Woking council has biggest debt per person in UK

The debt at Woking Borough Council is equivalent to more than £20,000 per person

- Published

A council in Surrey continues to have the largest debt per person in the UK, BBC analysis shows.

Woking Borough Council (WBC) owed £2.16bn as of April, which is equivalent to £20,601 per person and an increase from a previous study.

That is more than double that of Spelthorne Borough Council (SBC), which was second in the UK with average debts of £10,252, while Runnymede Borough Council (RBC) was fifth, with an average of £6,609 per person.

The analysis also shows that Surrey County Council (SCC) had the largest overall growth in the amount of its debt in the space of one financial year.

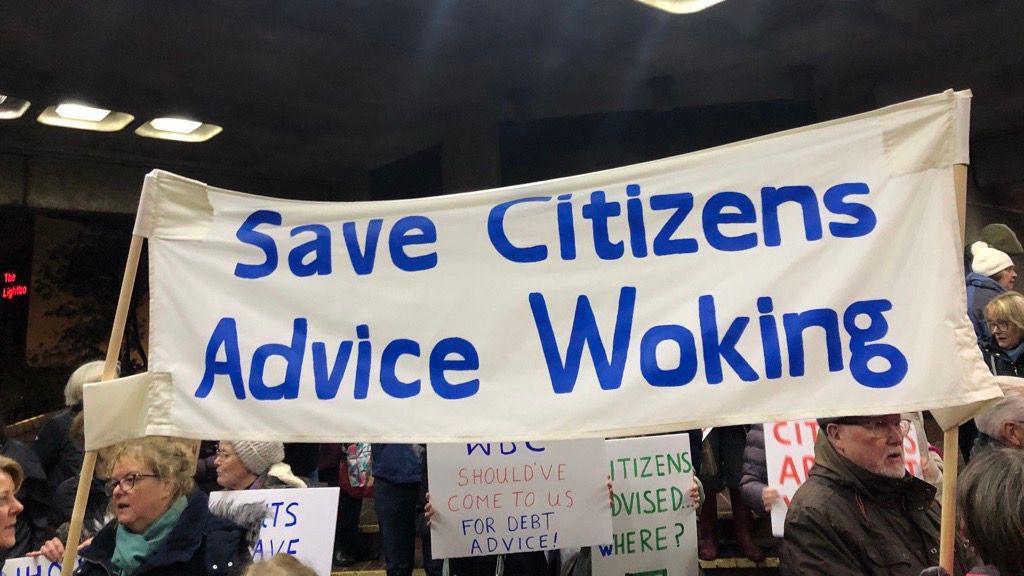

Protests were held in February 2024 over cuts to services in Woking

WBC effectively declared itself bankrupt in June 2023, issuing a section 114 notice, because of its historic borrowing and investment decisions.

Since then the authority has taken measures to balance the books, including cuts to services and selling off assets, as well as receiving support from the government to repay its debt.

In May, commissioners appointed by the government were sent to intervene in the running of SBC.

Neither Woking nor Spelthorne council provided a statement on the record about the study by the BBC Shared Data Unit.

WBC referred the BBC to a report about the progress being made on an Improvement and Recovery Plan, external.

Previously its leader, Liberal Democrat Ann-Marie Barker, told BBC Radio Surrey that the council was "moving the right way".

SBC also referred the BBC to a review of its finances, external in 2024/25, which said that the council continued "to deliver a balanced budget".

RBC has been approached for comment.

Tim Oliver is the leader of Surrey County Council

SCC saw its debt rise by almost 48%, from £726.9m in 2023/24 to £1.07bn in 2024/25.

Conservative leader Tim Oliver said that as part of the budget-setting process the council had made sure that the level of debt was "justifiable and manageable".

"Councils across the country are facing unprecedented financial challenges, and while here in Surrey we have a stable budget position, we are not immune to that pressure," he said.

"It's imperative that the outcome of the forthcoming Fair Funding Review is fair and proportionate.

"All our key services – including social care, children's services, and highways maintenance – are facing higher demand, higher costs, and reduced funding.

"We must find ways to continue to support those residents who need us most, and to deliver the services that people rely on every day.

"This means we have to reduce costs where we can – and there is more to do to set a balanced budget next year – but also transform the way we work and find new ways to deliver services more effectively."

A Ministry of Housing, Communities and Local Government spokesperson said: "While councils are responsible for managing their own budgets, we know that the current funding system is broken which is why we are taking decisive action so local leaders can deliver the public services their communities rely on."

Follow BBC Surrey on Facebook, external, and on X, external. Send your story ideas to southeasttoday@bbc.co.uk, external or WhatsApp us on 08081 002250.

- Published6 August

- Published8 May

- Published14 October 2024