French banks see shares plummet

- Published

Shares in French banks have plummeted amid concerns that France faces a credit downgrade, despite assurances that its AAA rating is safe.

Societe Generale shares plunged more than 20% at one point, while Credit Agricole fell 12% and BNP Paribas 9.5%.

The French finance ministry and the three major ratings agencies have denied rumours that France could follow the US in being downgraded.

Earlier, President Sarkozy promised new measures to reduce France's deficit.

The president cut short his holiday to hold an emergency meeting between government ministers and the head of the French central bank to discuss the "economic and financial situation".

In 2010, France's deficit was 136.5bn euros (£120bn), equivalent to 7% of GDP.

This was much lower, in percentage terms of GDP, than many other countries, including the UK (10.4%), the US (about 10%), Greece (10.5%) and the Republic of Ireland (32.4%).

However, it is more than double the 3% target that the EU sets its members.

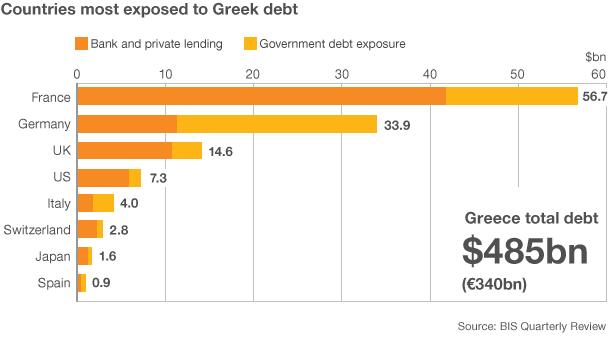

Banking shares across Europe slumped on Wednesday afternoon. French banks suffered the largest drops with investors concerned about their level of exposure to debt issued by troubled eurozone members.

French banks hold more than 40bn euros (£35bn) of Greek debt, for example - almost four times more than any other country.

Rumours also began circulating that France's top-notch credit rating could be under threat, though officials were quick to deny this.

"These rumours are totally unfounded and the three [rating] agencies - Standard & Poor's, Fitch and Moody's - have confirmed that there is no risk of a downgrade," a finance ministry spokesman said.

But despite the denial, Christian Jimenez, fund manager and president of Diamant Bleu Gestion in Paris, said the rumours were having a "catastrophic" impact.

"Shorts are on a rampage; it's a calamity. This has nothing to do with fundamentals," he said.

The Cac 40 index of leading French shares finished 5.45% lower at 3,002.99 points.

SocGen rumours

As well as speculation about France's sovereign rating, there were also market rumours about the financial stability of SocGen.

But a spokeswoman for the bank said: "SocGen categorically denies all the market rumours."

SocGen shares hit a two-and-a-half year low in afternoon trading, before closing down 14.7% at 22.18 euros.

During a frenzied period of rumour and speculation, there was also talk that representatives from the bank had been present at the government's emergency meeting earlier in the day.

But an official from the President's office said this had not been the case.

The government is set to meet again on 24 August to decide on measures to cut its deficit.