Masters of the universe: meet the world's best-paid men

- Published

Financial muscle: Hedge fund managers can earn extraordinary amounts of money thanks to performance-related fees

There are some in this world who look upon bankers' pay as small change.

They wouldn't even consider getting out of bed for the $13m (£8m) Goldman Sachs' boss Lloyd Blankfein was paid last year.

In fact, such a trifling pay packet represents just a few days' work for these staggeringly well-paid financial executives.

If bankers inhabit a different world, says London-based headhunter John Purcell, "these guys are out on their own in a different universe".

'Private bunch'

So just how much do these guys - for the vast majority are men - earn each year?

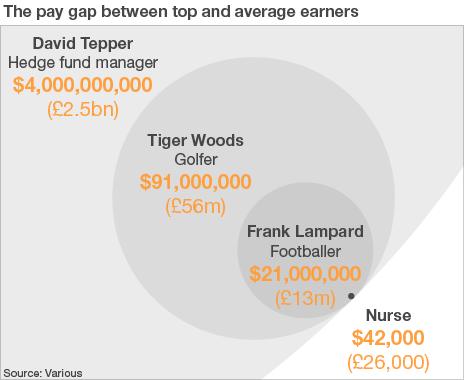

At the very top of the pile, we're talking $4bn. Just in case that hasn't quite registered yet - that's four billion dollars.

This does, of course, include bonuses and fees as well as salary. In fact, the salary is a tiny fraction of their overall pay.

And who are these men? They are called hedge fund managers - in other words, they are investors who buy and sell all manner of financial instruments with the express aim of making money for their clients, and for themselves.

Finding out much about them is notoriously difficult.

"They're a very private bunch," Mr Purcell explains, "largely because they earn so much. They are highly secretive in every aspect of what they do."

Discovering how they make their money is a little easier.

Popular myths

Hedge funds are actually one of the most misunderstood of all financial products.

They get something of a bad rap, largely due to some spectacular failures, most notably Long Term Capital Management, which blew up in 1998 and almost took Wall Street with it, and Amarinth Advisors, which lost billions of dollars in a few weeks on bad natural gas trades in 2006.

Many have also tried to blame them for some of the excessive risk-taking they say triggered the global financial crisis, but with little success.

As one industry insider argues, hedge funds are worth around $1.5 trillion in total - "less than the assets that some individual banks have on their books".

Hedge funds, then, are not the the gung-ho, high-risk beasts of popular mythology.

In fact, the majority are quite the opposite, seeking to produce what are called absolute returns - those over and above what you get from the bank, risk free - year in, year out.

In other words, they are designed to be low risk.

What sets them apart from most investment funds is the range of instruments they can use and the strategies they can employ.

Whereas traditional fund managers buy shares and bonds in the hope that they will rise in value, or occasionally dabble in financial derivatives, their hedge fund counterparts can do so much more.

For example, they can take advantage of movements in interest rates and currencies, company restructuring and bankruptcies, and pricing anomalies across different markets.

One of their most important strategies is shorting - borrowing shares to sell into the market in the expectation that they will fall, then buying them back at the lower price. This means they can make money when markets fall.

Results business

This investment freedom is what attracts so many investment managers to hedge funds. That and the quite extraordinary sums of cash that the very best can earn, of course.

In fact, many are not ready for the challenge. Encouraged by potentially huge fees, they begin running portfolios without the necessary knowledge and experience of the strategies they employ. As a result, many come unstuck.

Carl Icahn has pledged to give the majority of his wealth away to charity

And this is one reason why it is rather unfair to compare directly the pay of hedge fund managers with that of bankers.

For there is a very crucial difference - hedge fund managers get paid bonuses only when they make money. In other words, there is no reward for failure in this highly competitive business.

Salaries in the industry are not dissimilar to those paid in investment banking, so to make seriously mind-boggling amounts of cash, managers need their performance-related fees.

These typically amount to 20% of any returns made on a portfolio above a set benchmark, and this is how hedge fund pay rockets into the stratosphere and beyond.

But for those that make no returns, through no one's fault but their own, of course, the rewards are less attractive. In fact, the large number of managers who set up on their own don't even have a salary to fall back on, although they do take a 2% management fee on the funds they manage.

For this reason, "a lot of managers are not making any money at all," says the industry insider.

Equally, hedge fund managers invariably have their own money invested in the funds that they run, unlike bankers who generally stake other people's cash.

"Investors are very keen to see the fund management company have 'skin in the game'," says Mr Purcell.

Celebrity pay

It's also important to bear in mind that the very best-paid hedge fund managers - the John Paulsons and George Soroses of the industry - own their own companies.

They take a cut on all the assets under management across a number of funds run by their firm.

In other words, George Soros owns Soros Fund Management. By contrast, Lloyd Blankfein does not own Goldman Sachs.

And while it's relatively easy to find out what the boss of a public company owns, it's far harder to discover what the owner of a private company pays him or herself.

George Soros is one of the best-known and most successful hedge fund managers

Individual hedge fund managers actually earn a fraction of what their employers earn - on average $4.9m in 2007, the last year for which figures are available.

Still, nice work if you can get it.

In fact, when it comes to comparisons, bank bosses are nowhere near the best paid executives of even publicly-listed companies.

H Lawrence Culp Jnr, boss of US manufacturing and technology group Danaher, was paid $141m in 2009, while Larry Ellison, head of technology giant Oracle, got $130m, according to Forbes.

Not even sports starts or actors can match that - Tiger Woods, for example, earned $91m, while Johnny Depp pulled in $75m.

In the UK, the boss of consumer goods group Reckitt Benckiser, Bart Becht, was awarded £93m ($148m), while Sir Terry Leahy, outgoing chief executive of supermarket group Tesco, earned £18m, according to research company IDS.

Charitable giving

Staggering sums they may be, but they pale into insignificance compared with the multi-billion dollar packages the very top hedge fund managers earn.

It is important not to forget the huge amounts in tax that those managers not based in tax havens, of which there are many, pay.

Many also donate vast sums to charity and have become well-known philanthropists.

Carl Icahn, for example, who earned $1.3bn in 2009, recently signed up to the Giving Pledge, a club of billionaires who have promised to give large chunks of their wealth to charity.

Still, whichever way you look at it, $4bn sure is a lot of dough for one man to be earning over many lifetimes, let alone one year.

Are they worth it?

No doubt a good number of their clients, which include many the world's biggest pension funds, will say that they are. Their tailors may well agree.

Others may take a slightly different view.

- Published29 January 2011

- Published26 October 2010