Viewpoint: Possible future scenarios for Tokyo Electric

- Published

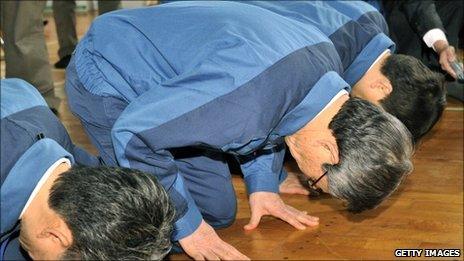

Masataka Shimizu, Tepco President apologise to evacuees who lived near the Fukushima nuclear plant

Just as the conditions at the Fukushima nuclear plant are fluid, so are Tokyo Electric's financial prospects.

Last week, the government announced a plan to create a body to help Tepco compensate the victims of the nuclear accident.

The plan is not yet law and was little more than a broad framework with a scant nine bullet points on the details of the new body.

This signals just how much contention there was within the ruling Democratic Party of Japan.

Clearly the plan will face much greater scrutiny and even more heated debate when it makes its way to the Diet floor.

So the future of Tepco remains unclear, but some options seem more likely than others.

Option 1: Bankruptcy

Unacceptable

Tepco provides power to 44.5 million people in an area that accounts for about a third of Japan's gross domestic product (GDP).

A formal bankruptcy would put all that at risk, as Tepco would struggle to procure fuels and services that allow it to supply power to the region.

Option 2: Nationalisation

Not ruled out

According to the framework, the new body could inject funds through acquiring preferred shares. Given the scale of capital likely to be needed, this could mean the company would effectively be nationalised.

The government is already closely monitoring management and could have more direct say once national funds are injected.

That being said, most statements suggest the government is wary of going down the route of nationalisation.

Option 3: Zombie company

Likely

Between decommissioning costs and compensation related to the disaster, Tepco will likely face trillions of yen in fresh liabilities.

This is on top of increased fuel costs and one trillion yen ($12.2bn; £7.5bn) of debt that must be repaid within the year.

Farmers hold cabbages to protest against the nuclear accident

The new body will probably have the ability to support not just compensation liabilities but Tepco's other ongoing cash needs.

While this would allow the company to stay afloat, the prospect of profits could be years away as the company struggles to pay the body back out of its future profits.

Ultimately, there could be some cap put on the liabilities, but multiple years without profits or a dividend seems reasonably likely.

Option 4: Fight back

Unknown

One little-discussed option is for the company its shareholders and or bondholders to fight back.

The Nuclear Act technically absolves a nuclear operator for liabilities arising from an extraordinarily large natural disaster.

While government officials have suggested this could not apply here, there has been no legal decision.

The design of the plant has not been shown to be outside of the guidelines and certainly the drive towards nuclear as a secure and clean energy supply was a matter of national policy.

Just last year the Ministry of Economy Trade and Industry had targeted nine new reactors to be built by 2020 giving credibility to calls for the government to take more responsibility itself.

In the long term we could potentially see the toxic assets that are Fukushima and its associated liabilities simply picked up by the government.

A changed country

It appears the entire power industry will be changed.

There is renewed talk of separating the grid from the power-generation facilities and nuclear policy is at the mercy of the residents of the areas surrounding the plants.

No matter what form Tepco eventually takes, Japan has a lot to think about.

Penn Bowers is a Tokyo-based analyst for CLSA Asia Pacific Markets.

The opinions expressed are those of the author and are not held by the BBC unless specifically stated. The material is for general information only and does not constitute investment, tax, legal or other form of advice. You should not rely on this information to make (or refrain from making) any decisions. Links to external sites are for information only and do not constitute endorsement. Always obtain independent, professional advice for your own particular situation.