'Holiday home dream left us crippled with debt'

Emma and James Richardson say they found themselves "haemorrhaging money" after buying a holiday home

- Published

When James and Emma Richardson bought a £110,000 caravan at a holiday park in Lincolnshire, they hoped it would benefit their whole family.

The couple, from Cleethorpes, used money left to Mrs Richardson by her parents – who died in 2017 and 2018 – to put down a £25,000 deposit and entered into a finance agreement to pay for the rest.

They wanted to let relatives use the caravan at Tattershall Lakes for free holidays and also rent it out to the public to offset the cost.

Mrs Richardson, 43, said: "I wanted to do something for the family. It was my way of being able to have them gain from me inheriting.

“Mum and Dad were very hard-working, very loving. Family was everything."

The Richardsons said a Tattershall Lakes salesperson assured them they would make enough income from hiring out their caravan to cover their monthly finance repayments of £1,269.

Away Resorts, which runs the park and manages rentals, denies any such promise was made. A spokesperson told the BBC the company was clear with caravan owners that "there are no guarantees" about subletting income.

The Richardsons said they found themselves "haemorrhaging money" after buying their caravan.

“We had months where we were taking £1,200 in rental costs, but we would only receive £200 of that because of linen charges, [visitor] passes, cleaning fees,” said Mr Richardson, 46.

“We were so far short of what we were sold.”

Emma and James Richardson lost more than £50,000 over two years

The couple soon decided to cut their losses and offered to sell their caravan back to the park. After this offer was rejected, the Richardsons paid £20,000 and handed over their caravan to get out of their third-party finance agreement.

"We lost, over a period of two years, in excess of £50,000, which has just crippled us," Mr Richardson said.

“I'm still paying credit cards off now. We've lost that inheritance that our parents worked all their lives for.”

Mrs Richardson said losing the money her parents had left was a “bitter pill to swallow”.

She added: “If it was just my money it would be completely different, but because it’s what my parents worked for… I felt like I’d let them down."

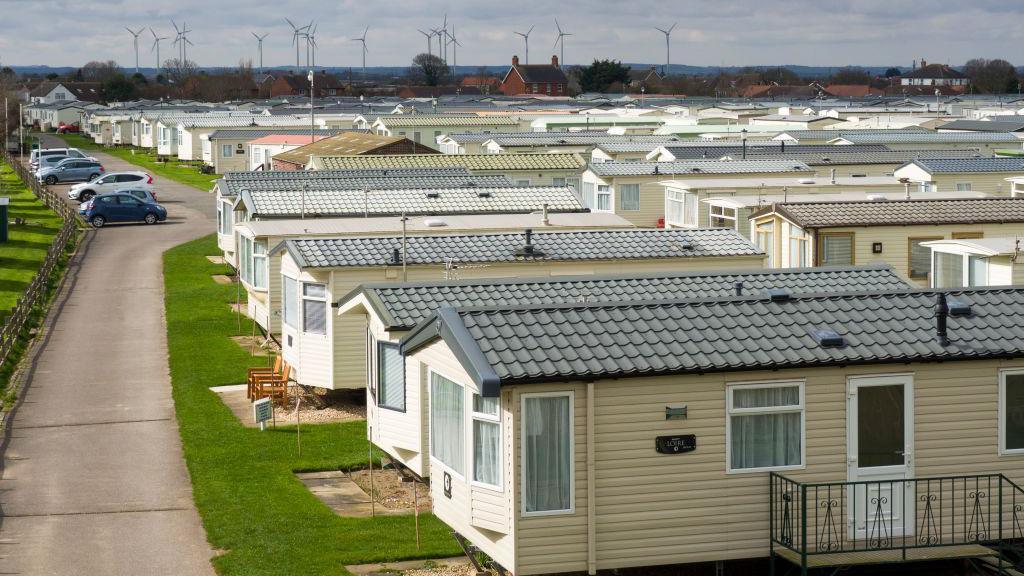

Skipsea in East Yorkshire is home to hundreds of holiday caravans

Since a boom in the 1960s, caravan holidays at Britain's seaside resorts and rural beauty spots have been a popular choice among families looking for an affordable getaway.

Today there are more than 3,000 parks across the UK. Caravan and camping holidays brought £7.2bn into the economy last year, according to industry figures.

The British Holiday and Home Parks Association (BHHPA), the national trade body for the sector, says these sites bring "vital tourism" and investment "to some of the UK’s most economically challenged areas".

The National Caravans Council (NCC), which also represents the industry, said there were "many thousands of happy holiday caravan owners across the UK".

But the Richardsons are not the only family to feel they have been left out of pocket by the dream of owning a holiday home.

Dozens of people have told the BBC they lost significant sums of money – some of them their life savings, pensions or inheritance – after buying a static caravan.

The founder of a group set up to support caravan owners said it was "scandalous" that "people's lives are being ruined".

'Sold the dream'

Andrew and Sue Dawson bought a static caravan at a holiday park on the East Yorkshire coast in 2022, they planned to spend their retirement whiling away weekends at the seaside with their daughters and grandchildren.

