Ministers rally round Rayner as she fights for political survival

Angela Rayner admits she didn’t pay enough tax on her second home and has alerted HMRC

- Published

Angela Rayner is fighting for her political future after admitting she underpaid stamp duty when buying a flat in Hove.

Sir Keir Starmer and cabinet ministers have backed the deputy PM but an investigation by the prime minister's standards adviser into whether she broke ministerial rules is expected to report back in the coming days.

Rayner, who is also housing secretary, has denied she tried to dodge paying extra tax, blaming the "mistake" on initial legal advice that failed to "properly take account" of the situation.

However, the Conservatives have called for her to resign, saying her position is "untenable".

Rayner has been under pressure in recent weeks after reports she had saved £40,000 in stamp duty on the £800,000 flat in East Sussex by not paying the higher rate reserved for additional home purchases.

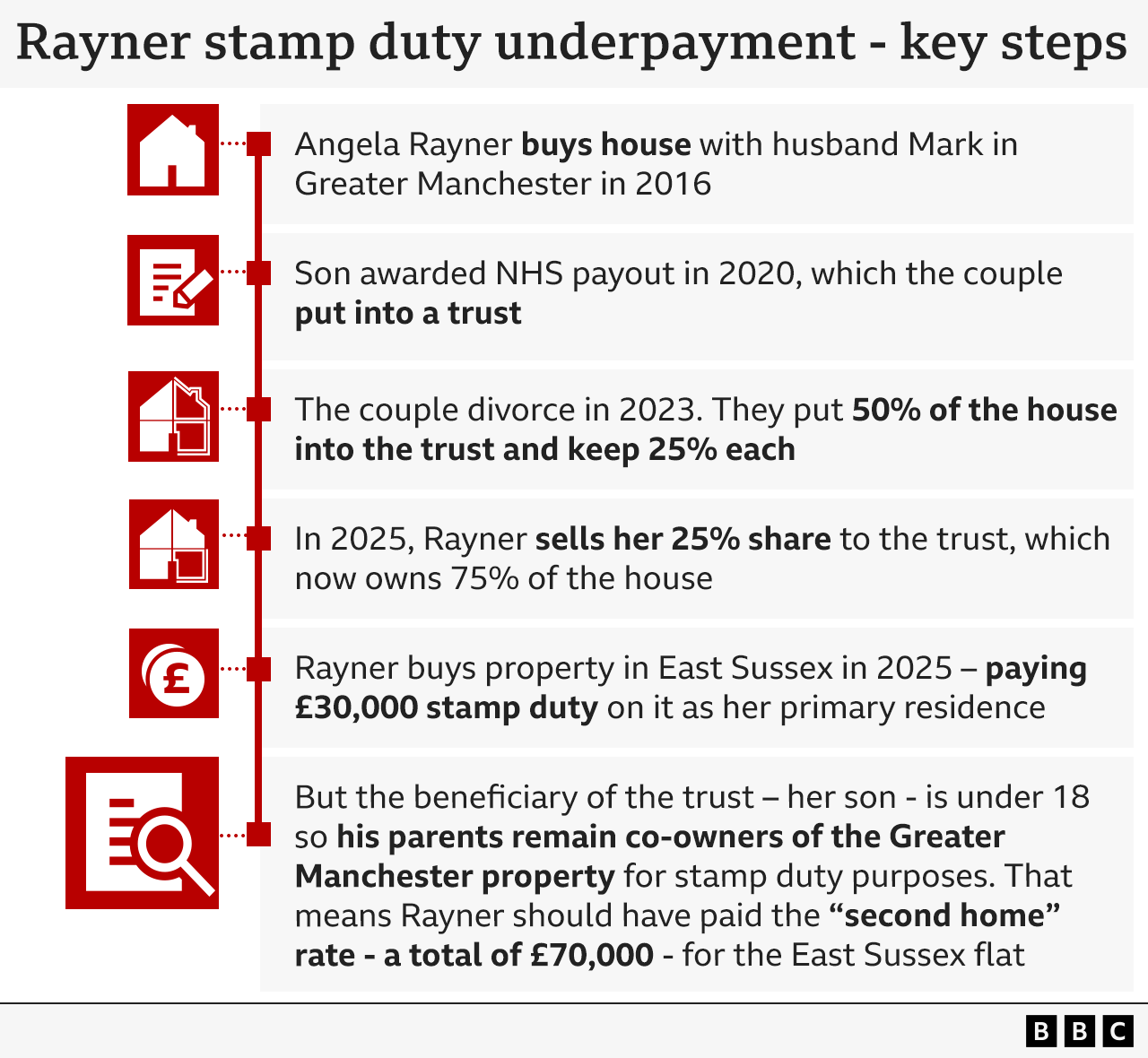

On Wednesday, she confirmed the arrangements around her family home in Greater Manchester meant she should have paid a higher rate.

In a statement, Rayner said she had part-funded the purchase by selling her remaining stake in her family home in Ashton-under-Lyne, Greater Manchester, which she shares with her ex-husband and family.

She said some of her interest in the home had already been sold following her divorce to a court-instructed trust previously set up to help fund the care for her son, who has lifelong disabilities.

But fresh legal advice revealed the provisions around the trust meant she should have paid the higher stamp duty rate on the purchase of the Hove flat, she said.

The existence of the trust had not previously been known, and Rayner said she had been prevented from sharing more details due to a court order that was lifted on Tuesday, after she successfully applied to have it waived.

A source close to Rayner told the BBC she initially consulted three people before buying the Hove flat - one individual experienced in conveyancing and two experts on the law around trusts.

However, it is unclear if any of those people were experts in complex tax law and it is not known if they were given the full details of the trust.

Rayner said she had now contacted HMRC to work out the tax she needs to pay, and referred herself for investigation by the PM's independent adviser on ministerial standards, Sir Laurie Magnus.

Following his investigation, Sir Laurie will provide advice to the prime minister on whether Rayner has breached ministerial rules.

