Pay growth surprise after first rise in over a year

- Published

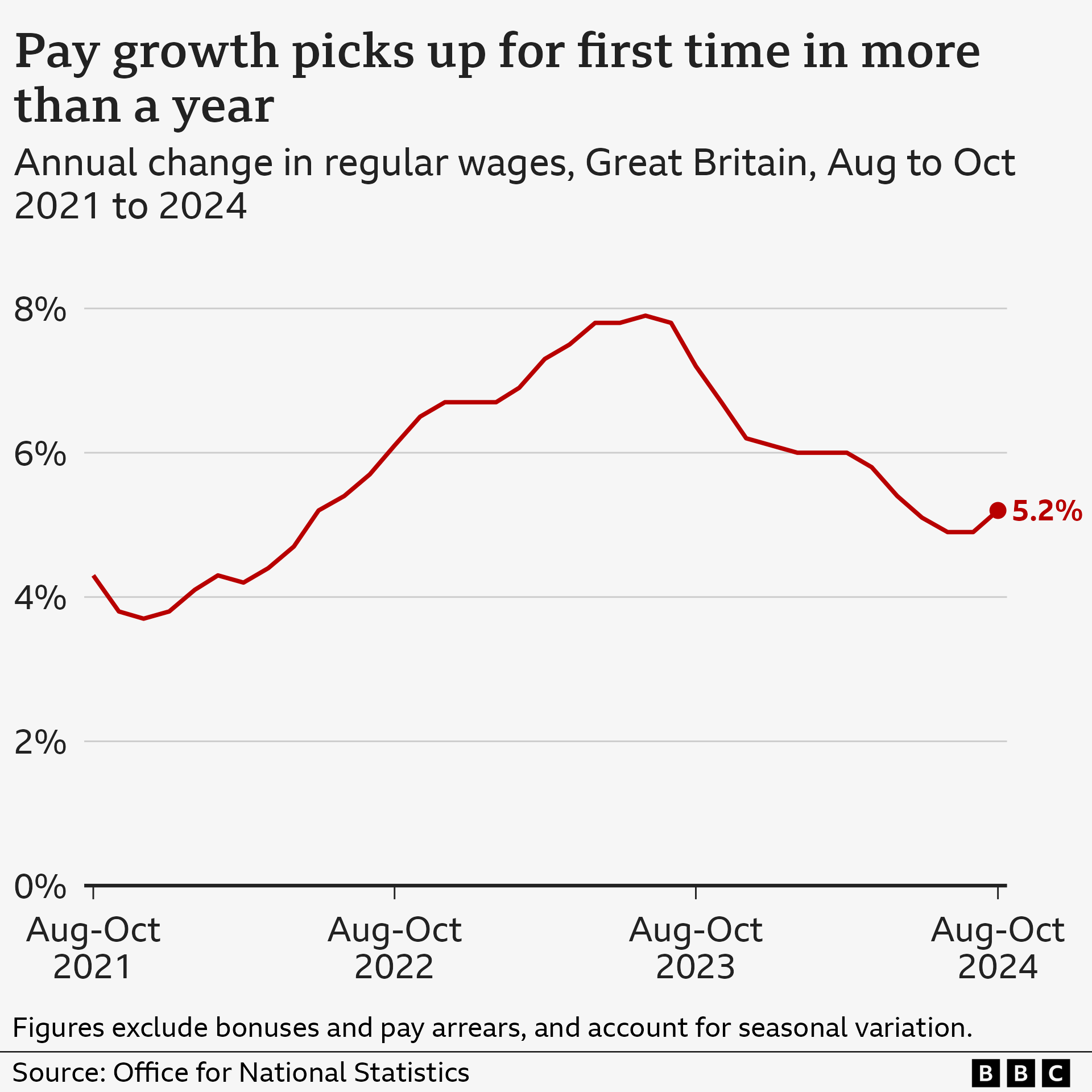

Pay growth has picked up for the first time in more than a year, the latest official figures show.

