India's passion for gold undimmed by rising prices

- Published

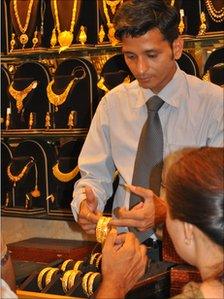

Colourful, crowded, and chaotic - as shoppers pack into the Dwarkadas Chandumal jewellery store at Zaverri Bazaar in Mumbai (Bombay), there is a sense of urgency in the air.

It is the Hindu festival of Akshaya Tritya, which means "one that never diminishes" in Sanskrit.

Tradition says anything bought on this day will bring long-term rewards and returns, and many believe buying gold now will ensure prosperity forever.

It is why Jyothi Rathod has chosen to make a purchase.

"I'm here because now is a very auspicious time to buy," she says as attentive staff hastily unpack boxes, helping customers decide what to buy.

"Keeping gold is good, and I'm buying it because it's lucky to do on this occasion."

Rising gold prices have not deterred Jyothi or any of the other shoppers.

Price volatility

In recent weeks the cost of gold worldwide has reached record highs on the back of a weaker dollar, pushing past $1,540 (£941) per ounce.

Last week, in the wake of the news of al-Qaeda leader Osama Bin Laden's death, it fell below $1,500, but now it is back to about $1,505.

Gold is revered in India, where many people would never contemplate buying silver as an alternative

The longer term pattern for gold has been a good one.

In the past 12 months it has steadily risen. And in anticipation of even higher prices, many shoppers are "panic buying", says the store's owner Deepak Tulsiani.

"We find that demand is going higher, the moment the rates are a little high.

"People who have weddings coming up in the family maybe after six months or eight months feel they should buy gold today," he adds.

In 2010, demand for gold jewellery rose 69% year-on-year, reaching a record total of 746 tonnes, according to the World Gold Council.

And Naveen Mathur, from Angel Commodities, says this demand will continue to grow.

Safe haven

With other commodities such as crude oil seen as less reliable, and real estate not providing the best returns, gold is one of the best asset classes to invest in, he says.

Mr Mathur says gold has for a long time been considered a safe haven investment in India, a country where it is revered.

"We are born with gold, we die with gold," says Prithviraj Kothari, the president of the Bombay Bullion Association, "the Indian mentality is to buy gold".

The World Gold Council (WGC) estimates that Indian marriages generate almost half of annual gold demand.

Mr Kothari says this cultural pull to gold means it is seen as an attractive investment by both rural and urban communities in India, and people from all socio-economic groups.

The nation's collective buying power for the metal make it the world's largest gold market, accounting for almost a third of jewellery demand.

Two thirds of Indian purchases for gold are for jewellery, the country has approximately half a million retail stores and about 100,000 goldsmiths, according to the WGC.

Long-term investment

But aside from bangles, bullion sales are also on the rise, says Mr Kothari.

He says more are people buying gold coins and bars because it is easier to sell on than necklaces and bangles, which can date as fashions change.

With gold prices at record highs, it is a good time to be a jeweller

Waiting in line at a crowded gold bullion shop in Zaverri Bazaar, student Pratik Shah says: "I'm buying these coins as an investment for my future, when I want to start a business or something like that.

"I have chosen to buy gold coins because they are easy to carry around, and they have a better return than jewellery."

Mr Kothari has also seen an increase in the number of Indians taking out Exchange Traded Funds (ETFs), which allow investors to buy gold without physically having to store it.

Some investors are choosing silver as a more affordable alternative to gold - but it is prone to price fluctuations.

In April silver hit record highs, topping $48 per ounce, but last week it fell to $34.

And many in India would never replace their gold chains for anything silver coloured. The metal is a part of the country's fabric.

"Gold is considered an asset here," says Sudhil Ramanathan, here shopping for an upcoming family wedding.

"We would never buy silver. We'll buy gold, no matter how much it costs. It is a requirement," he says.

- Published9 May 2011

- Published2 May 2011

- Published29 April 2011