However, the final decision on what action to take – and whether Rayner can remain deputy prime minister and housing secretary - will be made by Sir Keir.

This presents a political headache for the PM, given Rayner is popular with grassroots Labour members and provides an important link to the unions and left of the party.

As housing secretary, she is also responsible for key manifesto commitments, including a pledge to build 1.5 million new homes.

Henry Zeffman: The questions which could seal Angela Rayner's fate

At Prime Minister's Questions on Wednesday, Sir Keir backed his deputy, saying he was "very proud to sit alongside" her.

Ministers have also rallied around their colleague, with Education Secretary Bridget Phillipson saying Rayner "acted in good faith" and believed "she followed all the rules".

In interviews on Thursday morning, Phillipson said Rayner had received legal advice saying she had underpaid stamp duty on Monday.

However, she later told BBC Breakfast Rayner did not receive "final" and "definitive" legal advice until Wednesday.

Meanwhile, Chancellor Rachel Reeves said she had "full confidence" in Rayner.

She said Rayner had "tried to do the right thing" but made a "mistake", which she was "working hard now to rectify" with HMRC.

However, the Conservatives and Reform UK have both called for Rayner to resign.

Tory Party chairman Kevin Hollinrake said the rules around trusts and stamp duty on the HMRC website were clear.

"It cannot be claimed that you took reasonable care when the information is that obvious," he told BBC Breakfast.

Hollinrake said Rayner's position was "untenable", particularly given her role as housing secretary and her previous criticism of others for tax avoidance.

"If this was a Conservative member of Parliament, who was in the same situation, I think Angela Rayner would be calling for that person to step down," he said.

"And so you cannot be hypocritical in these matters, you've got to be consistent."

The Conservatives have also written to HMRC calling for it to launch its own investigation into whether Rayner tried to evade tax, something the deputy PM has denied.

If HMRC decides her actions were careless, Rayner could still face a penalty of up to 30% of the underpaid tax - £12,000 - on top of the £40,000 tax shortfall.

Sean Randall, an independent stamp duty expert, said the key question will be whether Rayner had a reasonable excuse for making the error in the stamp duty.

"It's not enough just to say that she relied on advice. I think she also needs to explain what it is that she told her lawyer and what advice that she received from her lawyer," he added.