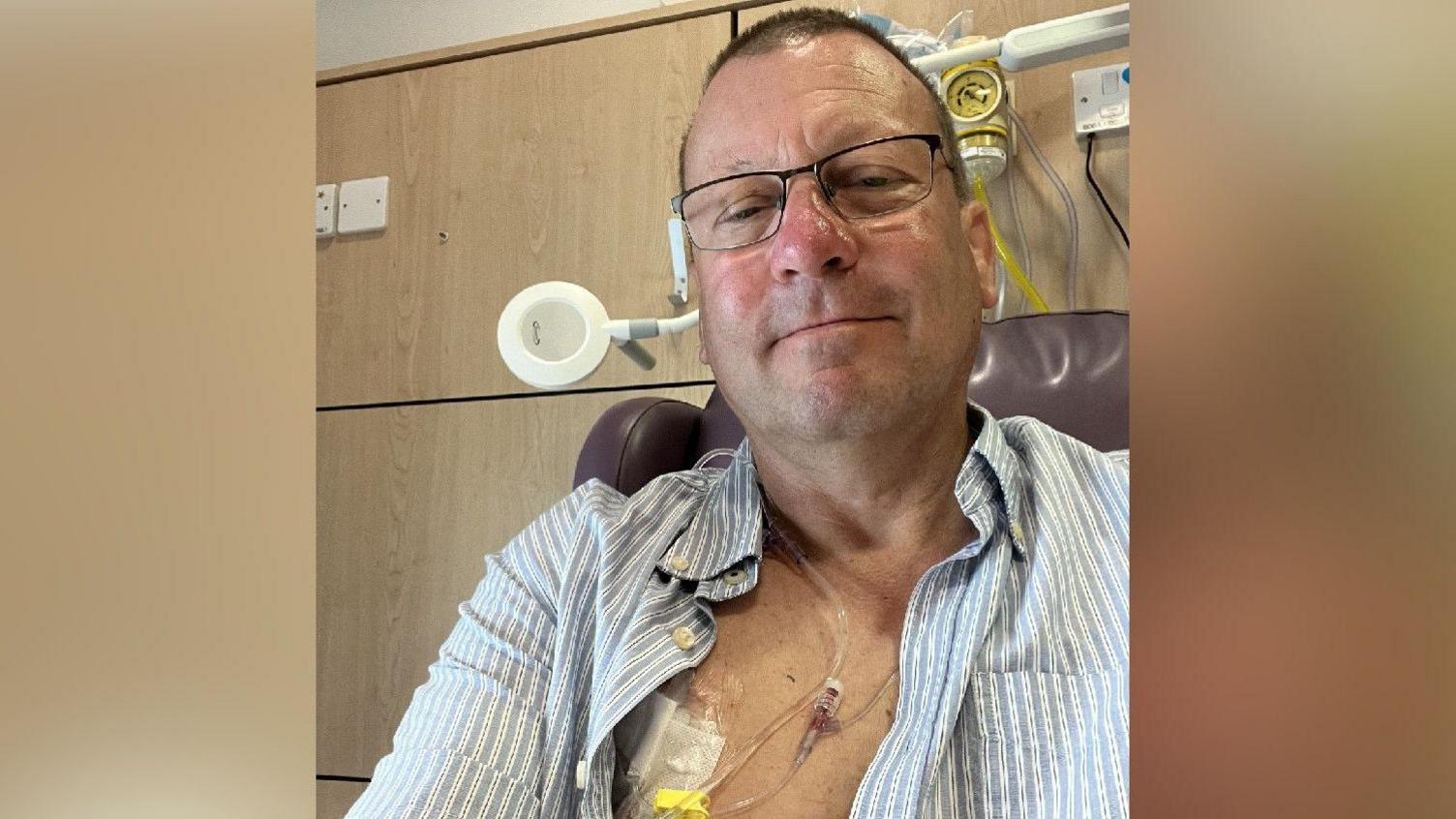

Then they received some devastating news. In February this year, Mr Dawson, 59, was diagnosed with incurable cancer.

"The doctors gave me between six months and – as they described it – a few short years," he said. "Obviously we started talking about the future. It completely changed everything."

The couple, from Leeds, began getting their affairs in order and decided to sell their caravan at Parkdean's Skipsea Sands resort.

But they were in for another shock. The three-bedroom caravan with decking, for which they had paid £62,400 in 2022, was worth just £17,000 two years later.

“We were gobsmacked,” said Mr Dawson. “No one ever told us we’d face that level of depreciation.

"The salesman sold us the dream, but didn't sell us the reality."

Andrew and Sue Dawson enjoyed spending time with their granddaughters at Skipsea Sands

Parkdean’s website states that “buying a holiday home isn't considered a financial investment, as holiday homes depreciate in value with age”.

But Mr Dawson said a Skipsea Sands salesperson told him caravans "pretty much hold their value".

Only when the Dawsons came to sell, following the cancer diagnosis, did they realise they could recoup only a fraction of their expenditure.

