Warren Buffett buys Lubrizol chemicals firm for $9bn

- Published

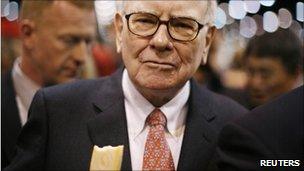

Mr Buffett said he was keen to use his cash pile to buy more companies

Warren Buffett's investment firm Berkshire Hathaway has announced what it has described as one of the largest deals in its history.

It is buying chemicals company Lubrizol for $9bn (£5.6bn) in cash, the equivalent of 28% above its latest market valuation.

Fast-growing Lubrizol saw its net income rise by 46% last year to $749m.

Mr Buffett told shareholders this month that Berkshire expected to use its cash pile to buy more companies.

"We will need both good performance from our current businesses and more major acquisitions," said Mr Buffett in his annual letter to Berkshire Hathaway shareholders.

"We're prepared. Our elephant gun has been reloaded, and my trigger finger is itchy."

Lubrizol, which had revenues of $5.4bn last year, makes chemical products used in engine oils as well as the plastics and pharmaceuticals industries.

Mr Buffett described the firm as the sort "we love to partner".

Lubrizol chief executive James Hambrick said the deal was "a clear endorsement of the growth and diversification success" his company had achieved.

Lubrizol's shares jumped to a record price of $134 in early trading in New York, just below the offer price of $135 per share. On Friday its shares had closed at $105.44.

The deal is still subject to gaining the approval of Lubrizol shareholders, but is expected to be completed in the third quarter of the year.

- Published9 March 2011

- Published26 February 2011

- Published17 November 2010