EMI finances threatened by pension dispute

- Published

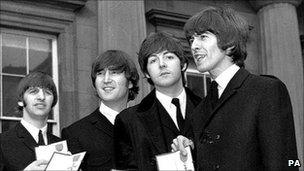

EMI sold 10 million copies of the Beatles' remastered albums last year

The Pensions Regulator has been asked to decide on the funding of the main EMI pension scheme because the trustees and the company cannot agree.

It will be the first time the regulator has decided how much extra cash should be pumped into a company scheme to clear its deficit.

The shortfall in the EMI fund is estimated at between £115m and £217m.

But the company has hinted that if the regulator's ruling is too harsh it might tip the firm into insolvency.

In its annual report, EMI said the dispute over the size of the deficit - a debt owed by firm to the scheme - was one of the factors that had cast "fundamental uncertainty" over the company's future.

Financial crisis

The EMI pension scheme has only 269 active members and was closed to new joiners in November 2005.

But bridging the deficit could be "the straw that breaks the camel's back," according to independent pension consultant John Ralfe.

"The outcome of the [regulator's] determination could conceivably push the company into administration," he warned.

EMI, home of the Beatles and a host of other pop stars, was bought by the private investment firm Terra Firma for £4.2bn in 2007.

However, the music firm's subsequent massive losses have plunged it into crisis.

In the year to April 2010, it recorded a pre-tax loss of £624m, after an even bigger loss the year before of £1.75bn.

EMI's balance sheet shows it now has net liabilities of £636m, which means it is technically insolvent, though it says it has sufficient cash coming in to meet its current debt repayments to its bank, Citigroup.

Even so, the company has warned it is still in danger of breaking its loan agreements with Citigroup, which means its shareholders will have to inject more cash into the business, as they have done in the past year.

If that extra money is not forthcoming, then a breach of the banking agreements could trigger a demand from Citigroup that EMI repay, in one fell swoop, all the £3bn it borrowed to buy the company.

To make matters worse, Terra Firma has been involved in a bitter dispute with Citigroup about the amount of money it was originally persuaded to pay for EMI.

Pensions Regulator

The deficit in the EMI pension scheme has been unresolved since 2007, despite first being referred to the Pensions Regulator in the same year.

Since it was set up in 2005, the regulator has used its powers to issue formal instructions about the running of pension schemes on 52 occasions.

Most of these decisions have been about conflicts of interest involving scheme trustees, or about the finances of schemes that have gone bust.

A formal decision about the funding of EMI's scheme, known as a determination, would be the first about the finances of a company still trading as a going concern.

The regulator declined to comment on the problems of EMI and its pension fund.

But it is understood to be concerned that using its determination powers for the first time in these circumstances might set an inadvertent precedent for other schemes involved in similar funding disputes with their employers.

Normally, when these funding issues come before it, the regulator persuades the schemes and companies to come to a compromise agreement themselves, without the need for the regulator to make a formal decision.