House prices and mortgage approvals fall

- Published

There are still too few buyers to push prices higher, the Nationwide says

New figures have shown falls in both mortgage approvals and house prices, marking a slow turn of the year in the housing market.

The Bank of England said the number of mortgages approved for house purchases showed a sudden dip in December.

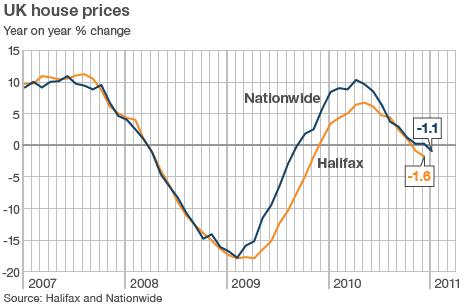

Meanwhile, the Nationwide Building Society said house prices had slipped by 0.1% in January, leaving them down 1.1% on a year earlier.

It meant the average UK home cost just over £161,600.

Mortgage data

The Bank of England said that the number of mortgages approved for house purchases in December fell to its lowest level since March 2009.

There were 42,563 approvals, showing a relatively sudden dip of nearly 5,000 from the previous month and a similar fall compared with the average of the previous six months.

Figures in the coming months will indicate whether this is the start of a renewed and sustained fall in the mortgage market.

However, the lack of activity shown in December's figures could put further downward pressure on house prices.

House prices

The Nationwide, which is the first to publish data on the housing market in January, said the outlook for the market was "still highly uncertain" but forecast that house prices would stay static or drift a little lower during 2011.

"Demand for homes looks to have stabilised, albeit well below the levels prevailing before the crisis," said the Nationwide's chief economist, Robert Gardner.

"Interest rates remain at historic lows, and labour market conditions have stabilised - both factors that will provide support to the market. However, the continued uncertain outlook for the economy will probably continue to keep many buyers on the sidelines.

"At the same time, there are few signs of a glut of unsold homes building up on the market that would lead to a sharper price correction. Indeed, there are tentative signs that the volume of homes coming onto the market may be slowing."

Predictions

A key issue in 2010 was that potential sellers started to outnumber would-be buyers, putting downward pressure on prices, particularly in the second half of the year.

The housing market is different depending on geography

This has continued into January, which was the fifth time in seven months prices had fallen month-on-month, according to the Nationwide.

Cheaper homes would generally be welcomed by potential first-time buyers. However, rationing of mortgage funds is still being imposed by lenders.

"With mortgage finance remaining thin on the ground for all but the cash and equity rich, many hoping to take advantage of a property market that is in the doldrums are simply unable to do so," said Matt Hutchinson, director of flat and house share website Spareroom.co.uk.

"Add into the mix soaring rents and the rising cost of living and the first rung of the property ladder remains tantalisingly out of reach for the majority of people."

Many commentators expect house prices to fall over the course of 2011.

While some estate agents and other property market businesses have forecast falls of up to 5% this coming year, other commentators and economists have suggested they could drop by more, possibly 10%.

Earlier this week, the Land Registry pointed out that movements in house prices in England and Wales in 2010 had been affected by geography.

Regions in the south of England saw prices rise over the year, led by a 6.2% increase in London, the Registry said.

But the value of homes dipped in northern regions, with the biggest fall of 3.3% in the North East.

Savings

Although unsecured borrowing rose slightly in December, according to the Bank of England, people have maintained a safety-first approach to borrowing on credit cards, loans and overdrafts.

Meanwhile, savers with building societies and other mutuals increased their deposits.

In December, they saved just over £1bn more than they took out, figures from the Building Societies' Association (BSA) showed.

Net savings have increased on only five occasions since the start of 2009, and this was the biggest rise since February 2009.

But Brian Morris, head of savings policy at the BSA, said that these funds might be eaten into as families felt the squeeze.

"Households face a challenging year ahead and may well need to dip into - or defer - savings to supplement their incomes," he said.

Mortgage lending in the mutual sector shrank for the second full year in a row, the BSA said.