Why do the German and UK economies differ sharply?

- Published

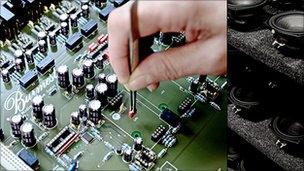

Quality and precision are qualities which have helped German companies sell their product abroad

Compare and contrast, as they used to say in the exams.

The German economy grew by 3.6% last year and is expected to grow by more than 2% this year.

According to the latest figures, the British economy actually shrank in the last three months of 2010, although it is expected to grow by 2% in 2011.

In the UK, unemployment is rising. In Germany, it is falling. The British unemployment rate is higher than Germany's, and so too is the rate of inflation.

In Britain, trade is in deficit. In Germany, it is in sizzling surplus.

Drilling for growth

Trade is the key to the German recovery.

The country makes things that others want to buy - particularly in growing economies, and particularly in China.

The German economy currently meshes nicely with China's needs, such as machinery to industrialise. It is also good at providing China's wants, including BMWs for the new rich.

As Germany's Economy Minister, Rainer Brüderle, told the BBC: "We give the equipment to the world, to the virgin markets that need it and want it".

German industrialists make much of the strength of their manufacturing.

Dieter Burmester created and owns Burmester Audio Systems which makes very high-end amplifiers and speakers - the price tags say hundreds of thousands of pounds, euros or dollars, for the top of his range.

"I don't understand politicians who don't know the value of production", he says.

You can see German technology all over the world, very often from small companies.

The disaster in Chile with the mining workers? The drilling machinery was from Germany. Drilling a tunnel in Switzerland? The machinery comes from here.

"Many years ago, when some countries saw their future in service industries like I believe the British did, I wondered about it.

"The strongest economy you will have is when you have to deal with something concrete, and it's not just a number written on paper," said Mr Burmester.

Dependable products

He is a classic German engineer and entrepreneur.

His company is a typical example of the "mittelstand", that swathe of medium-sized, often family-owned firms which produce things, often of high quality, with much investment in research and design.

His product is handmade in Germany. The words are written on the back of every item in English, but there is much research and development behind it.

He is an unflashy engineer. Solid, but with carefully planned change, might be his motto.

A growing economy means more spending power which in turn, helps the economy to grow even more

"Solid" is the word that keeps recurring with the German economy.

For consumers, it translates as "save then spend". In these times of austerity, that may be a virtue - though borrowing to expand is a virtue when times are less constrained.

Debt culture

But those are not the current times. British households are more indebted than their German counterparts.

In the UK, debt is about 80% of income left after tax. In Germany, it is about 60%.

On top of that, Britons borrow to buy property - the weight is around their necks for life.

Mortgages make up about 90% of people's debt. In Germany, it is about 70%.

Artur Fisher is a good person to compare and contrast. He is the joint-chief executive of the Berlin stock exchange. He has worked and lived in London and he's married to a British woman.

His mother-in-law lives in East Anglia so he goes there often.

He makes much of the British belief that owning one's own home is one of the prime aims in life while Germans rent.

"In Germany only 50-60% of the population own their own house. The rest rent. Renting is quite normal".

Contrast that with the UK where he says that 90% of households own their own home.

"The most important thing in their life is to own their own house. So you tie down capital."

He notes, too, a difference in attitude between him and his wife when it comes to mortgages.

The British, he says, are used to variable rates of interest - they go up and down over the lifetime of the mortgage. In Germany, you agree the rate and it stays fixed.

"My wife is English and when we agreed a ten year mortgage at 3.5%, she asked me why we didn't get a variable rate because it might go lower.

"This shows you the difference of attitude whereby the English see an opportunity in change whereas the Germans hate change - we don't want change. We want to plan things."

Artur Fischer, though, does not gloat. He does not feel the German way is always better.

And he can remember the 1970s when Britain reeled from crisis to crisis.

"The British economy was seen as the 'Sick Man of Europe'. This has turned around completely with all the measures that have been taken in the UK.

"So we know that the British are able to get out of this trouble and become very strong. They were able to live a prosperous life without having all those manufacturing companies.

"If the framework is correct, you will come out winning - probably, in three years time, when Germany might just go back into recession."