The couple reluctantly agreed to sell their caravan back to the park for £17,000 after negotiating with the sales team.

But on the day the Dawsons cleared out their caravan to finalise the sale, Parkdean cut the price they were willing to pay to £16,000.

Andrew Dawson was diagnosed with stage four cancer in February

Mr Dawson said his dealings with the park had been "dreadful".

"The amount of money we've lost and the way we’ve been treated, in my opinion is very underhanded and lacking in transparency," he added.

He said he felt there had been "a complete lack of empathy, really, knowing my condition, knowing why were selling – that we didn't really have a lot of choice".

"We feel they let us down very badly."

The Dawsons paid £62,000 for their caravan with additional decking

After the BBC contacted Parkdean, a Skipsea Sands manager called Mr Dawson and offered to pay him £1,000 to resolve the dispute.

A Parkdean spokesperson said the company was "aware of and sympathetic to Andrew’s situation" and had contacted Mr Dawson "to agree a suitable offer and settle the matter".

But Mr Dawson said it was "never about the money," adding: "It doesn't change my view on Parkdean and it doesn't change my view on the industry."

'Devastating impact'

Sally Nicholls, 70, from Sheffield, used her entire pension pot and a small loan to buy a £69,000 static caravan at Tattershall Lakes in 2021.

She said she told a salesperson she planned to live off the rental income in her retirement and was given figures indicating what she could expect to make.

“At the time, it looked like a good proposition," she added.

Ms Nicholls did make a small profit from her caravan in her first year as an owner, but her takings quickly dried up after repeated increases in park charges, which she was forced to pass on to customers.

She then found herself in competition with the park itself, which was able to offer more favourable rates, including free access to facilities, to prospective guests.

"That more or less put a complete halt to the bookings coming in," Ms Nicholls said.

Sally Nicholls sold her house after losing money on a caravan purchase

Ms Nicholls decided to sell her caravan but, like the Dawsons, was shocked at how little it was now worth.

After Tattershall Lakes declined to buy it back, she ended up selling to an outside trader for £17,500.

“It came as quite a shock to realise that I wasn’t going to get my pension back to live on in old age," said Ms Nicholls, who has since sold her house to free up funds for her retirement and moved to a smaller property in Bolsover.

"I had to consider what I was going to live on," she added. "The only option for me was to sell my home."

Away Resorts said it provided all prospective buyers with “comprehensive information, including detailed terms and conditions” to ensure they had “full awareness of the potential risks and rewards”.

A spokesperson added: “While subletting a holiday home can be a way for some owners to generate additional income, we make it clear that there are no guarantees in relation to this, as various factors – including seasonal demand and wider economic conditions – can influence returns.”

'Due diligence'

Ibraheem Dulmeer, a barrister who specialises in holiday park law, said caravan buyers were not always fully informed about the agreements they were signing.

He said it was "really, really essential" buyers did "due diligence" and got any promises from salespeople in writing.

“Many people from the outset are not provided with any legal advice or don’t obtain any legal advice, they simply go through shaking hands, handing over large sums of money," Mr Dulmeer added.

"And what seems to happen is that, as a result of that, they aren’t actually afforded the opportunity to review the terms, review the conditions, and see whether it fits for them. And that’s where most of the problems really stem from."

Barrister Ibraheem Dulmeer says caravan buyers should seek independent advice

The BHHPA, which represents holiday parks, said it was important consumers "read the small print" and "fully understand the sales contract" before committing to buying a caravan.

A spokesperson for the NCC, the trade organisation for the industry, said holiday caravan ownership was "a significant purchase decision" and potential buyers should conduct their own research to "fully understand what they are buying".

They added: "We work with our member parks to remind them of their obligations and responsibilities to help consumers understand clearly what they are buying, when and how they can use their holiday caravan or lodge, and that they treat all customers fairly and honestly using simple language and following best practice."

Caravan owners are protected by consumer rights laws, which are enforced by the Competition and Markets Authority (CMA) and local Trading Standards offices.

The CMA, a government regulator, told the BBC it could not comment on specific cases, but said businesses must not mislead their customers and any claims about products "must be honest and transparent".

'National scandal'

Last year, a petition signed by more than 27,000 people, which called for protections to be strengthened, was rejected by the Conservative government.

The petition was started by the Holiday Park Action Group, which has more than 66,000 members in a Facebook group in which caravan buyers voice complaints.

Its founder Carole Keeble said consumers were "consistently misled in respect of the true value of the caravans they are buying" and claimed the CMA was failing to act.

She told the BBC it was a "national scandal that people are losing their pensions, inheritance or having to sell their own homes to cover the losses they are incurring".

Meanwhile, Ms Nicholls said she wanted a regulator to "step up and take control" of the sector.

She added: "It's had a devastating impact on me. It's changed my life, basically."

Listen to highlights from Hull and East Yorkshire on BBC Sounds, watch the latest episode of Look North or tell us about a story you think we should be covering here, external.

Related topics

Related internet links

- Published1 September 2024

- Published11 March 2024

- Published13 August 2024