Labour and Tories clash over VAT increase

- Published

Ed Miliband: "Osborne should come out and say that he got it wrong this morning and he should apologise"

Chancellor George Osborne has defended the VAT increase from 17.5% to 20%, saying it could boost employment and was better than raising income tax.

But Labour leader Ed Miliband urged the government to apologise for suggesting that the rate rise was a "progressive" policy.

The VAT rise, which came into effect on Tuesday, will bring in an extra £13bn in revenue, the Treasury says.

Food, children's clothing, newspapers and magazines are not subject to VAT.

It is the second increase in a year, after Labour chancellor Alistair Darling restored the 17.5% rate last January, having temporarily reduced it to 15% for 13 months to stimulate the economy.

Research by the Centre for Retail Research and online shopping group Kelkoo has suggested that retail sales will fall by about £2.2bn in the first three months of the year as a result of the rise in VAT.

The British Retail Consortium has also warned that the rise, announced in the June Budget, may have squeezed the traditional January sales period into a concentrated burst around the New Year.

But Mr Osborne told BBC Radio 4's Today programme: "I didn't come into politics and become chancellor of the exchequer wanting to increase taxes. I'm actually someone who believes we want to try and lower taxes in this country.

"But when you've got a very large budget deficit and you've in the middle of a European sovereign debt crisis - and you've decided that at least part of dealing with the deficit has to come from tax rises - then I think VAT presents itself as the choice."

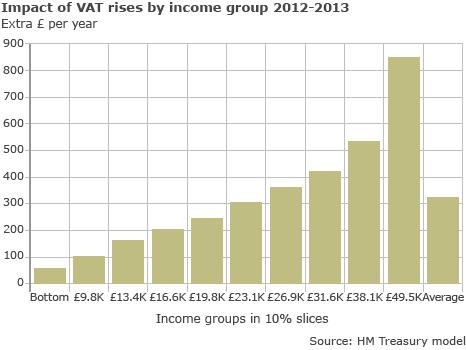

He added: "If you look at the population and how much they spend, then VAT is progressive."

Mr Osborne also said the VAT rise was a "tough but necessary step towards Britain's economic recovery", and that 20% was "a reasonable rate to set, given the very difficult situation we find ourselves in".

He added that he regarded the increase as "permanent" and it would "increase employment" because it would increase confidence that the government was tackling the budget deficit.

But, in an interview with the BBC News Channel's chief political correspondent, Laura Kuenssberg, Mr Miliband said: "David Cameron admitted before the election that VAT rises are unfair.

"Everyone knows that poor and middle-income households will be hit hardest. He should come out and apologise for misleading the British people."

Shadow chancellor Alan Johnson said: "This is a broken promise - this was the big issue of the general election campaign."

The change affects any VAT-registered business which sells or purchases goods or services that are subject to the standard rate.

- Published4 January 2011

- Published4 January 2011

- Published20 June 2010