Up in arms over pension changes

- Published

Pension arrangements for the military are very different from other public sector employees

An armed forces pressure group is hoping to stop the government cutting the value of pensions for the country's soldiers, sailors and airmen.

The Forces Pension Society, with 40,000 former and serving members of the armed forces, is angry about the impending changes to inflation proofing in the armed forces pension scheme.

In the June Budget, the Chancellor, George Osborne, said that in future state and public sector pensions should rise in line with the Consumer Prices Index (CPI) instead of the faster growing Retail Prices Index (RPI).

The government's aim is to save taxpayers' money and on Friday it dismissed the idea of special treatment for the armed forces.

However the Forces Pensions Society has estimated that in some cases the change will cost individual members more than half a million pounds each in lost pension income, between leaving the armed services and the end of their natural lives.

"Our beef with CPI is the amount it will devalue pensions, especially of those who have to take a pension early by being invalided out," says Maj Gen John Moore-Bick, general secretary of the society.

Losses

The society estimates the change to inflation indexing could cost the average armed forces pensioner - including those already retired - about £40,000 over the course of their lives to the age of 85.

That calculation assumes RPI at an average of 2.7% and CPI at an average of 1.7%.

Things will be much worse for younger service personnel who are invalided out.

Maj Gen Moore-Bick gave the example of a corporal, aged 27, who now has artificial legs as a result of having the real ones blown off in active service.

"He may lose £566,000 over the remaining years of his life because of a 1% difference between CPI and RPI," he says.

That takes into account the extra income for life that military invalids receive from the armed forces compensation scheme, whose payments are also index linked.

What about people who retire normally and leave the armed forces at 40 after 22 years' service, a much more common situation?

"Here is a Major who retires and retrains for another career," Maj Gen Moore-Bick says.

"He would have a pension of about £16,000 a year and over the rest of his life to age 85 he will lose £319,000 in cash."

Snowball effect

The average pension in payment in the armed forces, including widows' pensions, is currently about £8,000 a year.

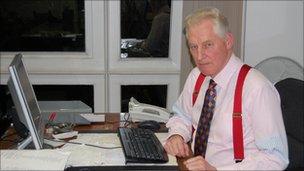

Maj Gen John Moore-Bick, former GOC (general officer commanding) in Germany

How come so much money is at stake?

The reason is simple. The scheme is unlike any other in the public sector.

Not only is it paid out of taxation (unfunded) and is non-contributory, it is also designed to encourage people to retire in middle age, so that the forces are staffed largely by people who are fit and young.

What are known as early departures can be paid a modest income if the member has at least 18 years service and is over 40.

That means they receive payments far earlier than employees elsewhere in the public sector.

Most other pension schemes in the UK, private or public, have a legal minimum pension age of 55.

The armed forces scheme is also designed to pay pensions to those invalided out at a very young age and to pay widows or widowers' pensions very early too.

So the effect of a less generous method of inflation proofing for service men and women will snowball over many more years.

Legal challenge?

All the literature given to members of the armed forces scheme refers to pensions being uprated in line with RPI.

The society wanted to take the government to court to challenge its impending change, which will come into effect next April.

But the society's legal advice is that the government can overrule the "legitimate expectation" of the members, due to "overriding reason of public interest".

The BT pension scheme - firmly in the private sector - has recently announced it will adopt CPI instead of RPI for pension uprating, and the company said this change would knock £2.9bn off its deficit.

However, a recent survey for the actuarial firm Aon Hewitt showed that the significance of using one inflation index or another is barely understood by the general public.

David Marsh, a former Lieutenant Commander in the navy and the society's pension expert, points out there was no consultation on the change.

"Don't unnecessarily penalise one group of people because you didn't think about it properly," he says.

"It is the more vulnerable who will be hit; those who are invalided."

Getting militant

The society is the closest thing the armed forces has to a trade union.

Service personnel with severe injuries increasingly survive to become early pensioners

Maj Gen Moore-Bick has even been to meetings with trade union officials at the TUC headquarters, to discuss Lord Hutton's potential proposals to change public service pension schemes.

The society has been giving briefings to members around the armed forces as well as lobbying government ministers and MPs but with little impact on government so far.

"The ministers just rubbish the figures and don't address the point," Maj Gen Moore-Bick says.

"I think the chancellor thinks this is all a jolly good idea."

The society is now pondering the possibility of public demonstrations.

"Existing pensioners are pretty angry and are complaining we are not doing enough - they all want a march in Whitehall," he says.

So what does the society actually want?

David Marsh says the government should focus on those who take their pensions early and make them a clear exception from its plans.

"I think it would be prudent for the government not to increase pensions by CPI for those under the age of 55."

However, Defence Minister Andrew Robathan said it would not be possible to treat the armed forces differently from other public servants.

"Given the economic wreckage left behind by Labour, tough decisions have had to be made to deal with the fiscal challenges the country is facing," he said.