Reeves optimistic despite surprise rise in UK borrowing

- Published

Chancellor Rachel Reeves says she is "optimistic" on the UK economy despite pressure on government finances after borrowing rose more than expected in December.

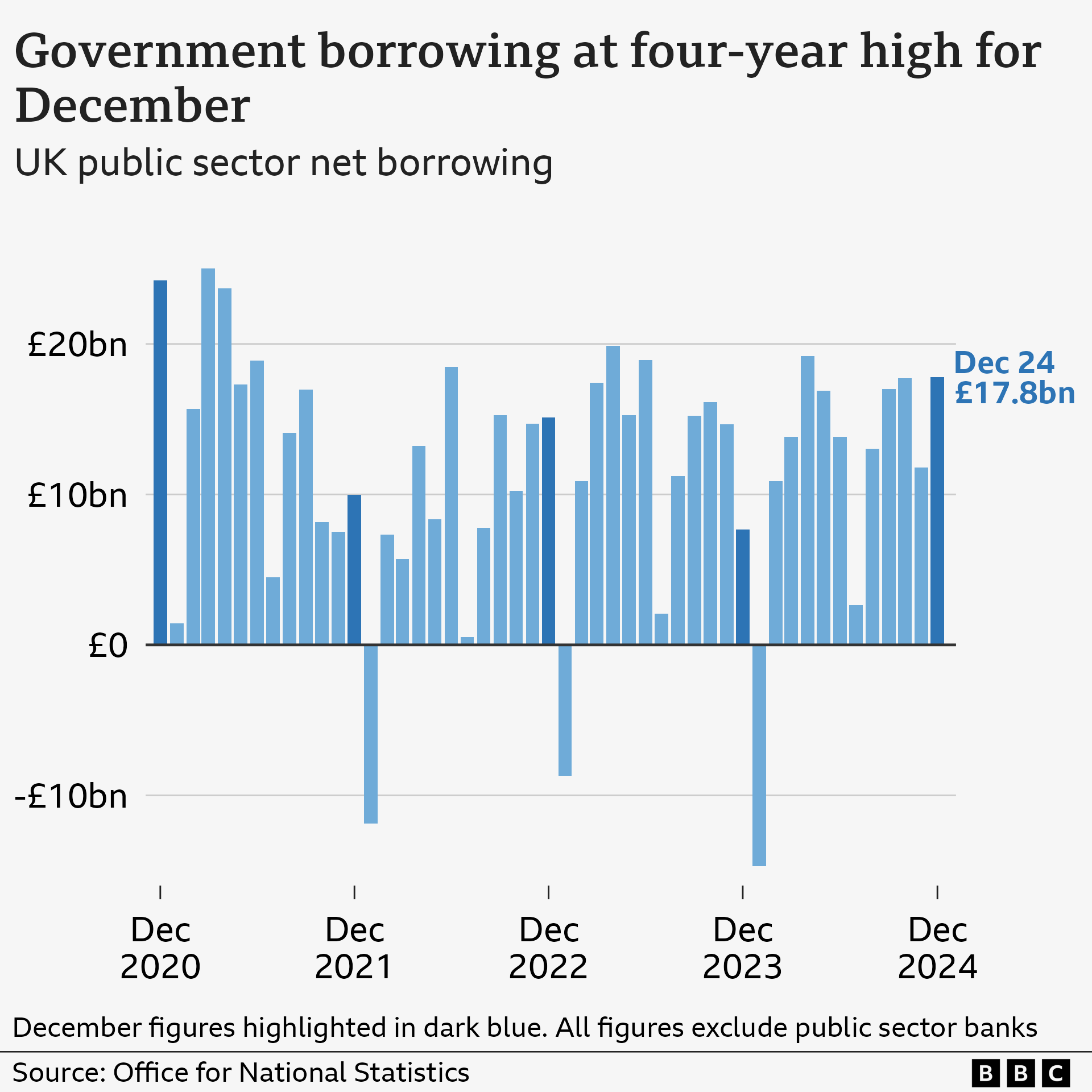

Borrowing - the difference between spending and tax revenue - was £17.8bn last month, the highest December level for four years, according to official figures.

