UK tax hike would have 'massive' impact on Scotland - Robison

Finance Secretary Shona Robison refused to rule out an increase in Scottish income tax

- Published

UK tax changes would have "a massive impact" on Scotland's public services, Finance Secretary Shona Robison has said.

She said that an income tax increase south of the border could lead to a £1bn cut in the Holyrood budget, and refused to rule out raising income tax to plug any shortfalls.

That came after Chancellor Rachel Reeves fuelled speculation of hikes ahead of the Autumn Budget, which is due to be announced in three weeks.

Reeves said she would do what was "necessary" to protect public finances.

The Scottish government has used its devolved powers to create a distinct income tax system from the rest of the UK.

A change to UK income tax - which applies in England, Wales and Northern Ireland - would not directly affect Scottish taxpayers, but an increase would lead to an automatic deduction from the block grant that the Treasury pays to the Scottish government.

This is because the UK government is able to deduct funds from the block grant that it estimates it would have received if tax-raising powers were not devolved to Holyrood.

The Scottish government raised concerns about this prospect despite First Minister John Swinney having repeatedly called on the UK government to raise income tax, claiming it could negate the need for budget cuts.

Reeves' pre-Budget speech fails to rule out tax rises

- Published5 November

What taxes could rise in the UK Budget?

- Published2 days ago

Ministers lack plan for £5bn black hole, auditor says

- Published30 October

Robison told BBC Scotland News that Scotland must not be an "afterthought" in the chancellor's Budget planning.

She said the fiscal framework - which could see Scotland's block grant cut if the UK government hikes income tax in England, Wales and Northern Ireland - was not "fit for purpose".

The Fraser of Allander Institute, an independent economic research unit at the University of Strathclyde, has estimated that a two percentage point increase in the basic rate of UK income tax would lead to a cut of about £1bn in Scotland's block grant in each of the next three financial years.

Holyrood's total budget for 2024-25 was about £60bn.

Robison said: "I can't believe that a UK Labour government would actively take steps to cut Scotland's budget by around £1bn."

She added that such a deduction would have a "massive impact" on the NHS and local government in Scotland.

Rachel Reeves is expected to announce tax rises in her Autumn Budget

Robison said her government did not want to hike rates to plug a funding shortfall, but she did not rule out the possibility.

"We will look through all of the options that we can take to make sure that we are fair to taxpayers but also that we sustain public services," the finance secretary added.

She also called on the UK government to increase funding for public services and to scrap the two-child cap on benefits payments.

Earlier, pressed on whether the Scottish government remained in favour of UK income tax rises, the first minister's spokesperson said he was "not aware that position has changed".

How is Scotland's tax system different?

Following a pre-Budget speech at Downing Street, there is speculation that the chancellor could increase income taxes but reduce National Insurance contributions for workers.

Rises in National Insurance, or VAT, would directly affect people in Scotland, but changes to UK income tax would not.

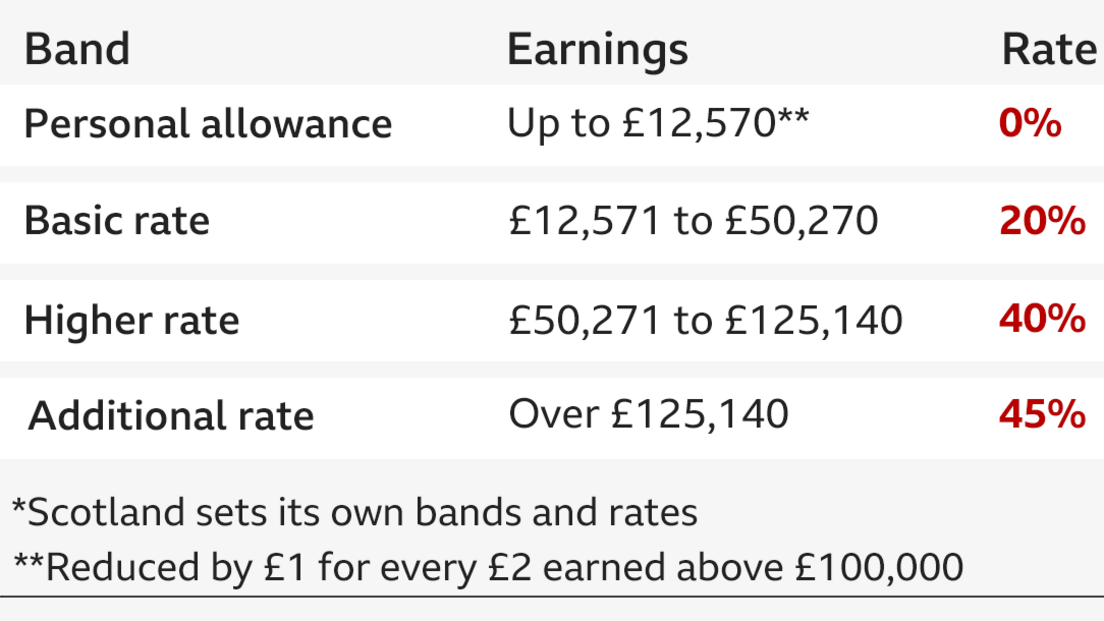

While Westminster sets the personal allowance (the level at which people start paying income tax), the Scottish government can set its own bands and rates beyond that.

