesses expect from the Budget?

- Published1 day ago

Tourist tax expected to be introduced for London

- Published2 days ago

Judith Bryans, chief executive of industry body Dairy UK, said it was "disappointing" that government had decided to expand the sugar levy, given that milk and yogurt based drinks helped provide "a range of nutrients" including B vitamins, protein, iodine and calcium.

But she welcomed the inclusion of the lactose allowance - which is a natural sugar found in dairy products - to address the "unique composition" of dairy.

"This will ensure that dairy companies do not pay the levy on naturally occurring lactose, as this is not a public health concern," she said.

The government consultation on expanding the tax looked at reducing the threshold to 4g of sugar per 100ml, but the government said it had considered feedback on the technical challenges involved in reformulating products below that level "as well as the costs and risks of reformulation for businesses".

A spokesperson for the Food and Drink Federation said it was pleased that the government had listened to industry.

"The new proposals take into account the costly and technically complex work that companies have to do to bring healthier products to market, and go some way to protecting the investment companies are making to help people follow healthier diets," they said.

The expansion of the tax may not mean a rise in the shop shelf price for milky coffees and milkshakes, if manufacturers absorb the cost of the tax, or if they lower the sugar levels in their products.

Many fizzy drink makers have changed their recipes to avoid the tax, though some still sell the higher-sugar version alongside the new one.

The government says the original tax had led to a 46% reduction in the sugar in fizzy drinks, contributing to healthier diets for adults and children as a result of the tax.

Producers would be expected to reformulate their products, lowering the sugar content, or reduce portion sizes in response to the tax change, the government said.

Any change in prices would also prompt a change in customer behaviour, it said.