Regular pay grew at a faster-than-expected annual pace of 5.2% between August and October, the Office for National Statistics (ONS) said, with wages continuing to grow faster than prices.

Analysts say the latest figures mean the Bank of England will almost certainly not cut interest rates when it meets this week.

The ONS data, external also suggested the jobs market is weakening, with job vacancies falling again and a drop in the number of people on payrolls.

The unemployment rate was unchanged at 4.3%, although there are questions over the reliability of the jobs figures from the ONS due to problems with gathering the data.

"After slowing steadily for over a year, growth in pay excluding bonuses increased slightly in the latest period driven by stronger growth in private sector pay," said Liz McKeown, director of statistics at the ONS.

Private sector pay grew at an annual pace of 5.4%, the ONS said, while in the public sector it was 4.3%.

The Bank of England watches the pay and jobs data closely when making decisions on interest rates.

It has cut rates twice this year as inflation - which measures the rate at which prices are increasing - has fallen.

The Bank meets to discuss rates again this week, but it is not expected to make a further cut given the strength in pay growth.

"The latest UK jobs report provides yet more justification, if any were needed, for the Bank of England to keep rates on hold at its meeting this week," said James Smith, developed markets economist at ING.

Mr Smith noted that the jump in wage growth was entirely down to the private sector.

"This matters for the Bank, because private sector pay trends tend to be more reflective of the wider situation in the jobs market than in the public sector," he said.

Monica George Michail, associate economist at the National Institute of Economic and Social Research, said: "With low inflation, workers have been making real income gains.

"However, given the slowdown in recruitment activity and rising unemployment, we expect wage growth to slow in the coming months, although the rise in National Living Wage in April would exert some upward pressure."

'Never reached it'

"I take it with a pinch of salt, this average wage increase. I've never reached it," says 61-year-old Nigel Wildgust, who lives in Nottingham.

He works in building materials supply, and says for the last two years, his average pay rise has been about 1%.

He thinks some people must be getting very large wage rises for the average increase to be 5.2%.

"If I were to get anything over 2%, I'd think it was a mistake," he says.

Even with a small Christmas bonus last year his average salary rises have "always been below" the average.

The number of job vacancies fell by 31,000 to 818,000 in the September-to-November period, the ONS said, although the total remains above pre-pandemic figures.

Liz McKeown from the ONS said the while the number of people on payrolls grew slightly in October, the annual growth rates "continue to slow".

The ONS also said provisional data indicated that the number of staff on payrolls fell by 35,000 last month, although analysts said this figure is volatile and can be subject to large revisions.

Many firms have argued the increase in National Insurance Contributions for employers that was announced in the Budget will lead them to cut back on hiring.

At the weekend, the boss of Reed, one of the UK's largest recruitment firms, told the BBC the economy was "cooling", suggesting a recession may be "around the corner".

A separate survey released on Monday, external indicated that private sector employment December had fallen at the fastest rate for nearly four years.

Work and Pensions Secretary Liz Kendall said the latest figures were "a stark reminder of the work that needs to be done".

"To get Britain growing again, we need to get Britain working again – so people have good jobs which pay decent wages and offer the chance to progress."

Liberal Democrat Treasury spokesperson Daisy Cooper MP said: "Over the Christmas period no one should have to worry about the impact that an impending tax rise may have on their employment.

"The new government must see sense and realise that their self-defeating hike in National Insurance will only make the situation worse for health services and high streets."

Labour has made boosting growth in the economy one of its key aims.

However, figures released last week showed the economy shrank by 0.1% in October, the second month in a row it has contracted.

Get in touch

Has your pay increased this year? Please share your experience

Falling job vacancies may signal recession, recruiter warns

- Published16 December 2024

UK economy shrinks for second month in a row

- Published13 December 2024

'I want to get a job but I don't know how'

- Published26 November 2024

Sign up for our Politics Essential newsletter to read top political analysis, gain insight from across the UK and stay up to speed with the big moments. It'll be delivered straight to your inbox every weekday.