Banks agree Project Merlin lending and bonus deal

- Published

Osborne: 'We are determined to bring responsibility and restraint'

A long-awaited agreement with the largest UK banks on lending, pay and bonuses has been announced.

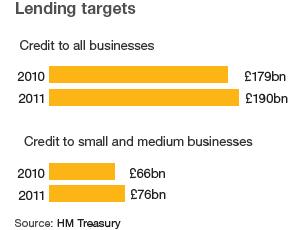

Under Project Merlin, banks will lend about £190bn to businesses this year - including £76bn to small firms - curb bonuses and reveal some salary details of their top earners.

The Bank of England will monitor whether loans targets are being met.

Liberal Democrat Treasury spokesman Lord Oakeshott resigned after the agreement was announced.

Chancellor George Osborne also formally ruled out imposing a bonus tax, despite pressure from Labour.

'Retribution to recovery'

On Tuesday, the government increased a levy on banks to £2.5bn this year - raising an extra £800m.

Shadow chancellor Ed Balls accused the chancellor of "putting politics ahead of economics".

"For the chancellor who talked so tough in opposition... this is a pitiful outcome and an embarrassing climbdown," he added.

He said the banks won't be forced to lend if they don't want to.

Mr Osborne acknowledged that the package would not be enough to assuage public discontent with the banks' role in the financial crisis, saying: "The anger will remain".

Treasury sources said that the time had come to move on from "retribution to recovery" - focusing on the lending boost from banks rather than issues over bonuses.

However, groups representing small businesses said that despite the increased lending, they feared the cost of borrowing would remain prohibitively expensive for many firms.

Bonuses

HSBC, Barclays, Royal Bank of Scotland (RBS) and Lloyds Banking Group have signed up to the Project Merlin agreement, external, while Santander has agreed to the lending parts of the deal.

Other pledges include providing £200m of capital for David Cameron's Big Society Bank, which is supposed to finance community projects.

However, while banks have also been asked to show restraint in bonus payments, these are expected to total more than £6bn this year.

On Wednesday, RBS said its investment bankers would share in a bonus pool of about £950m while chief executive Stephen Hester would get £2m in shares as a bonus.

And Lloyds Banking Group's outgoing chief executive Eric Daniels is in line for a £1.45m shares bonus.

As part of remuneration commitments under Merlin:

RBS, HSBC, Lloyds and Barclays have agreed to publish the pay of their five highest paid executives below board level - but this will exclude top-earning traders without managerial responsibility

The four banks will cut the amount provided for bonuses in 2010, after negotiations with ministers

Lloyds and RBS repeated their 2010 commitment that the cash element of any bonus will not be more than £2,000

From 2012 it will be law that all big UK banks publish the pay of their board members plus the eight highest paid executives below board level. This will apply to the UK operations of overseas banks such as Goldman Sachs and UBS.

BBC business editor Robert Peston said that "on paper at least, the UK will have the most transparent regime for bankers' remuneration in the world".

'Business concerns'

Banks loaned £179bn to businesses last year and the government wanted a commitment that this would increase.

They are also going to be providing £1bn of risk capital over three years for small businesses in parts of the UK worst hit by spending cuts.

The government said that the measure of whether banks were providing the promised credit to business would be among the performance targets used to determine bonuses of bank chief executives.

The £76bn to be loaned to small business is up 15% from 2010 levels.

However, the provision of credit to UK businesses will be on commercial terms.

And representatives of small companies have expressed concern that this means the lending pledge by the banks is "academic".

"The vast majority of businesses are not going to the banks and seeking finance at the moment," said Andrew Cave from the Federation of Small Businesses.

"And those that do are telling us that the cost of borrowing - both existing and new borrowing - is increasing and those issues are not going to go away with today's announcement."

The British Chambers of Commerce (BCC) said that small business lending was a separate and "far more important and long-standing challenge" than the debate over bonuses.

Ed Balls: 'This negotiation has turned from Project Merlin into the Wizard of Oz'

Firms had seen relationships with lenders strained, added the BCC's director general, David Frost, who said "poor or opaque decision-making, over-centralised processes and a lack of good relationship managers on the ground" had caused a crisis of confidence between business and the banks.

"While the big banks' renewed commitment to small business lending is welcome, ministers and the banks need to focus their energy on improving frontline services for small and medium-sized firms," he added.

"Without clear lending processes and more sensible decision-making at a local level, many businesses will still be reluctant to ask for loans and big net lending targets won't be met."

- Published9 February 2011

- Published9 February 2011

- Published9 February 2011

- Published9 February 2011