SNP ministers have made use of these powers to create what they say is a fairer, more progressive system.

Critics say Scotland's income tax regime, which has seven bands to the UK's four, is more confusing and penalises medium and high earners.

When the government set tax rates in its budget last year, it said people earning below about £30,300, external would pay slightly less income tax than they would elsewhere in the UK, with a maximum saving of about £28.

Above that threshold they would pay increasingly more as earnings increase.

Someone on £50,000 in Scotland, which includes some teachers and police officers, pays £1,528 more than they would in the rest of the UK. That rises to £5,207 for someone on £125,000.

The reality of what workers pay in tax can change in any given year because of job moves and salary increases.

In the Scottish Parliament on 29 October, Conservative MSP Liz Smith asked Finance Secretary Shona Robison to acknowledge that the latest statistics showed the "majority of taxpayers in Scotland pay more tax".

The minister answered: "At each budget, we set the starter and basic rate bands at such a level that more than half of taxpayers are expected to pay less in the year ahead than they would pay elsewhere in the UK. It is inevitable that earnings growth will be different to that forecast."

Scotland income tax levels

A hike in UK income tax would lead to an automatic deduction from the block grant because the devolved funding arrangement includes a block grant adjustment (BGA).

This is used to determine how much should be deducted from the block grant to effectively compensate the UK government for funds it has forgone by transferring tax-raising powers to Holyrood.

So if the chancellor raises income tax in the rest of the UK, the amount the UK government would have raised in Scotland increases. That would then lead to a larger BGA subtraction from the funds given to the Scottish government.

The Fraser of Allander Institute estimates that a one percentage point increase in the basic UK rate would lead to a £486m deduction in the Scottish Budget for 2026-27.

This figure rises to £972m if the UK basic rate increased by two percentage points, with cuts of more than £1bn to the block grant in each of the two following years.

A two percentage point rise in the UK higher rate would lead to a £225m deduction in 2026-27, according to the institute, rising to about £300m in each of the two following years.

England, Wales and NI income tax levels

Labour pledged not to hike income tax, VAT or National Insurance in its 2024 general election manifesto.

But the chancellor cited inflation, trade tariffs, poor productivity, Brexit and an increase in defence spending as she sought to lay the ground work for widely anticipated tax increases.

Speaking in Downing Street, she said: "I will do what is necessary to protect families from high inflation and interest rates, to protect our public services from a return to austerity and to ensure that the economy that we hand down to future generations is secure with debt under control.

"If we are to build the future of Britain together, we will all have to contribute to that effort."

The Institute for Fiscal Studies think tank has warned that Reeves will "almost certainly" have to raise taxes to make up an estimated £22bn shortfall in the government's finances.

The Office for Budget Responsibility is also widely expected to downgrade its productivity forecasts for the UK, potentially adding as much as £20bn to the amount the chancellor will need to find.

Anas Sarwar did not confirm whether Chancellor Rachel Reeves would raise income tax

Scottish Labour leader Anas Sarwar said he could not say whether the chancellor would break the manifesto promise not to increase income tax in England, Wales and Northern Ireland.

He told reporters: "Income tax in Scotland is the responsibility of the Scottish government, and actually the only person that's been campaigning loudly for the last two years for a rise in income tax in England and Wales is John Swinney, and he's the very same man negotiating the fiscal framework."

Responding to speculation of a Holyrood tax hike, Scottish Conservative finance spokesman Craig Hoy said: "We know the nationalists will always reach for the tax lever to plug the gap if their funding from the UK government is cut.

"Hard-working Scots are suffering at the hands of two failing, high-tax, left-wing governments."

Meanwhile, Scottish Greens co-leader Ross Greer urged Reeves to "tax the extremely wealthy", adding: "It's time for them to pay their fair share."

When is the Scottish Budget?

The UK government Budget, on November 26, will be a month later than it was last year.

That has had a knock-on effect on the Scottish Budget, which will not be announced until 15 January.

MSPs will have a shorter window for scrutiny before the end of the financial year in April.

The Scottish Budget will also be announced in the run-up to the Holyrood election in May, with the considerations of voters sure to be at the forefront of ministers' minds when they announce their tax and spending plans.

- Published6 October