Investment firm ran Ponzi scheme, High Court rules

London Capital & Finance was said to have misrepresented itself in a “widespread, fundamental and systematic” way

- Published

Individuals involved in a “Ponzi” scheme investment company which caused people to lose their life savings are liable to pay millions in damages, the High Court has ruled.

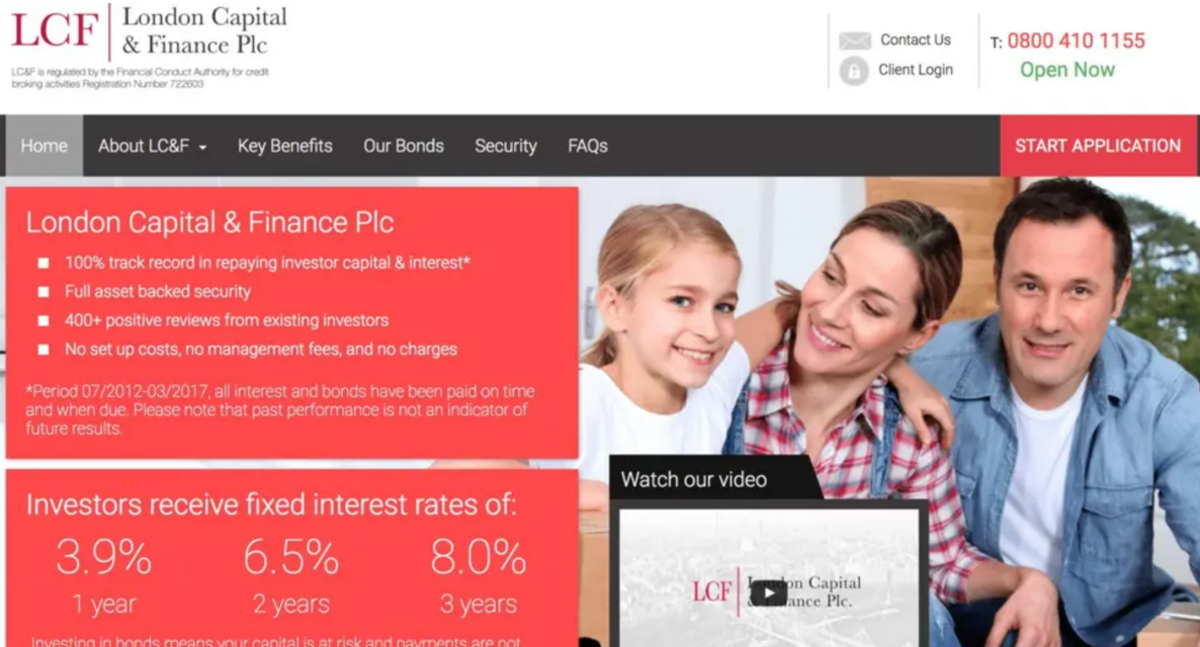

London Capital & Finance (LCF) raised £237m from more than 11,600 investors by issuing mini-bonds before going into administration in 2019. Mini-bonds are an investment that typically offer high returns.

Previous court documents stated that the directors, including individuals from Surrey, used money to buy property, supercars, pay for luxury travel and make donations to the Conservative Party.

Another court hearing could happen in December to decide how much compensation will be paid.

The High Court of Justice in London concluded that it operated as a Ponzi scheme to pay old bondholders with new bondholder’s money between 2013 and May 2018.

Mr Justice Robert Miles concluded on Thursday that LCF misrepresented itself to the public in a “widespread, fundamental and systematic” way.

People from across the country invested money into the mini-bonds, including from Sussex, Surrey and Kent.

Ponzi schemes often advertise attractive rates of return for investors in order to lure in money, but returns are paid from money coming in from other, new investors.

This happens until the scheme ends up owing more than they hold in investments.

The court found that former chief executive Michael Thomson and associate Spencer Golding were found liable on 14 November for breaches of duties as directors.

Three other men – John Russell-Murphy, from Eastbourne, Paul Careless, who was chief executive of Brighton-based Surge Financial, and Robert Sedgwick all “dishonestly assisted” Mr Thomson and Mr Golding, the court heard.

LCF promised returns of 8% for people investing for more than three years

Mr Justice Miles said LCF “presented itself to investors as a commercial lender” to small and medium sized UK companies.

But a “substantial” amount of money was taken and used to make payments to the defendants who used the money “as they wished”.

Claimants previously said this included private members clubs, investments, luxury jewellery and shotguns.

He added that all the defendants “all knowingly participated in the fraudulent conduct”.

Colin Hardman, of Evelyn Partners, on behalf of the joint administrators of LCF said: “This fraud was perpetrated against over 11,500 bondholders many of whom suffered significant financial hardship as a result of the wrongdoings.

“Not only were investors unwittingly mis-sold bonds but, unbeknown to them, the funds were then fraudulently misapplied for the benefit of the fraudsters’ lifestyles and their business interests.

“We hope that the outcome of this trial, together with tighter regulation which has subsequently been introduced, will act as a deterrent going forwards.”

Related topics

- Published9 March 2019

- Published17 December 2020

- Published8 May 2024