UK CPI inflation rate rises to 3.7% in December

- Published

Inflation is being driven by air transport, fuel, utilities and food costs

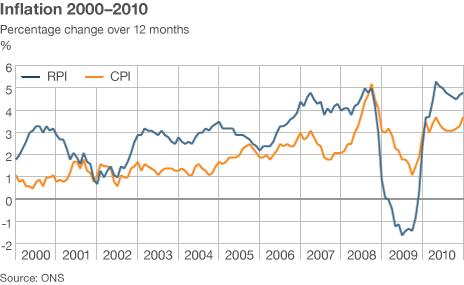

UK inflation jumped in December with the Consumer Prices Index (CPI) rising to 3.7%, up from 3.3% in November.

Retail Prices Index (RPI) inflation - which includes mortgage interest payments - rose to 4.8% from 4.7%.

The rise will put further pressure on the Bank of England to lift interest rates to curb rising inflation.

The recent VAT rise from 17.5% to 20% could further fuel inflation, which has now remained above the 2% target by one percentage point or more for 13 months.

The Office for National Statistics said the biggest drivers of inflation were air transport, fuel, utility bills and food costs.

Fuel prices increased at their fastest annual rate since July, while the cost of food showed its biggest annual rise since May 2009.

'Hike this year'

The BBC's economics correspondent, Stephanie Flanders, says "the chances are that the CPI will rise even further in the next few months - maybe reaching 4% by February or March".

Sterling was 0.77% higher against the dollar, at $1.60110, as traders factored in the chances of an earlier-than-expected rise in interest rates.

But our correspondent says there are few indications that a majority of the Monetary Policy Committee are ready to respond with an early rise in the base rate.

"The question is whether the peak is 4.1, or is it higher?" said Alan Clarke, economist at BNP Paribas.

He added: "It confirms my suspicion that the first rate hike will come this year; the only question is how soon.

"Our call is August, but clearly there is a risk it comes as soon as May."

Howard Archer, economist at Global Insight, also said an increase could be on the cards.

"Despite the undeniably significant risk to growth coming from the fiscal tightening that is now increasingly kicking in, there is mounting pressure on the Bank of England to enact at least a token near-term interest rate hike to send out the message that it has not taken its eye off the inflation ball," he said.

But the British Chambers of Commerce (BCC), echoing calls made at the weekend by the Ernst & Young Item club, said the Bank must "hold its nerve" in the face of calls for an early increase in interest rates.

"Raising rates at a time when fiscal policy is being tightened, while businesses and individuals are facing greater pressures, would be a mistake and should be avoided," said David Kern, chief economist at the BCC.

Budget cuts

The Bank of England's governor, Mervyn King, had to write four letters to the chancellor last year as inflation has remained above its 2% target.

But with the new government having announced the biggest round of budget cuts since World War II, the Bank still expects the resulting slowdown in spending to bring inflation down over the next two years.

The latest increase was more than economists had expected and above the Bank of England's own forecasts.

And core inflation, which strips out volatile items such as energy and food prices, rose from 2.7% to 2.9%.

(Story continues below)

The RPI figure for the whole of 2010 was 4.6% - the highest rate since 1991.

This annual figure is used as the benchmark for many wage deals, and as people feel the squeeze from rising prices there is the possibility of them requesting substantial pay increases, thus further fuelling inflation.

Wage issues

"We are already starting to see rising inflation expectations," said David Page, economist at Lloyds Banking Group.

"We think if this translates to further growth in wages over the coming months that is when the Bank of England will start to see the short-term inflation spike becoming more medium-term inflation pressure.

"And it is under those circumstances that the Bank of England might start to consider raising interest rates."

Many public sector workers have already been told that their pay will be frozen, however.

"This is chilling news to hundreds of thousands of low-paid public sector workers, who face pay freezes, job losses, a 3% hike in pension contributions and a daily battle to put food on the table," said Unison general secretary Dave Prentis.

"The inflation hike comes on top of the 20% VAT rise, soaring prices of transport, petrol, gas and electricity bills and national insurance contributions. Those at the bottom of the ladder also face cuts in housing benefits, disability allowance, council tax benefits and other welfare payments."