Tax letters: How to deal with a claim

- Published

The problems are likely to affect many thousands of people

The holiday season ends, the kids go back to school and then the tax problems begin. Things seem back in their old routine.

However, the big problem with this tax issue is that this is not a flippant situation if you are one of the many who may have underpaid tax.

If you have overpaid, well, you are in a fortunate position and will generally feel quite pleased about the taxman paying you for once.

That is, of course, until it dawns on you that if you had not been over taxed for the last couple of years, then that loan you took out to get a new kitchen or car might not have been necessary after all.

Why it happened

The reason behind the current problem is that the Pay As You Earn (PAYE) system was created in the 1940s when people had much simpler work patterns.

They tended to stay in the same job year after year, if not from school, for the rest of their lives.

Today, some of us juggle two or more part-time jobs, or change jobs more frequently. Many now receive tax credits.

The computer architecture at HM Revenue and Customs (HMRC) has not been able to keep up efficiently with such a continuously changing environment.

But new technology at HMRC has been able to get up to speed - and has found that a lot of people were paying the wrong amount of tax.

I want to inject some sanity here among the panic.

Most of us will not have a tax problem, so do not start losing sleep. But if you find you receive a form from HMRC then you need to deal with it.

The process

HMRC started sending the form P800 tax calculations for 2008-09 and 2009-10 to taxpayers from 6 September. This process will continue until January 2011.

Chas Roy-Chowdhury says that people should not panic

The forms will only be sent to taxpayers who have paid too much or too little tax. If you use an accountant they will not receive a copy of the form and you will need to contact them if you want them to help you sort things out.

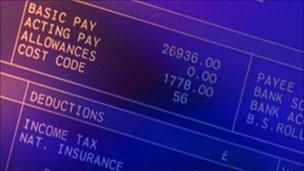

The form P800 will show your total income and the allowances that are due to you for each of these two years.

As already mentioned and I emphasise again, not everyone will get a calculation, only those who HMRC claims have paid too much or too little tax.

If you receive a calculation, it is important you check it to make sure you agree with the information included. If you agree with the calculation you do not need to do anything, but keep it safe.

Please make sure you read the notes that came with the calculation as these will help you understand what it means. You can read the notes online by going to www.hmrc.gov.uk/P800, external.

HMRC deals with issues differently:

If you have paid too much tax, HMRC will automatically send you a repayment, usually within a week

If you have paid too little tax and the underpayment is under £2,000, HMRC will automatically include the amount you have underpaid in your tax code for 2011-12. This spreads the collection of the underpayment throughout the year

If the underpayment is under £2,000, but the coding deduction causes hardship, you can ask for the underpayment to be included in your tax code over a longer period

If the underpayment is £2,000 or more, HMRC will write to you and ask for direct payment. You should contact HMRC on 0845 3000 627 if you wish to discuss a repayment schedule

HMRC may forgo collection in very limited cases. There are specific, limited, circumstances in which HMRC can agree to forgo collection of an underpayment where information they held was not used at the right time.

There are details on the HMRC website at http://www.hmrc.gov.uk/esc/esc.htm, external. Broadly the situation would be that HMRC should have used the information provided within 12 months after the end of the tax year in which it is received.

You should read the link to the website and if you think this applies to you, or you need further information, contact HMRC on 0845 3000 627.

What next?

If you do not agree with something included in the tax calculation, you can contact HMRC on 0845 3000 627 or you can write to HMRC at the address shown on the calculation.

One would hope that after this current problem HMRC will put in place a greater emphasis on capturing tax information and acting upon it in a timely manner, which the new IT architecture is meant to do.

But it may also mean a greater emphasis on asking more of us for some form of "tax return", such as a one page form for example.

While this may not be welcome, or whatever other solution is planned, it at least would mean we are not revisited by this sort of dire problem again.

But looking ahead, whatever happens, we need to be able to trust the tax system.

The opinions expressed are those of the author and are not held by the BBC unless specifically stated. The material is for general information only and does not constitute investment, tax, legal or other form of advice. You should not rely on this information to make (or refrain from making) any decisions. Always obtain independent, professional advice for your own particular situation.