If we can have a single benefit, why not a single tax?

- Published

Iain Duncan Smith has a big job ahead of him

Pensions Secretary Iain Duncan Smith is proposing to combine about 30 work-related benefits into a single universal credit.

He says that the current system is hugely complex, costly to administer and vulnerable to fraud, but some would argue that the same could be said for the tax system.

The Nobel Prize-winning economist Sir James Mirrlees has described the UK tax system as "opaque and unnecessarily complex", in a report for the Institute for Fiscal Studies (IFS)., external

The Mirrlees Review questions in particular why it is necessary to have two separate taxes on income in income tax and National Insurance.

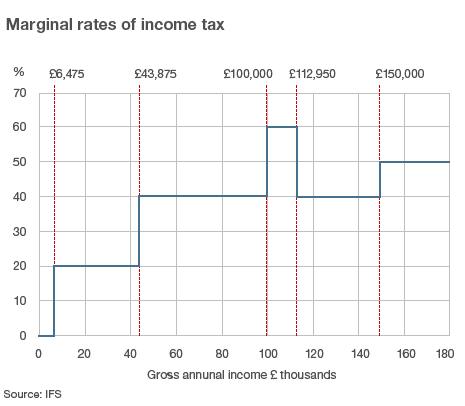

It also points out the current anomaly in income tax rates that appears at an income of £100,000.

The personal allowance on which no income tax is payable starts being withdrawn once people are earning £100,000. Above that, people lose £1 of their allowance for every £2 they earn, which means that between £100,000 and £112,950, people pay an effective tax rate of 60%.

Another anomaly in the system will appear once the government introduces rules that mean people paying higher rate tax stop receiving child benefit.

It means that the effective tax paid on the £1 that takes someone above £43,875 will be thousands of percent.

In addition to income tax, employees also pay National Insurance (NI) contributions at 11% until their earnings reach about the level at which 40% tax starts being paid. After that, it is paid at 1%, although both rates will be going up by one percentage point in April.

"If you talk to employers, simplifying income tax and National Insurance is at the top of their request list," says John Whiting, tax policy director at the Chartered Institute of Taxation, who also works for the government's new Office of Tax Simplification.

"Ideally they should be combined, or at least the definitions used for the two could be made the same."

At the moment, for example, if you make a contribution to a pension scheme, it reduces your income for income tax purposes, but not for National Insurance.

Link to pensions

One of the arguments against combining the two is that National Insurance contributions are linked to receipt of benefits and the state pension.

But Business Secretary Vince Cable has already proposed a flat-rate pension that would be unrelated to National Insurance contributions.

There are still potential problems with combining income tax and National Insurance, according to Chas Roy-Chowdhury, head of taxation at the Association of Chartered Certified Accountants.

"There is a danger that it would be used as an excuse for raising tax," he says.

Mr Roy-Chowdhury is concerned that a single tax on income would be uncapped, which he says would reduce the UK's competitiveness, especially when combined with the 60% and 50% tax rates now payable above £100,000.

In addition, employers make National Insurance contributions, which would have to be changed into a sort of payroll tax.

Also, self-employed people have different rules for NI, and income tax is payable on savings, but NI is not.

Council Tax

But if the government decided to start combining taxes, there are other possibilities as well.

In some countries, all direct taxes are collected straight away from earnings, which avoids the situation in which Council Tax, for example, is paid on earnings on which income tax and NI have already been paid.

"As long as it's just a collection mechanism that's fine," says Mr Whiting, although there are concerns about what central collection might do to local accountability.

But there have also been discussions about replacing Council Tax with a local income tax, which would indeed have to be collected centrally.

The Calman proposals for funding the Scottish Parliament discuss raising more funds for Scottish government from the income tax system. The Scottish Parliament already has the power to raise or lower the basic rate of income tax by 3p in the pound, so national and regional variations are clearly possible.

There are clearly problems that would have to be dealt with if taxes were to be combined, but if this government can combine 30 benefits into a single benefit, combining a few taxes will be child's play.

- Published11 November 2010

- Published10 November 2010

- Published7 November 2010

- Published5 October 2010