Trump says anti-Tesla protesters will face 'hell'

- Published

People protesting against Tesla should be labelled domestic terrorists, President Donald Trump said on Tuesday at a White House media event designed to bolster Elon Musk's electric car company.

Trump sat in the driver's seat of a brand new red Tesla that he said he planned to buy, with Musk in the passenger seat, but did not test drive it.

Demonstrators have targeted Tesla showrooms in recent weeks in protest against Musk's cost-cutting role in Trump's administration.

Trump said they were "harming a great American company", and anyone using violence against the electric carmaker would "go through hell".

Watch: 'Thank God for Elon Musk' - Maga Republicans praise Doge cuts

The president described the shiny red Model-S, one of a number of Teslas lined up on the White House drive, as "beautiful" but said he was no longer allowed to drive and so would keep the car for the use of White House staff. Current and former presidents are not allowed to drive for security reasons.

He also said he would not want to buy a self-driving model, which Musk said would reach the market next year.

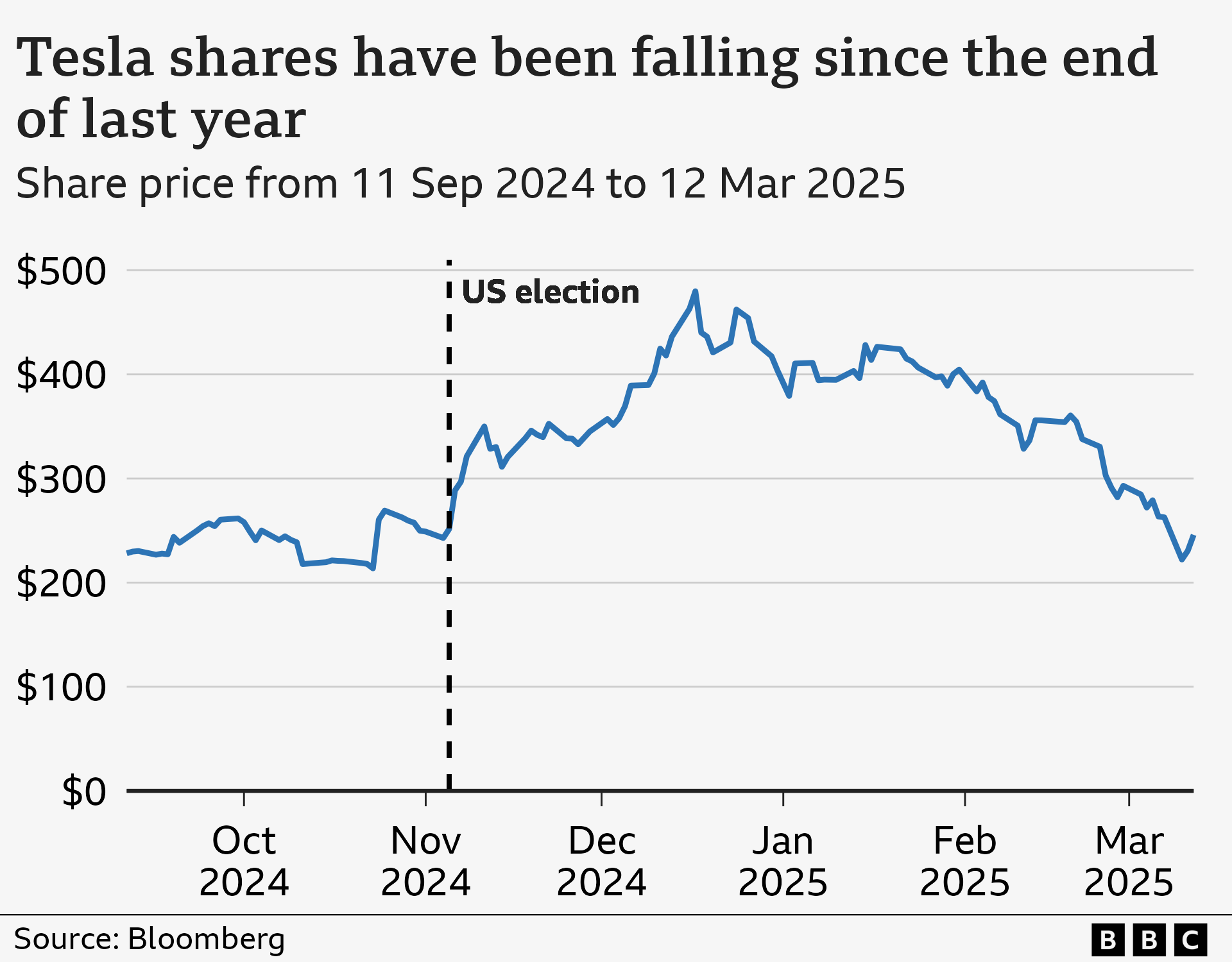

The showcase for Tesla's cars outside the White House came after Tesla's market value halved since its all-time peak in December, sliding 15% in a single day on Monday, before recovering slightly on Tuesday.

Trump said he had told Musk, "You know, Elon, I don't like what's happening to you, and Tesla's a great company."

Musk, Trump's top donor in the election campaign, has been tasked with radically cutting government spending through his Department of Government Efficiency (Doge).

He has instigated sweeping cuts to the federal workforce, cancelled international aid programmes, and has voiced support for far-right politics.

That has prompted a backlash among Tesla owners.

"Tesla takedown" protests have seen demonstrators gather outside dealerships, in Portland, Oregon, last week, and New York City earlier in March, with the aim of undermining the Tesla brand.

Organisers behind the protests said on social media that the demonstrations were peaceful, but a few have been destructive with fires intentionally set at Tesla showrooms and charging stations in Colorado and Massachusetts last week.

Asked in front of the White House whether such protesters should be labelled "domestic terrorists", the president said "I will do that", a position later confirmed by a White House spokesperson.

"You do it to Tesla and you do it to any company, we're going to catch you and you're going to go through hell," Trump said.

On his social media platform, Truth Social, Trump blamed Tesla's share price falls on "radical left lunatics", who he said were trying to "illegally and collusively boycott" the firm.

