Thames Water fined £122.7m in biggest ever penalty

- Published

Thames Water has been fined £122.7m for breaching rules over sewage spills and shareholder payouts.

The penalty is the biggest ever issued by the water industry regulator Ofwat, which said the company had "let down its customers and failed to protect the environment".

The watchdog confirmed the fines would be paid by the company and its investors, and not by customers who were hit with water bill increases last month.

Thames Water said the company took its "responsibility towards the environment very seriously", and added it was continuing its search for new investment as it struggles under a £20bn debt pile.

The penalties come as Thames continues to face heavy criticism over its performance in recent years following a series of sewage discharges and leaks.

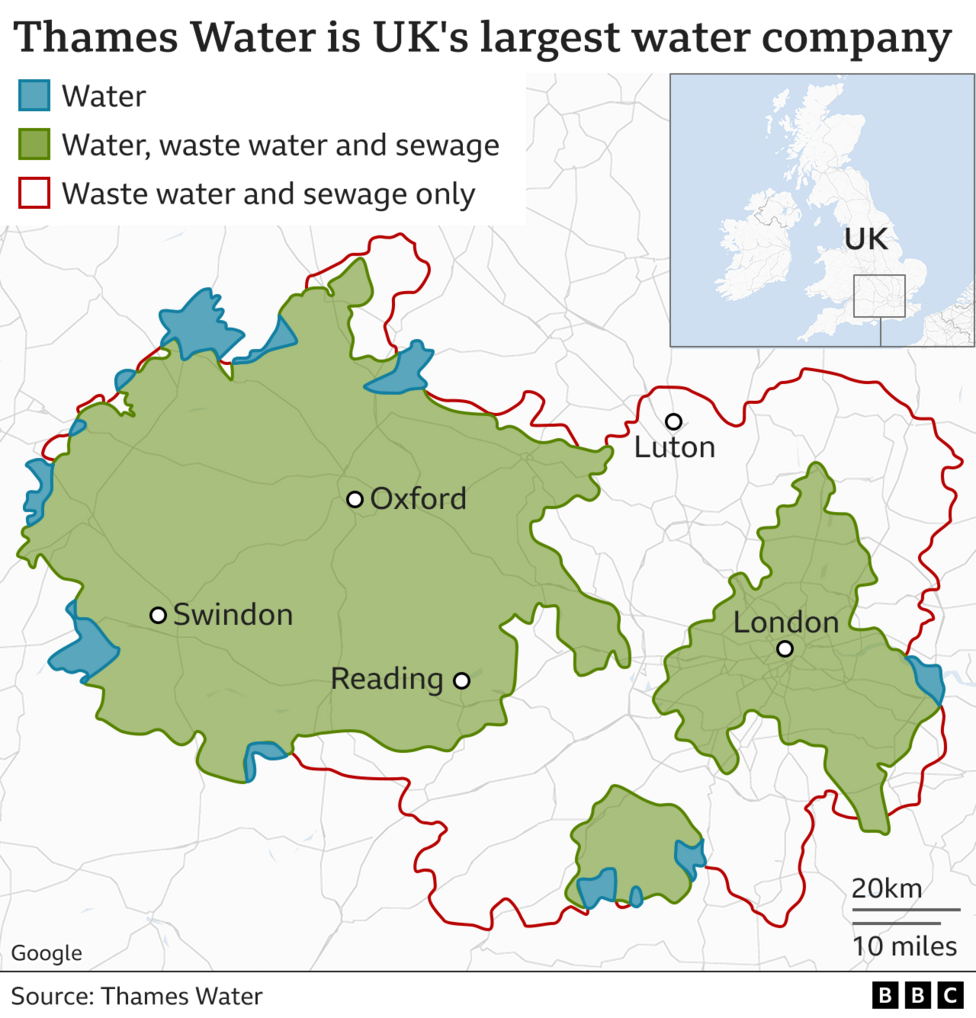

The supplier serves about a quarter of the UK's population, mostly across London and parts of southern England, and employs 8,000 people.

It has been almost two years since the dire state of the company finances emerged, but Thames managed to secure a £3bn rescue loan earlier this year to stave off collapse.

On Wednesday, Ofwat ordered Thames Water to pay a fine following two investigations into its operations.

A penalty totalling £104.5m has been issued for breaches of rules connected to Thames's sewage operations.

Releasing raw sewage has the potential to significantly damage the environment and poses a risk to human health for those swimming in a river or sea where sewage is being discharged.

Water companies are allowed to release untreated sewage into rivers and seas - storm overflows - when it rains heavily, to prevent homes being flooded.

But Ofwat said its findings suggested three quarters of Thames Water's storm overflows were spilling "routinely and not in exceptional circumstances".

It also fined Thames an additional £18.2m for breaches relating to shareholder payouts - known as dividends. One such payment worth £37.5m made in October 2023 to the firm's holding company and another £131.3m dividend made in March 2024, were found to have broken the rules.

The regulator said the shareholder payouts were "undeserved" and did "not properly reflect the company's delivery performance". It is the first time the regulator has fined a water company for this reason.

The scrutiny of dividends also adds to long-running criticism that Thames paid out billions in dividends over years instead of investing more cash in water infrastructure.

David Black, the chief executive of Ofwat, said the latest fines were a result of a "clear-cut case where Thames Water has let down its customers and failed to protect the environment".

"Our investigation has uncovered a series of failures by the company to build, maintain and operate adequate infrastructure to meet its obligations," he added.

"The company also failed to come up with an acceptable redress package that would have benefited the environment."

Thames Water is currently in "cash lock up" and no further dividend payments can be paid without approval from Ofwat.

The company had expected to run out of cash completely by mid-April before it secured a rescue loan, and the government has been on standby to put Thames into special administration.

Regardless of what happens to the company in the future, water supplies and waste services to households would continue as normal.

Ofwat said the penalties "will be paid by the company and its investors, and not by customers".

The money from the fines will ultimately go to the Treasury, but no firm decision has been made about what it will be used for.

The regulator said the March 2024 payout was funded through a tax break and that it will now make the company pay the tax to "claw back the value" of it.

In April, water bills for households in England and Wales rose by £10 per month on average, although costs vary depending on suppliers - Thames customer bills have gone up from £488 to £639 a year.

Ofwat proposed the £104m fine in August last year, but confirmed the penalty, and the additional £18.2m fine on Wednesday.

Environment Secretary Steve Reed said the "era of profiting from failure is over".

Earlier this month, Thames Water's boss Chris Weston told MPs the company's survival depended on Ofwat being lenient over fines and penalties.

Last week, the company decided to "pause" its scheme to pay out big bonuses to senior executives linked with securing its £3bn rescue loan.

The decision comes after Downing Street said bosses at the troubled firm "rewarding themselves for failure is clearly not acceptable".

A spokesperson for Thames Water said: "We take our responsibility towards the environment very seriously and note that Ofwat acknowledges we have already made progress to address issues raised in the investigation relating to storm overflows.

"The dividends were declared following a consideration of the company's legal and regulatory obligations."

The company said its bid to raise more investment was continuing. Thames is in discussions with private investment group KKR about a cash injection of up to £5bn.

But that deal being completed is also dependent on lenders to the company accepting a discount on the nearly £20bn they are owed. Some junior lenders could see their entire loan being written off.

Get in touch

Are you a Thames Water customer - what do you think?

Get our flagship newsletter with all the headlines you need to start the day. Sign up here.