How Spanish-owned bank TSB was born in a tiny Scottish village

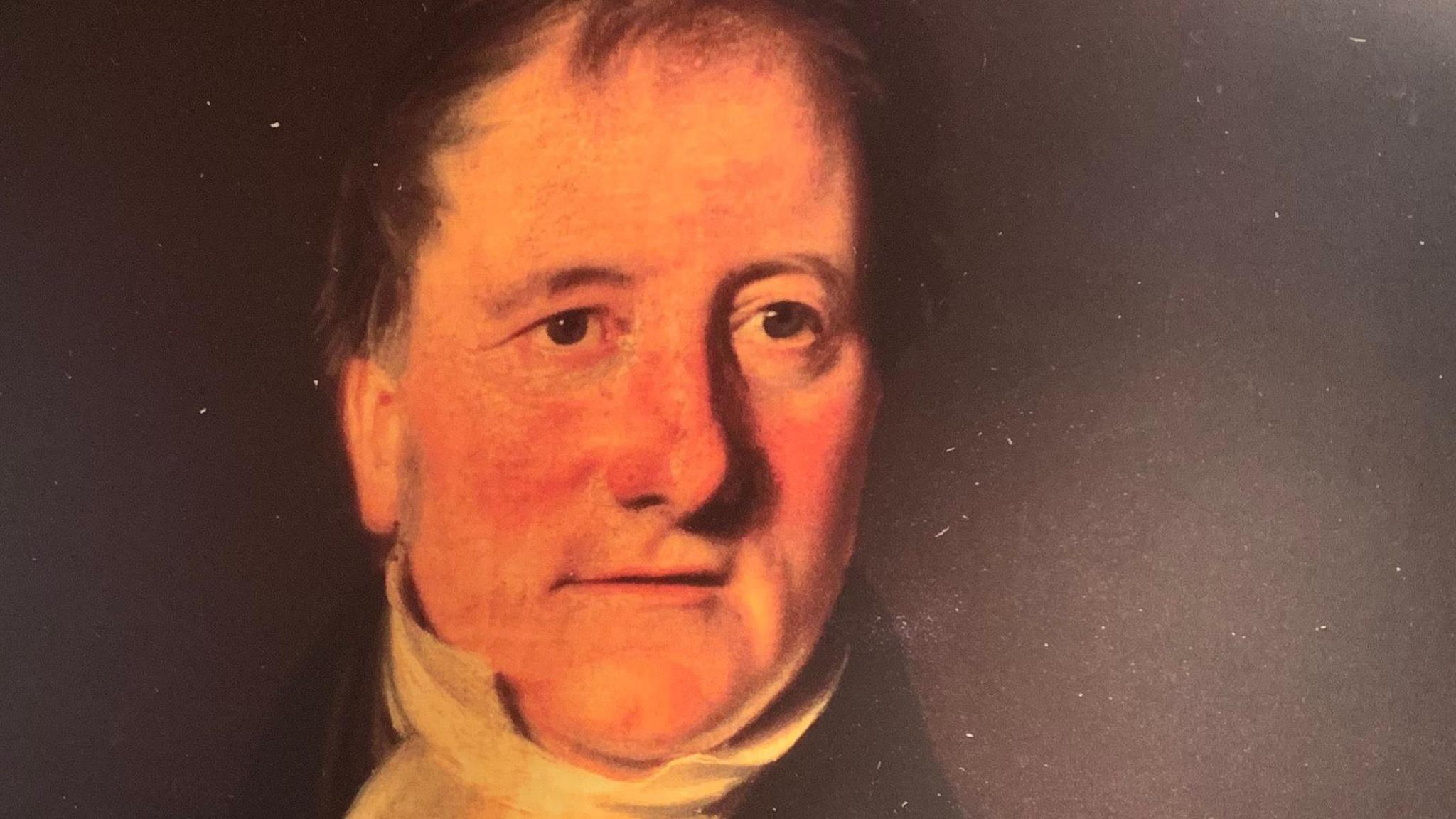

Henry Duncan founded what is claimed to be the world's first savings bank

- Published

Edinburgh-based bank TSB is set to be bought over by Santander, after 10 years with rival Spanish owner Sabadell.

The deal, which could see the TSB name disappear from UK high streets. is the latest change for the bank which was founded in Dumfriesshire in 1810, thanks to the vision of a Scottish clergyman.

In 19th Century rural Scotland personal banking was unimaginable for most people due to the high deposit required at commercial banks and low earnings of workers.

That changed when the Rev Henry Duncan started his "penny bank" in the hamlet of Ruthwell to give parishioners access to savings and interest for the first time.

And so the Trustee Savings Bank (TSB), said to be the first savings bank in the world, was born.

The TSB model was soon adopted around the globe to form the savings bank organisations we know today.

The 18th century building which houses the Savings Banks Museum reopened in 2024

At the time the TSB was founded, commercial banks required a minimum deposit of £10 to open an account, a sum far out of the reach of agricultural labourers and domestic servants who typically earned 10d (4p) a day.

Many workers were only paid for the days they worked, and often received payments once every three months.

Rev Duncan based his new penny bank on business principles, encouraging them to budget and paying interest on its investors' modest savings.

He had worked for three years in a commercial bank in Liverpool before taking up the ministry in Ruthwell Parish so he knew how the system worked.

It is believed he took the money from Ruthwell and redeposited it into a commercial bank, where he received between 5% and 6% interest and paid out between 4% and 5%.

The desk used by banking pioneer Henry Duncan features in the museum in Ruthwell

Within five years, savings banks based on Duncan's model were operating throughout the UK, and by 2002 there were 109 savings bank organisations in 92 countries.

The Trustee Savings Bank's original 18th century building closed in 1875 due to the small population of the hamlet.

But the cottage where he opened his savings bank - initially for one hour a week on a Thursday evening - is now the Savings Bank Museum.

It reopened last summer after being closed for five years, now housing hundreds of piggy banks as well as Duncan's desk.

Duncan died in 1846 from a stroke, aged 71.

The headquarters of TSB Bank at 120 George Street in Edinburgh is named Henry Duncan House after its founder.

TSB is set to be taken over by Santander in a £2.65bn deal

Since 1810 TSB has gone through a number of iterations before merging with Lloyds Bank in 1995 to form Lloyds TSB.

During the global financial crisis in 2008, Lloyds was forced by the European Commission to spin off the business as a separate brand after Lloyds received a £20bn bailout.

Lloyds eventually sold its remaining stake in TSB to Spanish organisation Sabadell in 2015 in a deal worth £1.7bn.

On Tuesday it was announced TSB will be bought by Santander for at least £2.65bn if shareholders agree, and the rival Spanish bank "intends to integrate TSB in the Santander UK group".

TSB has 175 branches in the UK and 5,000 employees while Santander has around 349 banks, but it has been shutting branches, saying more customers want to do their banking digitally.

The UK management said it would be "business as usual" for customers and staff, with the takeover expected to happen early next year, but the TSB name could soon be a thing of the past.

Related topics

- Published25 August 2024

- Published2 July

- Published9 September 2013