Does Chinese investment benefit or damage Ireland?

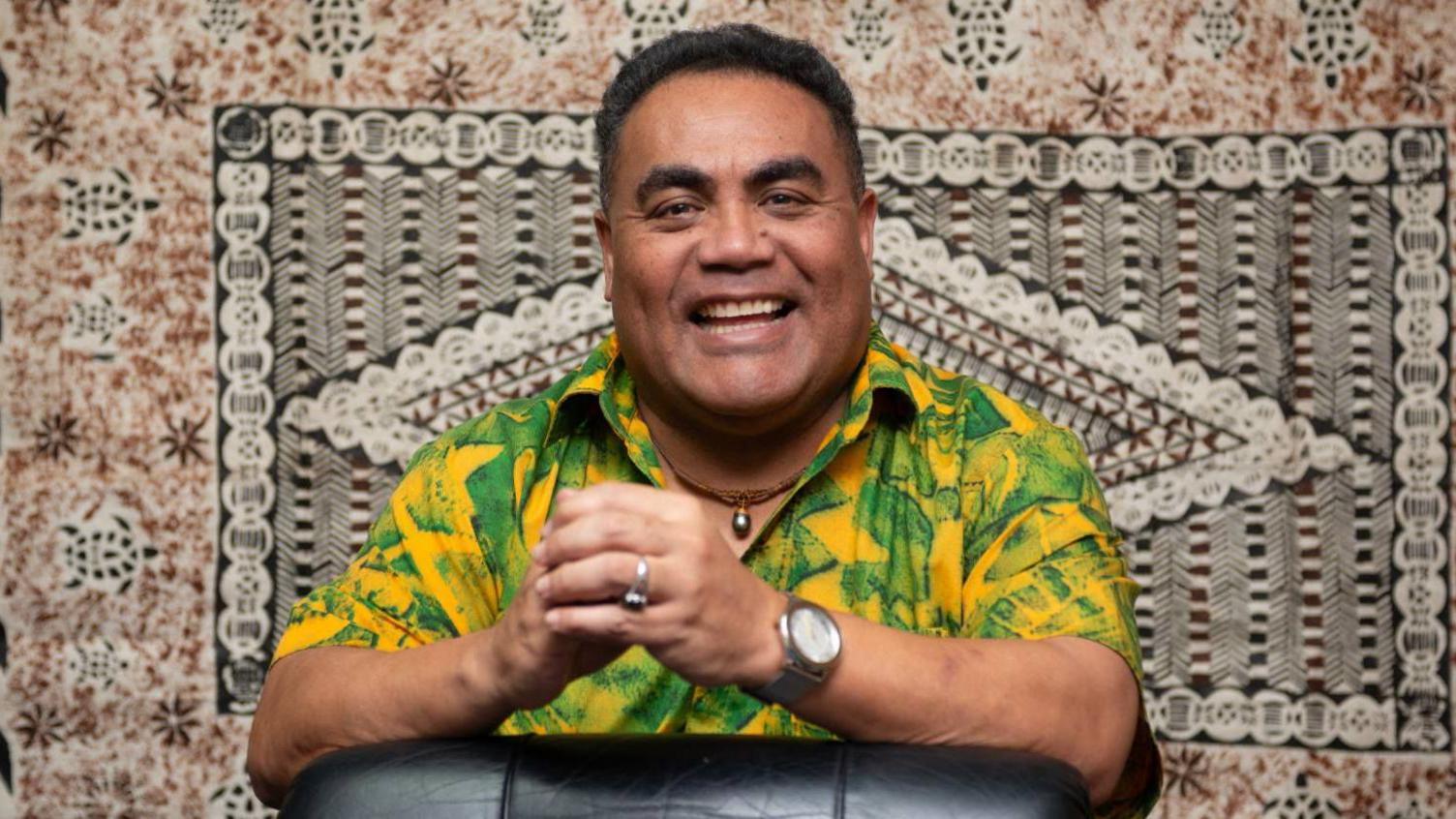

Back in May, Irish Minister Dara Calleary helped Huawei celebrate 20 years of doing business in the country

- Published

The Irish economy has been increasingly attracting Chinese investment, but does it come with a reputational cost?

In 2020, 25 Chinese companies had operations in the Republic of Ireland. By this year the number had jumped to 40., external

For some this new flood of yuan into the country offers Ireland an opportunity to reduce its reliance on being the European base for US tech giants such as Apple and Alphabet. And it creates additional jobs.

But for an increasing number of critics, Ireland being home to Chinese firms links the country to the human rights abuse allegations levelled against some such companies. These include Chinese clothing firm Shein, which since May 2023 has had its European headquarters in Dublin.

Shein has long been attacked for how the workers who makes its clothes are treated. And earlier this year it had to admit that it found child labour in its supply chain.

The Irish government is also in the diplomatically awkward position of luring many of the very Chinese companies that the US has sanctioned.

Two cases in point – telecoms firm Huawei and drugs company WuXi Biologics.

In May, Ireland’s Minister of State for Trade Promotion, Dara Calleary, welcomed a report , externalcelebrating how Huawei was contributing €800m ($889m; £668m) per year to the Irish economy. The firm has three research and development centres in Ireland.

