Chase criticised for 'mocking' customers' spending habits

- Published

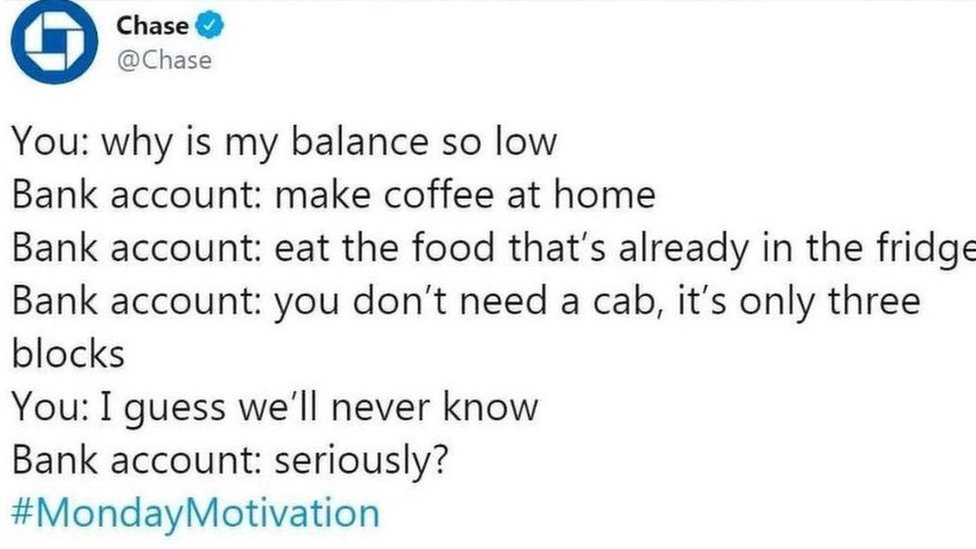

Chase's tweet about financial advice on Monday backfired

US bank Chase has been criticised on social media for sending a tweet 'mocking' customers' spending habits.

Offering financial advice on Twitter, the bank appeared to chastise consumers who question their low bank balances but buy take-away coffee and short taxi rides.

The meme was deleted shortly after it was posted on Monday, but not before critics including high-profile lawmakers highlighted the bank's own financial practices.

In 2008 Chase received a $25 billion government bailout in the US foreclosure crisis.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The meme suggested a conversation between a Chase customer and their account about a low bank balance.

When the hypothetical bank user fails to see that buying take-away coffee or taxi rides could be behind their drained finances, the 'account' replies "seriously?"

Many online took exception to the tone of the advice, including several high-profile politicians.

Democratic Congresswoman Katie Porter suggested that higher salaries would help workers save more, and she called on the bank's chief executive to apologise.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

When asked to explain how one of his bank's starting employees could make ends meet, Jamie Dimon replied: "I don't know, I'd have to think about that."

You might also like:

Democratic Senator Elizabeth Warren, who is running for president in 2020, offered her own take on Chase's meme by referring to low wages, rising costs, and the bank's government bailout.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Others suggested that the reason workers struggle to balance the books was due to the high cost of rent or medical bills rather than coffee and cabs.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Chase customers also took the opportunity to highlight fees and charges levied by the bank, suggesting they don't aid keeping a healthy balance.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

However others suggested that too many people "live beyond their means" and that Chase offered sound financial advice.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The tweet came at a time of heightened criticism of financial practices in the US.

In April, banking executives faced criticism during a hearing of Congress House Financial Services committee assessing the sector's preparedness since the recession.

Representatives grilled a group of CEOs on business and social issues including the financing of gun makers, low wages, and funding America's private prison system.

Following the hearing, JP Morgan's CEO defended the bank's wages, external, saying: "We take very good care of our entry-level jobs: $35,000 to $37,000 per year, medical, retirement."