Tax return delays criticised by islanders

More than £1m has been paid in compensation for late tax rebates, the States heard

- Published

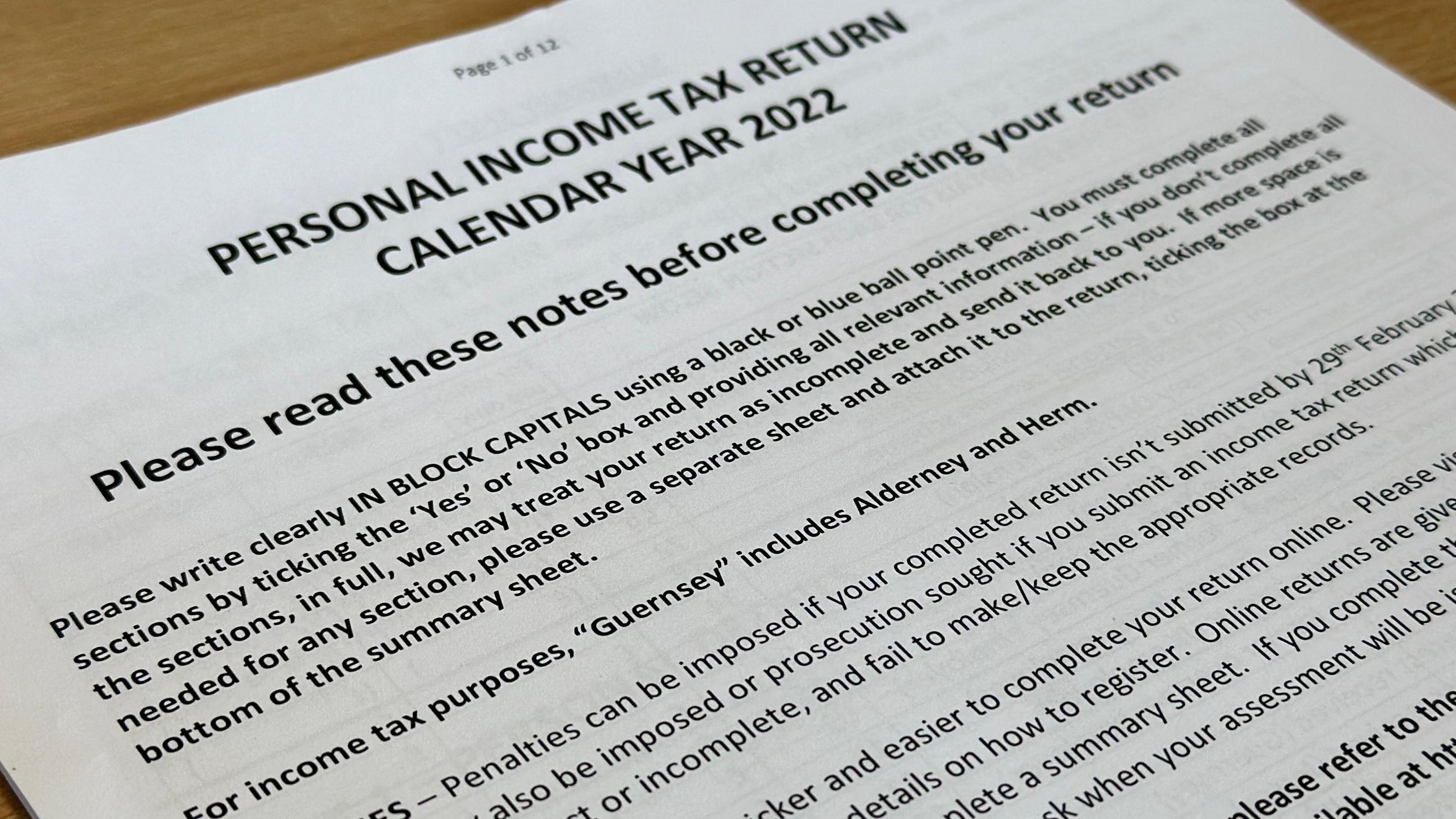

Islanders have complained about "non-existent" communication from Guernsey's tax office amid long delays in the processing of tax returns.

Mike Snelling, who is still waiting for his 2021 and 2022 tax assessments, said communication with the Revenue Service had been "one-way" and he urged officials to "get their act together".

About £1.1m of compensation has been paid to Guernsey residents who should have received tax rebates in the past two years, the States has heard.

Nicky Forshaw, the director of the Revenue Service, said "addressing delays remains a priority for the service".

Mike Snelling said he was still waiting for his 2021 and 2022 tax returns

According to the latest Revenue Service figures, a fifth of personal tax returns from 2020 have still not been assessed, while two-fifths remain outstanding for 2021.

The service has still not dealt with two-thirds of tax returns for 2023, the figures showed.

Mr Snelling said of his communication with the Revenue Service: "You send emails and answer cometh not.

"The communication is none existent - it's one way.

"I would like them to get their act together, start talking. When that will happen, I don't know."

The BBC spoke to several other people who had experienced similar issues.

'Feels wrong'

Deputy Steve Falla, Vice-President of Economic Development, criticised the level of compensation paid to islanders experiencing delays.

"The compensation is paid ironically, out of taxpayers' money and it just feels wrong that it should reach that kind of level," he said.

"Particularly when there are so many things that we could do with a million pounds."

He said the situation had been getting steadily worse and it appeared it hadn't been dealt with before because it was "too hard".

Online tax returns

Ms Forshaw said the Revenue Service was dealing with the backlog.

"Addressing the delays remains a priority for the service to address and I want to thank customers for their ongoing patience," she said.

"In order to help reduce the backlog, we have introduced a number of measures to enable greater efficiencies in our processes and to help our team assess tax returns quicker.

"The best and most efficient method for customers, and for us, is for customers to complete their tax return online if they are able to do so.

"The more people file online, the more efficient the assessment process will be."

Follow BBC Guernsey on X (formerly Twitter), external and Facebook, external. Send your story ideas to channel.islands@bbc.co.uk, external.

Related topics

- Published10 May 2024

- Published8 March 2024