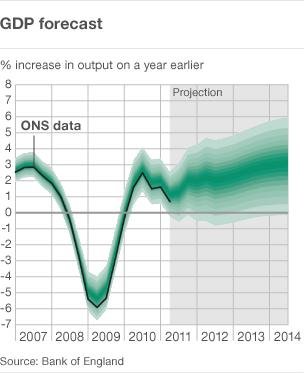

Bank of England cuts UK economic growth forecast

- Published

Sir Mervyn King said 'headwinds are becoming stronger by the day'

The Bank of England has cut its UK growth forecast for 2011 from 1.8% to about 1.5%, warning that the "headwinds are growing stronger by the day".

Bank governor Mervyn King said Europe's debt crisis and fears of contraction in the US overshadowed the world economy.

Mr King told a press conference that the UK economy had weakened since May, adding that inflation was still on course to hit 5% this year.

But he repeated that the Bank still expects inflation to fall next year.

Mr King said that some of the biggest risks to economic growth come from the eurozone, where some countries are trying to shore up their fiscal and banking systems.

"Were they to crystallise, the risks emanating from the euro area have the potential to have a significant impact on the UK economy," he said during a presentation of the Bank's latest quarterly Inflation Report.

"The imbalances in the world economy are still not being properly tackled and the burden of debt is still there," he added.

"This problem will take, I think, a number of years before we will find our way through it."

Mr King said there were still reasons for economic optimism, however. "The central view is there will be growth. It is a gradual recovery, but it is still a recovery.

"I don't want to underestimate the gravity of the crisis facing the world economy.

"But having said that, the UK has done what it can. We have a credible medium-term fiscal plan, which many countries do not, and we have had a depreciation of our exchange rate [which could help exports]," he said.

'Deep squeeze'

Inflation would continue rising through the autumn before falling back next year, Mr King said.

Although there was a "good chance" of inflation hitting 5% by the end of the year, the Bank still expects the rate to fall back next year as temporary factors fade.

The Consumer Prices Index will be a "little below" the Bank's target of 2% in the medium term, he said.

Earlier this year, the governor said the UK was enduring the longest squeeze in living standards since the 1920s.

And he said on Wednesday that the "long and deep squeeze" would continue because of such factors as higher fuel bills.

But he added that recent falls in oil and other commodity prices could bring forward the end of that decline in living standards.

He declined to comment on whether the Bank was considering quantitative easing to pump money into the economy.

However, he said later: "There is a limit to what UK monetary policy can do when large, real adjustments are required."

More risks?

The Bank's report was compiled before the latest meltdown on financial markets, and Mr King acknowledged that "the mood in markets has taken a sharp turn for the worse".

Some analysts believe the crisis in the markets will add to the Bank's existing concerns.

"It is important to remember that the report itself was compiled before the recent market volatility and so the forecasts will not have reflected the recent plunge in equities and commodity prices," said James Knightley, an economist at ING.

"This would probably add to the downside risks to these new numbers," he said.