At the heart of Russia's diamond industry

- Published

The disused diamond mine at Mirny is one of the world's biggest man-made holes

Mirny is a giant hole in the ground.

Hopefully the town's inhabitants will not be offended by this description, but the hole is the reason they all live in this remote corner of Russia's Far East.

Obviously, there are buildings: Functional apartment blocks, government offices and shops, as well as roads and an airport.

But everything is dwarfed by the giant diamond mine on the edge of the town. It is 525m (1,722ft) deep and 1.2km (3,937ft) wide, and you can only really grasp how vast it is from the air, flying over it in a plane.

Harsh climate

Mirny's life started in the 1950s, when Soviet scientists discovered a huge diamond deposit here in Yakutia, 4,300km (2,672 miles) east of Moscow.

The climate is harsh, even by Russian standards. Late in April the ground is still covered in snow. Lakes and rivers are still frozen.

In winter, temperatures can drop to below minus 50C. The nearest town is 250km (155 miles) away.

In almost half a century, the giant hole has produced diamonds with a total value of at least $17bn (£10bn).

Alrosa polishes only a small proportion of its diamonds in-house

Today, the Russian state diamond company Alrosa has mines dotted around the region, but Mirny is still the jewel in the crown. It is here that all the rough diamonds come to be assessed.

Walnut-sized diamonds

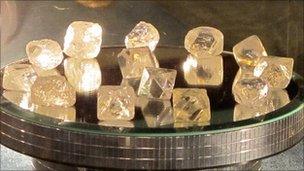

Diamond-shaped street lamps indicate the way to Alrosa's sorting centre. Twenty people in white coats examine the rough diamonds and set a preliminary price, based on colour, size, form and quality.

There are quite shiny 20-carat gems, which come with a minimum price of $120,000, and there are unappealing, grey stones of low quality that will be used in diamond-polishing machines.

Alrosa polishes only a small proportion of its production in-house, so most of the rough diamonds are sold to traders and polishers, many of whom are based in Antwerp in Belgium, or in India.

"The biggest and most beautiful diamonds are auctioned off, usually for much more than the minimum price," explains Oleg Popov, deputy director of production.

Next door, in the exhibition hall, some of the best stones are spread out on a green-clothed table, including about a dozen walnut-sized diamonds, each weighing 60 carats.

Touching them is not allowed.

Going underground

This diamond is worth half a million dollars

Today, the diamonds no longer come from that giant hole in the ground. Alrosa had to move production underground, as declining yields and safety concerns have forced it to shut down the open pit.

That was 10 years ago, and it marked the beginning of a new era.

Valeriy Latynin, who runs a mine on the outskirts of Mirny, says the future lies underground.

"We can dig as deep as we want as long as there is a diamond pipe," says Mr Latynin.

With open pits, the problem is "that as you dig deeper you have to support the walls and it gets more difficult to get the ore out", he adds.

But underground mining is much more expensive. In the past decade, Alrosa's debt increased considerably as a result of its investment in new pits and areas of activity.

The opening of a new underground mine in 2009 coincided with the financial crisis and a steep drop in demand for diamonds. The Russian state, Alrosa's main shareholder, had to come to the rescue.

At his work place 960m (3,150ft) below the surface, Valery Kosar drives a giant machine that burrows deep into the rock to extract the ore.

The ore that he scoops up from the ground is dark and not very sparkly. There is not a diamond in sight.

Mr Kosar has been working underground for eight years, but he also has a life outside the mine.

"At home there's one family, and the miners are my other family," Mr Kosar says.

"We have known each other for years. If someone comes here to work he tends to stay for a long time."

Some 70% of the working population in Mirny work for Alrosa, in the mines, in the factories or in the administration. Or they work for Alrosa Air, or for the company-owned hotel.

Alrosa has built hospitals and cultural centres, it finances cheap housing, health care and pensions for its workers, and it pays for a return flight to another place in Russia every two years.

Everyone in the company, from the chief executive to the local press officer, insists the company has a social responsibility for the people here.

And in case Alrosa should forget, the regional government of Yakutia, also a major shareholder, will not be shy about reminding the company of its duties. Half of Yakutia's regional budget comes from the diamond firm's taxes.

Stock market plans

It is not clear how much impact a plan by the company to sell shares on the stock market for the first time will have here.

Alrosa is now using machines like this one underground, instead of digging big pits

Alrosa is hoping to raise enough money from its share sale, which is expected in autumn 2012, to pay off its debts, develop deposits near Archangel and move more production underground.

Private investors are likely to push for cost cutting and higher payouts to shareholders, potentially endangering the way of life here.

Yet questions about it draws nothing but blank looks from a group of young mothers chatting in front of the local supermarket.

Whatever the changes facing the company, both in terms of technology and corporate structure, the giant hole in Mirny will remain the symbol of Russia's diamond industry.