Global golf industry facing challenges

- Published

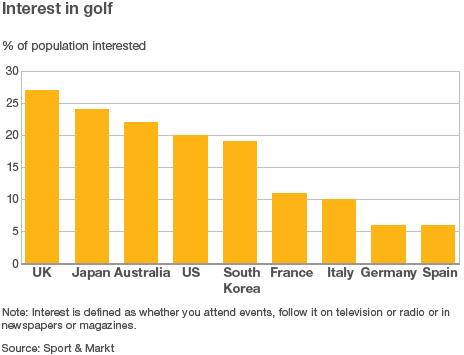

Golf is a multi-billion dollar global industry, with the increasingly passionate markets of the Middle East and East Asia joining the traditional power centres of the US and Europe.

The four big majors of the year; the US and British Opens, as well as the US Masters and US PGA, are truly global sporting events, being broadcast to TV audiences around the world as international stars battle it out for huge cash prices.

Meanwhile, the Ryder Cup between the US and Europe is also is a major attraction, with the host cities of this transatlantic battle looking for a golfing boost to their economies.

'Changes needed'

As well as golf tournaments, sponsorship and television rights, there are other elements to the golf industry.

They include golf course operations such as green fees, memberships; capital investments such as new course developments; golfer supplies such as equipment, clothing; golf tourism and golf real estate.

The sport is played by roughly 55 million people around the world, and also supports millions of others in employment.

There are calls for fresh blood and new marketing in mature golf markets such as the UK and US

And, despite its often-perceived connection with the world of big business, the sport is played by keen golfers from all social strata, and both sexes.

But, despite these strengths, the industry suffered during the recent economic downturn, and many challenges remain.

While the upper tier of the game continues to attract global media attention thanks to star names such as a rehabilitated Tiger Woods, and also enjoys continued sponsorship, this top level seems to have been decoupled from the rest of the golf industry.

"Overall it is quite gloomy - there will have to be a lot of changes made," says Marnix Von Bartheld from KPMG's golf business unit based in Budapest, Hungary.

"Golf piggy-backed for a decade on a growing economy and now needs to restructure."

Japan is the third biggest golf market but much of East Asia has still to be developed

In Europe and the US, as well as golf-tourist destinations such as the Middle East, in the run-up to the downturn of 2008 there had been a boom in building golf courses, with plenty of cheap money available.

Not only did that building come to an end, but player participation numbers also dropped.

There was also less investment in golf course upgrades and maintenance, while many other proposed projects did not get off the ground as banks withdrew funding.

Other facilities went into liquidation, in the Republic of Ireland for example, distressed assets' body NAMA took over many course developments.

Meanwhile, bad weather in Europe and increasing fuel prices also had a detrimental effect.

European differences

"People have had less discretionary income for golf," says Mr Bartheld.

"Golf tourism also suffered - things like the lads' weekend away in the Algarve for a round of golf, were cancelled."

Now the Dutch-born Mr Von Bartheld says that the sport in Europe needs to take a long, hard, look about the way forward.

"Like the US it is also a mature market, but there are some fascinating differences," he observes.

For example whereas in Hungary one in 10,000 people play, in Scandinavian countries it is one in 25 people.

In Holland he says there are schemes to encourage more youngsters and women to play, but that more inventiveness was needed in mature markets like the UK.

"Operators now have to be more creative with their membership schemes," he adds.

Golf tourism was hit after the global economic downturn of 2008

"There have to be reductions in the cost of playing, and more flexible schemes to allow more people to play," Mr Bartheld says.

"And in fact in some traditional markets prices have been coming down."

Then there is the area of hobby investors - the 6,000 courses in Europe that are not run as going concerns and which Mr Bartheld says are never going to be viable.

"It is going to take a lot of restructuring, to sort out what are commercially viable businesses and which are speculative."

'Unused capacity'

Meanwhile, in the other major market of the US, things are scarcely better.

Casey Alexander is a golf industry expert at golf analysts Gilford Securities in New Jersey.

He says the US golf market has reached saturation point in terms of players, with participants dying or retiring and not enough new blood coming through.

"Golf in the US has also been hit by the economic downturn, and before then it was not growing," says Mr Alexander, who is also a member of the Golf Writers Association of America.

"It is a fully saturated market and there is unused capacity on golf courses, where there has been overbuilding.

He said in terms of basic household economics, golf has also been hit.

"Golf is expensive, hard to learn, and cannot be played unsupervised by children in the US," adds Mr Alexander.

He also said that whereas a soccer ball would set a family back about $12, a full set of golf clubs costs thousands of dollars.

"In addition, the US consumer was over-leveraged coming out of 2007, and discretionary spending was cut back by households when economic trouble hit."

'Creative marketing'

Meanwhile, what of Asia and other parts of the world?

Since the late 1980s, improving economies in Asia have translated into more disposable income and an appetite for the status symbols that accompany it, including golf.

However Mr Alexander says that Japan, like the US and much of Europe, is a saturated market.

However he said there was potential growth for the industry in South Korea, which has 9,000 registered professional coaches, and the former Soviet countries of Eastern Europe.

The broker also said that golfing centres such as Dubai, as well as China, should be seen currently as golf-tourism destinations, rather than organically-growing centres for indigenous middle classes to play the sport.

Mr Bartheld also agrees that golf tourism destinations such as Turkey and Spain have been hit, but sees possible potential for growth in underdeveloped markets such as Germany.

"Golf is a great pastime but it also needs more creative marketing channels, and being in the Olympics [from 2016] should help there," he adds.

"In mature markets it needs to be cooler for young people, and more accessible for children, to become a truly multi-generational game."