Public pensions review recommends higher contributions

- Published

Lord Hutton said he was 'ruling out a race to the bottom'

Members of public sector pension schemes should pay higher contributions, says an independent commission led by Lord Hutton.

The change is an initial recommendation from the commission, which was set up to consider ways to cut the rising cost of public sector pension schemes.

Lord Hutton said the pensions should be changed from a final-salary basis, possibly to career-average schemes.

He is also likely to recommend that public service employees retire later.

The pension schemes cover millions of workers in the civil service, NHS, local government, education, police, armed forces and fire service.

The main problem highlighted by Lord Hutton was that people were living longer in retirement, so their pension funds had to pay them for much longer.

But he also said the final-salary nature of the schemes was "fundamentally unfair".

"[They] can lead to high-flyers getting almost twice as much back in pensions than those on more modest earnings for the same amount of pension contributions," he explained.

Big changes ahead

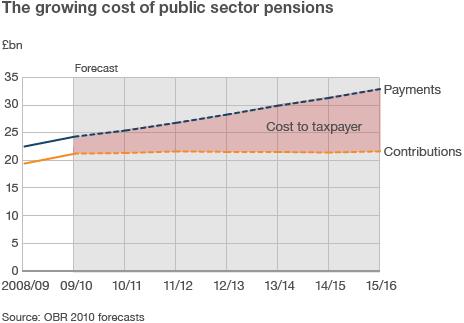

When setting up the commission earlier this year, Chancellor George Osborne said that the projected rise in the cost to taxpayers of public sector pensions was "unsustainable".

He called the report "impressive and substantial" and said the government would give its official response in the forthcoming spending review.

Many public sector workers argue that they have accepted lower pay than they could get in the private sector in order to benefit from better pension provision.

But, in his report, external, Lord Hutton rejected this: "There is no evidence that pay is lower for public sector workers to reflect higher levels of pension provision," he said.

Among the longer-term changes being considered by Lord Hutton's independent public service pensions commission are:

changing the public service schemes from a final-salary to a career-average structure

copying the Swedish and Dutch examples of defined-contribution schemes

raising normal pension ages beyond their current levels - typically 65 - as longevity increases.

Cost falling already

The interim report points out that the long-term cost of funding public service schemes has already been drastically reduced.

The recent decision to uprate pensions in line with the consumer prices index (CPI) rather than the retail prices index (RPI) has shaved 15% from the cost of the schemes.

Taken together with other changes in the past few years, such as raising the pension age to 65 for newer recruits, the schemes now cost 25% less to fund than they did a few years ago.

"All these past reforms, the current pay freeze and planned workforce reductions will reduce the future cost of pensions," the report said.

"The gross cost of paying unfunded public sector pensions is expected to fall from 1.9% of GDP in 2010-11 to 1.4% of GDP by 2060."

Gold-plated?

Lord Hutton rejected the frequently made claim that public sector pensions are gold-plated.

He pointed out that the average pension in payment was currently £7,800 a year, which he described as modest, not excessive.

And he rejected the idea put forward by employers' organisations that because private sector pension provision was poor by comparison, public sector pensions should be dragged down to the same level.

"I have rejected a race for the bottom," he said.

Trade unions reacted with alarm. Unison, which has many members in both local government and the NHS, said many of its members would struggle to pay in more.

"There is a real danger that taking a career average to calculate pensions will see the low paid getting less in their retirement - especially as the government has switched from using the RPI to using the CPI to calculate pensions, said Dave Prentis, Unison's general secretary.

"Public sector workers already pay a sizeable amount into their pension schemes year in, year out," he added.

Joanne Segars, of the National Association of Pension Funds (NAPF) said: "The report dispels some of the myths about these pensions but is realistic about the need to reshape them.

"All workers deserve a good workplace pension, whether private or public sector."

Ed Miliband, the newly elected Labour leader, said he would not decide if he was for or aganst Lord Hutton's report until he had read it.

"These are not gold-plated fat-cats and I think it's really important that Mr Cameron and his government and the way they deal with this issue don't try and somehow try and condemn the whole of the public sector," he said.

The commission's final report will be published in time for the 2011 Budget.

- Published7 October 2010

- Published10 March 2011

- Published15 June 2011

- Published7 October 2010