This is the same Huawei whose telecoms network equipment the US has banned since 2022 due to concerns over national security. The UK has moved in the same direction, ordering phone networks to remove Huawei components. And mobile phone networks in many Western nations, including Ireland, no longer offer Huawei handsets.

Meanwhile, WuXi has, since 2018, invested more than €1bn in a facility in Dundalk, near the border with Northern Ireland.

Earlier this month the US House of Representatives passed a bill, external to restrict US firms’ ability to work with WuXi, again citing national security concerns. The bill now has to go to the US Senate.

WuXi has a big facility in Dundalk, near the border with Northern Ireland

Ireland’s Industrial Development Authority is the government agency whose mandate is to attract foreign investment into the country. It has three offices in China, and says it seeks “to promote Ireland as a gateway to Europe for Chinese investors”.

Another Chinese firm that has its European headquarters in Ireland is social media video app TikTok, which is owned by Beijing-based parent firm ByteDance. And the parent of Chinese online retailer Temu moved its global headquarters , externalfrom China to Ireland last year.

Prominent critics of Ireland rolling out a “green carpet” to Chinse firms include Barry Andrews, one of Ireland's members of the European Parliament. “Human rights and environmental abuses should not be allowed in Irish shopping baskets,” says the Fianna Fáil MEP.

He points to a US Congress report from last year, which said there was “an extremely high risk that Temu’s supply chains are contaminated with forced labour”., external

Temu had told the investigation that it had a “zero-tolerance policy”, external towards the practice.

“One person’s bargain is another’s back-breaking work for poverty wages,” adds Mr Andrews, whose party is part of the current Irish government coalition.

Critics also argue that there are substantial differences between US tech firms operating in Ireland and Chinese ones – for example, about openness.

For instance, Huawei and WuXi declined an opportunity to be interviewed for this article. Shein provided a spokesperson who was only prepared to speak off the record, then did not reply to follow-up questions.

Some leading economists question whether Ireland even needs the few thousand jobs that the Chinese firms provide.

“Ireland’s economy has been running at near full employment for the best part of a decade," says Dan O'Brien, chief economist at Ireland's Institute of International and European Affairs.

Irish unemployment was 4.3% in August 2024, only slightly above its all-time low of 3.90% in October 2020. Economists generally consider an unemployment rate of around 4 to 5% to represent full employment., external

Huawei has a big presence in Ireland but the main Irish phone networks no longer offer its handsets

Mr O’Brien also points to the fact that a fifth of Ireland’s private-sector employment is directly, or indirectly, attributable to foreign direct investment (FDI), according to official figures., external He says this is too high.

It is so elevated because Ireland has one of the lowest standard corporation tax rates in Europe, at 12.5%. This is the tax that all but the very biggest firms have to pay on their profits. By comparison, the UK rate is 25%.

Mr O’Brien says that Ireland’s level of FDI was already too high without the Chinese investment on top. “Given we are already overly dependent on FDI in a world that is at risk of deglobalisation, we don’t need another major source of FDI on top of that from the United States.”

He adds EU rules should be “actively used to discourage Chinese FDI” in Ireland.

The Irish government tells the BBC that it "supports the common EU approach to China on de-risking... [but] the government has been clear that de-risking is not decoupling".

Irish Minister for Enterprise, Trade and Employment, Peter Burke adds: “In an era of continuous global uncertainty, Ireland offers a stable and pro-business environment. Multinational companies, including Chinese companies, recognise these opportunities.”

Given how much Ireland's economy does depend on FDI, some economists say Chinese investment in Ireland can be seen as a welcome insurance policy in case some US firms pull out.

“There is a huge pressure on US tech companies to re-domicile and re-invest in the US," says Constantin Gurdgiev, an economist at Trinity College Dublin and the University of Northern Colorado.

Meanwhile, other European countries, such as Poland, Estonia, Slovakia, and Malta, have made inroads in courting US investments, presenting Ireland with new competition from countries with cheaper housing and less rain.

Dr Gurdgiev also points to “the forever-looming threat of global corporate tax reforms”, further eroding Ireland’s low corporation tax. The country has already signed up to Organisation for Economic Co-operation and Development rules, and as a result, this year introduced, external a 15% corporation tax rate for firms with an annual turnover of more than €750m ($835m; £625m).

And earlier this month, the European Court of Justice ruled that Apple had to pay Ireland €13bn in unpaid taxes. It followed after the European Commission accused Ireland of giving Apple illegal tax advantages.

Dublin consistently argued against the need for the tax to be paid, but said it would respect the ruling.

Dr Gurdgiev adds that Ireland is acting “with some strategic foresight” in courting Beijing. And that even if Dublin is welcoming the likes of Huawei, he says that the strength and influence of the Irish diaspora in the US means that Washington will turn something of a blind eye.

He argues that this is why the US authorities have been “largely laissez-faire in their approach to chasing tax optimization schemes that Dublin has been developing over decades”.

Plus, he says Ireland provides the US, EU and China with a useful “neutral ground” where both US and Chinese tech firms can operate.

Dr Gurdgiev adds that by putting itself in such a position, Ireland is playing a “dangerous geopolitical game” for a small economy.

However, he says its diplomatic closeness to the US should make its position "relatively safe".

Read more global business and tech stories

- Published25 September 2024

- Published19 September 2024

- Published16 September 2024

- Published9 September 2024