Spending on public services, benefits, and debt interest were all up on the year, while an increase in tax receipts was offset by National Insurance cuts made by the previous government.

Recent rises in borrowing costs threaten the government's economic plans, with Reeves under pressure after figures last week showed the UK economy had flatlined.

The government has said economic growth is its top priority in order to improve living standards, but fears over the health of the economy adds to speculation that Reeves could cut spending on public services.

The Chancellor repeated her pledge to go "further and faster" to deliver growth as she signalled her intention to back expansions to Heathrow and Gatwick Airports in a bid to boost the economy, despite environmental concerns.

"We will look at all plans to bring infrastructure, to bring investment to Britain," she told the BBC, on her visit at the World Economic Forum in Davos, Switzerland, where investors that own the airports were present.

"When there are decisions around infrastructure investment, the answer can't always be 'no', and with this government the answer is 'yes'," Reeves added.

The Treasury is looking at whether to support a third runway at Heathrow and approve a second runway at Gatwick, but such projects would not start for some time.

The potential plans come as figures revealed interest charged on government debt hit £8.3bn, the third-highest December repayments since monthly records began in 1997.

The £17.8bn borrowed by the government last month was much higher than the £14.6bn forecast by the Office for Budget Responsibility, the UK's official forecaster.

Earlier this month interest rates charged on government debt surged in part due to concerns over the UK's economic outlook, but have since fallen back.

Why are UK borrowing costs rising and what does it mean for me?

- Published13 January

UK economy disappoints despite return to growth

- Published16 January

Reeves played down any impact the recent market turbulence would have on her meeting her self-imposed financial rules, which pledge not to borrow to fund day-to-day spending, repeating that they were "non-negotiable".

She also said regulators needed to "regulate for growth" following the ousting of the chair of the UK's competition watchdog by government ministers on Tuesday.

"We want regulators to be part of the mission for growth in a way that they haven't perhaps always been in the past," she added.

Reeves has previously told businesses that she would not be "coming back with more borrowing or more taxes" following her first Budget in October.

But Alex Kerr, UK economist at Capital Economics, said against the backdrop of weak economic growth and high interest rates, "December's overshoot in borrowing is further disappointing news for the chancellor".

He added that while UK borrowing costs had fallen back, they were still higher than at the time of the Budget and suggested Reeves "may need to raise taxes and/or cut spending" in March in order to meet her own rules.

Danni Hewson, head of financial analysis at AJ Bell, suggested "only growth" could offer an alternative to "reigning in ambitions".

Business are set to bear the brunt of tax rises coming into effect in April, with hikes in the National Insurance rate and a reduction to the threshold for employers.

Firms have repeatedly warned the extra costs, along with minimum wages rising and business rates relief being reduced, could impact economic growth, with employers expecting to have less cash to give pay rises and create new jobs.

Research released this week by Lloyds Bank, the UK's biggest money lender, suggested business confidence had "waned further", with price rises to slow activity this year.

The higher borrowing by the government means, with most of the financial year gone, the difference between what the government has spent and what it earns in taxes is £4bn more than official forecasts.

However, that figure includes lots of estimates which are often revised at a later date.

January's borrowing figure is typically lower than in December due to lots of people submitting self-assessment tax returns, which increases the government's revenue.

Separately, asked if the UK would introduce retaliatory tariffs should the Trump administration levy their own on the UK, she warned not to "get ahead of ourselves".

"No tariffs have been levied on the UK," she said. "And I look forward to working with the Trump administration and the new US Treasury Secretary when he's confirmed shortly.

"When President Trump was last president of the United States, trade between the UK and the US increased. I've no doubt that that can happen again in the interests of both of our economies."

Sign up for our Politics Essential newsletter to read top political analysis, gain insight from across the UK and stay up to speed with the big moments. It'll be delivered straight to your inbox every weekday.