However, stock analysts said the main reason for the poor performance of the shares was fear about Tesla meeting production targets and a drop in sales over the past year.

UBS warned that new Tesla deliveries could be much lower than expected this year.

Lindsay James, an investment strategist at Quilter Investors, said that although there was "an element" of Elon Musk's politics having a "brand impact", there were other reasons for the share price fall.

Ultimately the drop came down to "hard numbers", she said.

"When we look at new orders, for example in Europe and China, you can see that they've effectively halved over the last year," she said.

Sales in Europe have fallen sharply this year. Across the continent, they were down 45% in January compared to the same month in 2024, according to the European Automobile Manufacturers' Association (ACEA).

There has also been a steep decline in China – a key market – and Australia.

Some experts have said Tesla is over-valued, so the fall is seen as a correction, while others have pointed to rising competition from some of China's electric vehicle companies.

Investors are "certainly getting more worried about an economic slowdown too, so the richest-valued companies like Tesla have been hit hardest in recent days", Ms James said.

There have also been concerns that Musk has not been focusing enough of his attention on his firms.

In an interview with Fox Business on Monday, he said he was combining the Doge role with running his businesses "with great difficulty".

Alongside Tesla, his businesses include Space X, which has experienced serious failures in the last two launches of its giant Starship rocket, and the social media network X, which suffered an outage on Monday.

Despite his supportive comments, President Trump's policies so far have been designed to limit electric car sales in the US, including revoking a 2021 order by former president Joe Biden that half of all car sales should be electric by 2030, and halting unspent government funds for charging stations.

Trump's tariffs could also hurt the manufacturer. Tesla chief financial officer Vaibhav Taneja said in January that Tesla parts sourced from Canada and Mexico would be subject to the levies and that this could hit profitability.

Tesla's share price fall came against a broader US market slump on Monday as investors, concerned about the economic effects of Trump's tariffs and weakening confidence in the economy, sold shares.

Sign up for our Tech Decoded newsletter to follow the biggest developments in global technology, with analysis from BBC correspondents around the world.

Outside the UK? Sign up here.