LVMH to take over Bulgari in 3.7bn euros deal

- Published

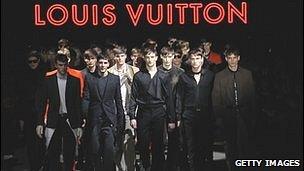

LVMH had a strong 2010, boosted by sales in key markets such as China

LVMH, the world's largest luxury goods company, has unveiled a 3.7bn euros ($5.18bn; £3.18bn) all-share deal to take over Italian jeweller Bulgari.

LVMH will buy 50.4% of Bulgari, issuing 16.5 million shares in exchange for 152.5 million shares held by the Bulgari family.

The French firm will also seek to buy the rest of Bulgari shares at 12.25 euros a share - a premium of about 60%.

Trading in Bulgari shares in Milan was suspended after they gained 58%.

Bulgari has agreed to the takeover "in order to reinforce, in accordance with its history, values, craftsmanship and identity, the long-term development of the Bulgari Group", it said.

As part of the deal, the Bulgari family will become the second-biggest family shareholder in LVMH.

At the start of February, LVMH reported record revenues for 2010, with all areas of the group seeing double-digit growth.

Economic recovery in key markets such as China helped to increase LVMH's revenues by 19% to 20.3bn euros, in what it dubbed "a great vintage year".

- Published4 February 2011