Barclays chief executive Bob Diamond gets £6.5m bonus

- Published

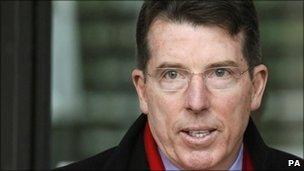

Mr Diamond became chief executive at Barclays at the beginning of this year

Barclays has revealed that its new chief executive Bob Diamond got a bonus of £6.5m for 2010.

The sum was awarded for his performance as head of Barclays' investment banking and wealth management operations, the bank said in its remuneration report, external.

That figure is on top of his £250,000 annual salary.

His predecessor John Varley, who was chief executive for the whole of 2010, received a bonus of £2.2m, on top of his annual salary of £1.1m

Mr Varley also received an annual performance cash incentive of £550,000.

Bonus agreement

Bankers' bonuses have come under increasing scrutiny since the financial crisis began, and banks have agreed to show restraint on pay.

Last month, Chancellor George Osborne announced details of Project Merlin - an agreement between the government and the UK's four biggest banks.

The banks agreed to rein in bonuses and lend £190bn to businesses this year.

Mr Diamond's bonus consists of £1.8m in shares and a deferred award of £4.7m in shares and contingent capital - bonds that convert into shares in certain circumstances.

BBC business editor Robert Peston said the bonus and salary would annoy those who argue they are based on banks' unsustainably large profits.

'No justification'

Barclays says that Mr Diamond asked the bank's remuneration committee to award him a smaller bonus than his entitlement - because of his sensitivity to current popular views on bankers' rewards.

But Mr Diamond has come under criticism himself recently for saying that he thought the time for remorse and apology from banks was over.

Responding to the publication of the bank's remuneration report, Len McCluskey, general secretary of the Unite union, said: "Bob Diamond tries to convince taxpayers that the era of remorse and regret within banking is over, yet he has no shame in pocketing a seven-figure bonus.

"There is no possible justification for this highly-paid individual taking home this enormous windfall."

As agreed in the Project Merlin deal, Barclays has disclosed the pay of its five highest-paid executives below board level for the first time.

The top earner received £10.9m, plus a long-term incentive award of £3.3m.

In total, the top five individuals received £38.3m, plus £10.8m in long-term incentive awards.

BarCap profits

Barclays reported pre-tax profits of £6.07bn for 2010, a rise of almost a third on the £4.59bn profit the bank made the previous year.

Mr Diamond took over as Barclays chief executive at the beginning of 2011.

Prior to that, he was head of Barclays Capital. Profits at the investment banking division almost doubled to £4.78bn in 2010.

Mr Diamond will also get a long-term incentive award of £2.25m, contingent on future performance, which would take his total pay package for 2010 to £9m.

That compares with £6.2m paid to HSBC chief executive Stuart Gulliver last year, which included a £5.2m bonus.

Neither Barclays nor HSBC received any direct support from the government during the financial crisis.

RBS and Lloyds, which both received government bail-outs, have also announced bonuses for their chief executives.

RBS boss Stephen Hester will receive a £2m bonus for 2010, all in shares and payable after three years, while outgoing Lloyds chief Eric Daniels will receive a bonus of £1.45m for 2010.